A hawkish cut: the ECB has not started a cutting cycle (yet)

The real surprise was the inflation projections revision

Key Takeaways

The ECB surprised by cutting rates despite higher inflation forecasts.

This data-dependent approach suggests future rate decisions will depend on economic data.

The market now expects fewer ECB cuts, favouring the Euro and potentially European equities.

The contrasting monetary policy stances of the ECB and Fed are impacting global market dynamics.

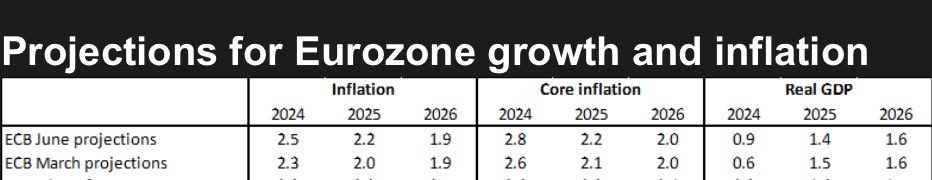

The ECB’s telegraphed cut was not the focal point. In a move that has left the market somewhat baffled, the European Central Bank (ECB) has cut rates by 25 basis points (bps), bringing the main rate to 4.25% and the deposit rate to 3.75%. This is first ECB rate cut since 2019. This decision comes despite the ECB’s inflation projections for 2024 and 2025 being revised upwards, with forecasts for 2024 now at 2.5% (up from 2.3%) and for 2025 at 2.2% (up from 2%). The inflation revision was the real surprise and it seemed like the central bank succumbed somewhat to investors expectations.

Lagarde:

“Inflation is expected to fluctuate around current levels for the rest of the year. It is then expected to decline towards our target over the second half of next year”.

Inflation, for one, quickened more than anticipated in May, with a gauge of underlying trends also wrong-footing analysts by edging higher. Elsewhere, wage rises failed to moderate in the first quarter — suggesting elevated growth in services prices will persist. Another crucial measure of pay is due Friday and may paint a similar picture.

The ECB’s decision not to pre-commit to any particular rate path, instead opting for a data-dependent, meeting-by-meeting approach, suggests that the bank will likely maintain a restrictive stance. This implies that key rates will likely remain above the neutral rate for the next 12 to 18 months.

And its preferred measure of euro-zone pay showed acceleration at the start of 2024, in the latest sign that price pressures in the region are proving stubborn: compensation per employee rose by 5.1% from a year ago in the first quarter, up from a revised 4.9% in the previous three months.

The market initially expected a more dovish stance, anticipating two additional rate cuts this year. However, the ECB's higher inflation projections and cautious tone dampened those expectations. Unsurpisingly, bond yields have slightly increased across maturities after the announcement, without significant weakness in peripheral rates. The market is now pricing in fewer than two rate cuts for the remainder of the year, aligning with expectations of one rate cut per quarter: i.e. traders are pricing in just 36 bps of further rate cuts this year, meaning another cut and less than a 50% chance of a third to follow. This is a significant shift from earlier on Thursday, when there was over a 60% chance of a third cut.

Shifting Tides: Eurozone vs. US

This hawkish tilt from the ECB contrasts with renewed easing expectations for the US Federal Reserve (Fed). The stronger Eurozone economic performance in Q1 2024, compared to a sluggish US showing, has reversed the earlier trend of investors favouring US debt. This shift is reflected in increased bets on Fed rate cuts (potentially reaching 50 bps this year) and lagging performance of Eurozone government bonds compared to US Treasuries.

WSJ: A scenario where the ECB cuts rates further while the Fed stays put would risk reducing the euro's strength against the dollar, pushing up the cost of imports and lifting eurozone inflation higher. This could delay further loosening in Europe, whose economy is in bigger need of relief than the robustly growing U.S. economy. Despite the sharp interest-rate increases of the past two years, economic growth in the U.S. has proven resilient. The U.S. economy remains robust despite recent interest rate hikes, unlike Europe's stalled economy since late 2022, though there was some growth early in 2023 and strong performance in the south due to tourism. Both regions see strong job creation and high wage growth, contributing to eurozone inflation.

Earlier in the year, both the ECB and the Fed were expected to cut rates, but rising U.S. inflation disrupted these expectations. The U.S. inflation rate reached 4.1% annually in early 2024, leading some Fed officials to consider further rate hikes. Despite a strong U.S. labor market and economic activity, including a 2.8% rise in final sales to private domestic purchasers and a low 3.9% unemployment rate, wage growth remains too high for inflation to sustainably hit 2%. Fed policy decisions will depend on economic data, with rate cuts contingent on lower inflation or significant job market weakening.

The ECB’s hawkish tone has added fuel to a shift in the economic divergence theme, with receding ECB rate cut bets contrasting with a renewed increase in US rate cut expectations. This shifting outlook means government bonds in the euro zone will continue to lag, after they underperformed US Treasuries for the first time since January last month.

However, prospects for fewer ECB cuts is better news for the euro. It edged higher on Thursday to $1.0883, adding to its roughly 2% rally from a 5-month low hit in mid-April. The euro zone’s improving economic performance means European stocks are also seen gaining. While underperforming US peers, they have rallied over 9% this year and touched record highs earlier on Thursday.

What shall we expect from here?

First reaction of markets showed that the cut was almost a non-event. Global yields grinded marginally higher through yesterday’s trading session and the sell-off was largely unaffected. The 5y point suffered 1bps more relative to the short end and the long end, on a relatively upbeat growth assessment. 10y Bunds ended 4bps higher on the day at 2.55%.

As usual, only out-of-consensus data will change this well-telegraphed path. ECB eyes will be on the labour market: if it doesn’t slow down on cue over the summer, another rate cut in September would be much less likely. Therefore, we can expect volatility to remain low and credit spreads tight in the foreseeable future.

As we said last time, we will continue to play momentum until it lasts, but we cannot forget how tight the market has become. This chart is self-explanatory and offer a great picture of the current credit market.

Source: Ashenden Finance Team