2023 S&P outlook. What the Street thinks

New year is approaching, let's see SPX forecasts of the main guys in the Street

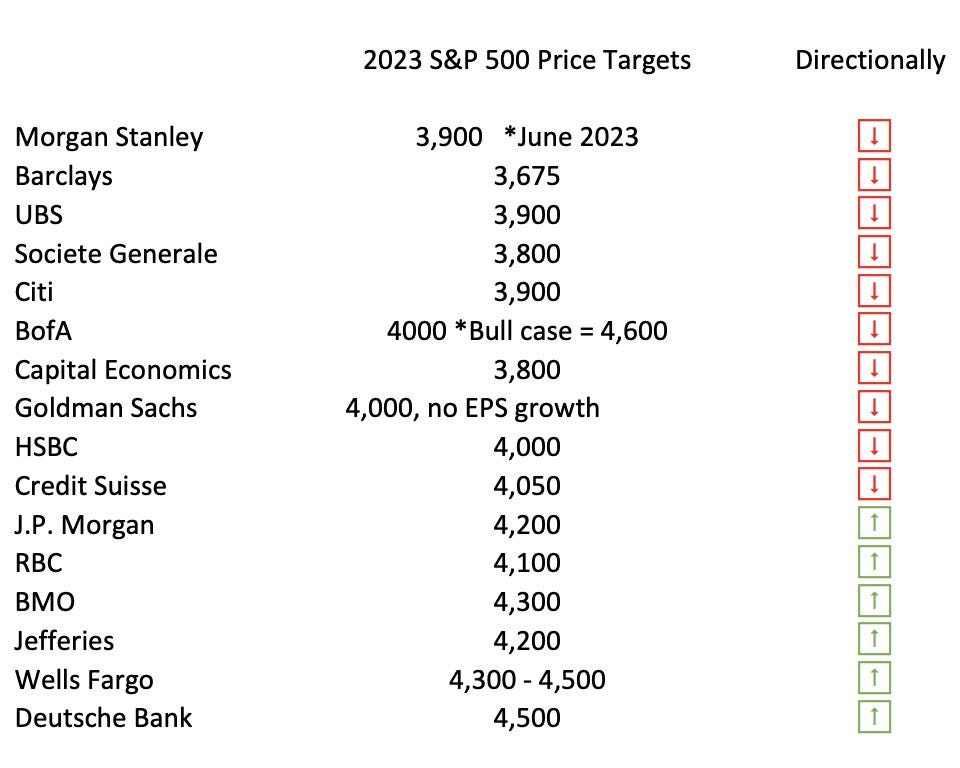

Wall Street 2023 price targets for S&P 500

Morgan Stanley went bullish on China, turning overweight for the first time since February 2021

Wall Street 2023 Price Targets for S&P 500

Sam Ro, CFA, did an excellent job in collecting few of the Wall Street’s main views (see his Substack newsletter: Tker). Here we report his great recap, integrating it with other analysts views and some more detail.

The opinions are reported in SPX ascending level. Most analysts see little to no appreciation in 2023, but from 3,200 to 4,800 there is a good dispersion in opinions and EOY 2023 levels. No shame, as we are well used to Wall Street fragmentation.

Canaccord Genuity: “new lows”, US$ 210 EPS (as of Dec. 5). 2023 Outlook is all about a recession.

“If the economy goes into recession, it would be historically unique to have already made ‘the’ bear market low before the recession even began. There are three indicators that give us a very high level of conviction there should be a recession in 2023:

The current level of possible yield curve inversions (82.2%), that has historically led to a recession each time

Whenever the year-year change in the Conference Board Leading Economic Indicators hits the current level (-2.7), the economy is either in or very close to a recession

The Philadelphia Fed State Coincident Index 1-month diffusion shows the majority of states are worse than a month ago, and any negative reading has always been associated with recession

[…]

+ The Fed channelled their inner Volker by severely inverting the US Treasury Yield Curve(s) that historically causes recession.

Summary - lowering 2023 EPS, keep an eye out for when ‘bad news becomes bad news.’ Investors focus heading into 2023 should turn to the challenge for economic growth rather than the risk of inflation and higher rates that are beginning to show up in an economic recession and weaker corporate data. We are lowering our 2023 EPS estimate to US$ 210/share to reflect the lower expectation for year-end 2022. Our estimate is derived from small single-digit nominal growth and some degree of margin compression as the economy enters recession. We continue to believe risk assets should bottom in the first half and may see a significant rally in the second half as the Fed realizes it has gone too far with rate hikes in a levered system and changes course earlier than expected. We would enter 2023 with a more defensive posture, with an eye on adding risk as the market begins to more fully reflect the likelihood of recession.”

BCA Research: 3,200 (as of Dec. 5). The Darkest Hour Before Dawn. 2023: recession, EPS down 20-25%, S&P 500 low ~3,000 (~25% decline)

“Recession in 2023 , SPX to decline to 3,000-3,200 bottoming ~4 months before recession end hitting bear-market low in 23H1:

Inflation will subside as monetary tightening runs its course. However, it will take a long time to reach the elusive two percent target.

