A look at this bullish run: Market Momentum and Economic Outlook

Analysis of Market Trends, Economic Challenges, and Credit Dynamics in Q1 2024

The market’s bullish trend: a double-edged sword

In March, the market continued its relentless ascent, marking a fifth consecutive month of gains and a strong quarter. The Euro Stoxx 50 ended the first quarter of 2024 up by 12.42% and +3.7% on the month, outperforming both the S&P 500 and the NASDAQ 100 – a rare sight indeed. The S&P 500 closed up by a notable 3.1% for the month, propelling its year-to-date performance to an impressive 10.2%. Meanwhile, gold has reached record levels, further accentuating the buoyant sentiment pervading the investment landscape. Finally the 10-year U.S. Treasury yield concluded the quarter at 4.2%, up by 32 basis points since the year's start.

This bullish trend, characterized by a mind-numbingly narrow channel, extremely low volatility, and high complacency, has lasting much longer than many anticipated. Investors must maintain their long positioning and remain vigilant for a break of the trend channel to take more aggressive risk reduction actions.

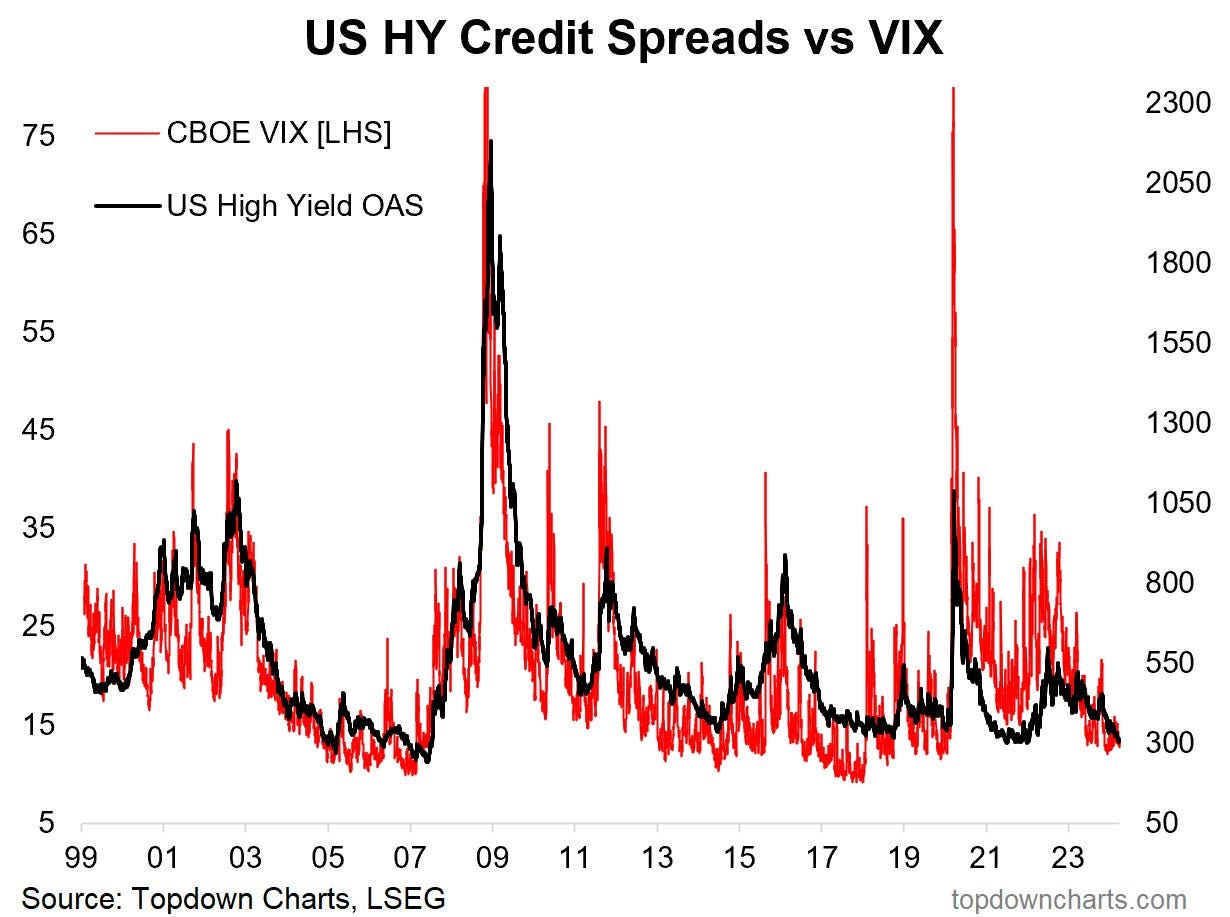

As markets calmly drifted higher, implied volatility moved lower, reflecting a dormant risk sentiment. This is evident across the risk curve, with High Yield credit spreads and Emerging Markets risk sentiment plumbing the lows. The VIX at 13 till last week (and now 16) certainly suggests that it would be imprudent not to hedge portfolios for a pullback that seems highly probable this quarter, even within the context of a strong bull market.

The Q1 earnings season is about to start and it will be unsurprising that we will see a high percentage of companies “beat” Wall Street estimates. Analysts remain optimistic about earnings even with economic growth weakening, inflation remaining elevated, and liquidity declining. Even with the decline in earnings from the peak, valuations remain historically expensive. The S&P 500 now trades at 20.8 times forward earnings which is meaningfully higher than its 16 median over the last decade.