The Fed is likely to err on the side of caution towards inflation and not pivot even if growth slows until it is confident that core PCE is on track to 2%. There is a high probability of overtightening as a policy mistake.

Tighter monetary conditions will inevitably lead to economic slowdowns. We expect a recession in the second half of 2023.

The earnings recession has already commenced. Earnings will continue on a downward path in 2023, and analyst downgrades are highly likely.

2023 will be a year of two halves. In the first half of the year, the S&P 500 will reach new lows, falling as much as 20-25% of current levels to the 3,000 to 3,200 range on the back of earnings contraction.

SPX earnings in 2023 are expected to decline 20-25%, while Wall Street analysts are expecting 5% growth.”

Barclays: 3,675, US$ 210 EPS (as of Nov. 21)

“We acknowledge some upside risks to our scenario analysis given post-peak inflation, strong consumer balance sheets and a resilient labour market. However, current multiples are baking in a sharp moderation in inflation and ultimately a soft landing, which we continue to believe is a low probability event.“

Societe Generale: 3,800 (as of Nov. 30)

“Bearish but not as bearish as 2022 as the returns profile should be much better in 2023 as Fed hiking nears an end for this cycle. Our ‘hard soft-landing’ scenario sees EPS growth rebounding to 0% in 2023. We expect the index to trade in a wide range as we see negative profit growth in 1H23, a Fed pivot in June 2023, China re-opening in 3Q23 and a US recession in 1Q24.”

Capital Economics: 3,800 (as of Oct. 28)

“We expect global economic growth to disappoint and the world to slip into a recession, resulting in more pain for global equities and corporate bonds. But we don’t anticipate a particularly prolonged downturn from here: by mid-2023 or so the worst may be behind us and risky assets could, in our view, start to rally again on a more sustained basis.“ I’ve personally never heard of these guys before.

Morgan Stanley: 3,900, US$ 195 EPS (as of Nov. 14). S&P 500 will tread water, ending 2023 around 3,900, but with material swings along the way. Overall, investors will need to be more tactical and pay close attention to the economy, legislative and regulatory policy, corporate earnings and valuations, says Mike Wilson, Chief Investment Officer and Chief US Equity Strategist.

“This leaves us 16% below consensus on ’23 EPS in our base case and down 11% from a year-over-year growth standpoint. After what’s left of this current tactical rally, we see the S&P 500 discounting the ’23 earnings risk sometime in Q123 via a ~3,000-3,300 price trough. We think this occurs in advance of the eventual trough in EPS, which is typical for earnings recessions.“

UBS: 3,900, US$ 198 EPS (as of Nov. 8)

“With UBS economists forecasting a US recession for Q2-Q4 2023, the setup for 2023 is essentially a race between easing inflation and financial conditions versus the coming hit to growth+earnings. History shows that growth and earnings continue to deteriorate into market troughs before financial conditions ease materially.“

Citi: 3,900, US$ 215 EPS (as of Nov. 18)

“Implicit in our view is that multiples tend to expand coming out of recessions as EPS in the denominator continues to fall while the market begins pricing in recovery on the other side. Part of this multiple expansion, however, has a rates connection. The monetary policy impulse to lower rates lifts multiples as the economy works its way out of the depths of recession.“

BofA: 4,000, US$ 200 EPS (as of Nov. 28)

“But there is a lot of variability here. Our bull case, 4600, is based on our Sell Side Indicator being as close to a ‘Buy’ signal as it was in prior market bottoms – Wall Street is bearish, which is bullish. Our bear case from stressing our signals yields 3000.“

Goldman Sachs: 4,000, US$ 224 EPS (as of Nov. 21)

“… most markets are still some way off pricing even a standard recession as their base case, and a long way off pricing a more severe recession. […] As a result, we think that equities would likely still have significant downside if a full recession occurred (simple scenarios suggest from 2900 to 3500 on the S&P 500 depending on the severity of the recession and the inflation backdrop) and low-rated credit would also trade much wider. A larger rise in the unemployment rate (to 5% or beyond) would also likely raise risk premia and volatility across a range of assets, particularly in the case where that recession was induced by a need for further rate hikes in response to sticky inflation.” “The performance of US stocks in 2022 was all about a painful valuation de-rating but the equity story for 2023 will be about the lack of EPS growth. Zero earnings growth will match zero appreciation in the S&P 500.“

HSBC: 4,000, US$ 225 EPS (as of Oct. 4)

“…we think valuation headwinds will persist well into 2023, and most downside in the coming months will come from slowing profitability.“

Credit Suisse: 4,050, US$ 230 EPS (as of Oct. 3). 2023: A Year of Weak, Non-Recessionary Growth and Falling Inflation. Credit Suisse analyst Jonathan Golub:

“We expect a reversal of spreads and volatility, leading to 1-2x multiple points of rerating through year-end. By contrast, 2023 returns should be driven primarily by earnings growth.”

RBC: 4,100, US$ 199 EPS (as of Nov. 30)

“We think the path to 4,100 is likely to be a choppy one in 2023, with a potential retest of the October lows early in the year as earnings forecasts are cut, Fed policy gets closer to a transition (stocks tend to fall ahead of final cuts), and investors digest the onset of a challenging economy.“

JPMorgan: 4,200, US$ 205 (as of Dec. 1)

“…we expect market volatility to remain elevated (VIX averaging ~25) with another round of declines in equities, especially after the run-up into year-end that we have been calling for and the S&P 500 multiple approaching 20x. More precisely, in 1H23 we expect S&P 500 to re-test this year’s lows as the Fed overtightens into weaker fundamentals. This sell-off combined with disinflation, rising unemployment, and declining corporate sentiment should be enough for the Fed to start signaling a pivot, subsequently driving an asset recovery, and pushing S&P 500 to 4,200 by year-end 2023.“

Jefferies: 4,200 (as of Nov. 11)

“In 2023, we expect bond markets will be probing for the Fed’s terminal rate while equity markets will be in ‘no man’s land’ with earnings still falling as growth and margins disappoint.“

BMO: 4,300, US$ 220 EPS (as of Nov. 30)

“We still expect a December S&P 500 rally even if stocks do not hit our 4,300 2022 year-end target. Unfortunately, we believe it will be difficult for stocks to finish 2023 much higher than current and anticipated levels given the ongoing tug of war between Fed messaging and market expectations.“

Wells Fargo: 4,300 to 4,500 (as of Aug. 30)

“Our single and consistent message since early 2022 has been to play defense in portfolios, which practically means making patience and quality the daily watchwords. Holding tightly to those words implies that long-term investors, in particular, can use patience to turn time potentially to an advantage. As we await an eventual economic recovery, the long-term investor can use available cash to add incrementally and in a disciplined way to the portfolio.”

Deutsche Bank: 4,500, US$ 195 EPS (as of Nov. 28)

“Equity markets are projected to move higher in the near term, plunge as the US recession hits and then recover fairly quickly. We see the S&P 500 at 4500 in the first half, down more than 25% in Q3, and back to 4500 by year end 2023.“

Dr. Ed Yardeni: 4,800 (as of Dec. 3). Durable goods inflation subsides, Fed pauses, China emerges, backstopping Euro Zone. He is most bullish on energy, financials, and technology. S&P 500 could climb to 4,800 by year-end.

"This time around, the credit system is in much better shape. I think the economy is much more resilient to a tighter monetary policy […] I think it's either rates are going to go higher, causing a recession, which would bring interest rates down next year, or else it's going to be a scenario where rates are going to just go sideways for a while and that'll relieve a lot of inflationary pressures and move through with a soft landing."

Morgan Stanley: Lifting EM targets and upgrading China to overweight alongside existing overweight on Korea and Taiwan

Narrative building to the upside

“Two months on from our upgrade of Asia/EM equity markets, we feel more confident that a new bull cycle is beginning. In recent trading, the MSCI EM index has reached our base case target. Reviewing the top-down situation and incoming market and sector developments, we raise our base case target 10%, to 1,100 from 1,000 (+12% upside), and reiterate our overweight call on EM vs. DM equities.

In terms of recent developments, we highlight the following:

1) Korea: Our strategist for Korea, Joon Seok, upgraded his KOSPI target on December 2 to 2,750, highlighting positive cyclical drivers from troughing earnings estimate revisions, disinflation, and a firming currency trend, as well as structural drivers arising from US export controls and renewable supply chain incentives.

2) China: China's Covid containment policy now appears to be being adjusted on a sustained basis, both in official statements and in actions taken on the ground.

The chart shows a measure of the stringency of Covid restrictions, which allows comparisons through time and across the country, based on nine different sub-components. It shows the elevated level of restrictions currently in place (albeit declining) in China in comparison with the normalisation seen in a selection of other regional economies.Oxford Stringency Index - we expect a steady decline from here in Covid restrictions in China; further potential declines would be important for our overweight call on China.

In particular, investors should keep an eye on:

Mid and large-cap companies: The MSCI EM, an index of mid and large-cap companies in 24 emerging markets, could see 12% price returns in 2023. Japanese stocks, meanwhile, could benefit from a combination of low valuations and idiosyncratic tailwinds—translating to 11% gains for the Tokyo Stock Price Index next year.

Emerging market debt: Another potential bright spot, EM debt could benefit from a combination of trends—including declining rates, improving economic fundamentals and a weakening dollar. Fixed-income strategists forecast a 14.1% total return for emerging market credit, driven by a 5% excess return and a 9.1% contribution from falling U.S. Treasury yield. Emerging market local currency denominated debt should see an even stronger total return of 18.3%.”

Thank you for the coverage, appreciate.

Street is unusually skeptical about 2023 ... hmmm ...

My complementary 2022 S&P 500 deep dive below ... 2022 YE price target & rationale as well.

https://maverickequityresearch.substack.com/p/the-s-and-p-500-report-performance

Have a great week!