Market sentiment is a little overstretched so a consolidation would be a healthy move in a generally constructive environment. While exuberant markets can stay that way for a while due to the underlying momentum, we advise some caution regarding increasing allocations at current levels. We anticipate a better entry point for riskier positions over the next month or so.

Wall Street is expecting a subdued US earnings season despite the stock market fireworks. Consensus is for 3.9% profit growth, Bloomberg Intelligence said. In particular, Bloomberg highlights five themes:

Concentrated Growth. A resilient economy and strong consumer demand are expected to fuel a rise in earnings growth for S&P 500 companies for a second straight quarter following three straight quarters of profit contraction. And strong margins from big tech firms will likely be a key driver.

Raising Expectations. Analysts have been raising their earnings forecasts faster than they are marking them down for previously unloved groups, from health care to utilities. Seven S&P 500 sectors are forecast see EPS growth accelerate over the next year:

Cash Hordes. Corporate cash and free cash flow are at record high levels, setting the stage for a recovery in how the largest US companies deploy their capital, whether through payouts to stockholders or investing in expanding their businesses

Margins Improving. Traders will be keeping a close eye on operating margins, a key gauge of profitability that historically offers a signal on where a company’s stock price is headed

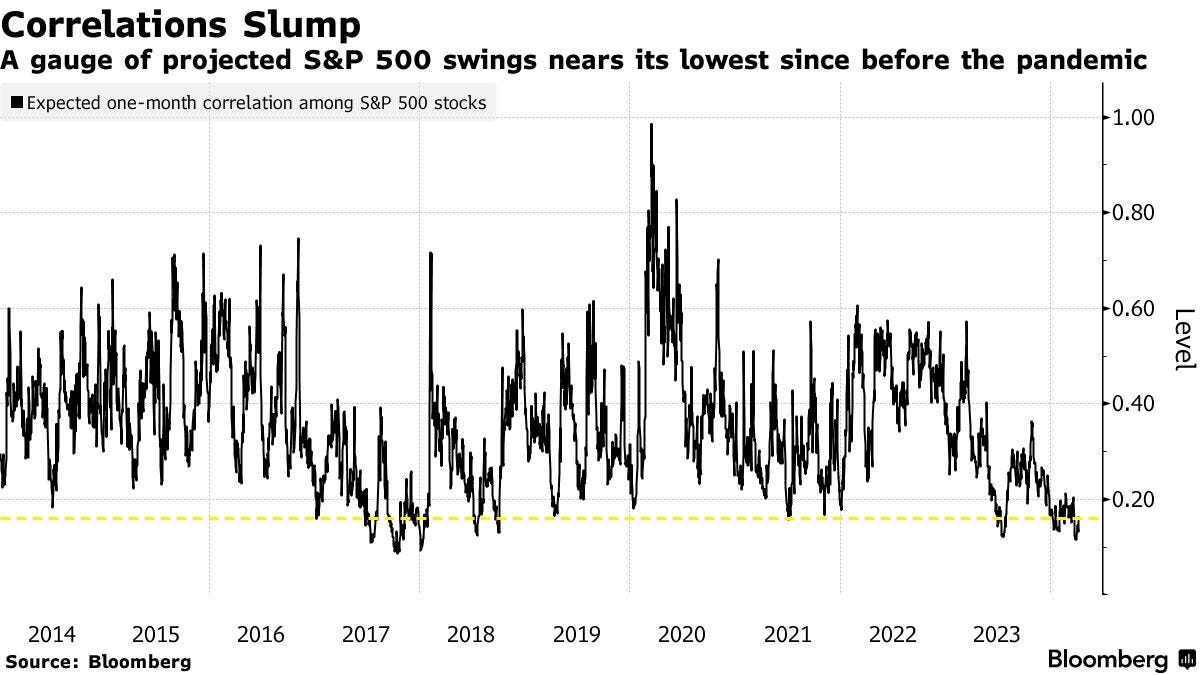

Sector Picking. Traders aren’t expecting share prices to move in unison this earnings season. Differing inflation outlooks for S&P 500 sectors has left a gauge of expected one-month correlation in the index’s stocks hovering near its lowest since 2018, Bloomberg data show. A reading of 1 means securities will move in lockstep, it’s currently at 0.16.

The economic outlook: challenges and risks

Inflation remains a persistent challenge in 2024. Despite the slight increases seen in January and February, the Federal Reserve attributed these to seasonal factors during its March 20 meeting. However, the current geopolitical tensions in the Middle East and Ukraine, as well as rising commodity prices, could impede a significant decrease in inflation. While the risks of a second inflationary wave, similar to the late 1970s, remain low, they are not non-existent. Therefore, it is crucial to monitor inflation closely as it remains a key variable.

The labour market in the US is showing signs of marginal weakening, and the post-COVID savings are being spent. Delinquencies in credit cards and car loans are increasing, and the weakest socio-economic sectors are feeling the burden of increased interest rates. Although these changes are gradual and overshadowed by the healthy financial conditions of large corporations and most wealthy households, some clouds are appearing in the macroeconomic sky.

The Federal Reserve has already indicated that it will quickly intervene (by cutting interest rates) in case of a significant deterioration in the labour market. Additionally, the reduction of the central bank's balance sheet will be modulated to avoid a dramatic drop in liquidity in the financial system. However, if there is no employment shock, interest rates are expected to remain high for a longer period, and the central bank's balance sheet will shrink, which may pose challenges for the economy.

Bank of America stated that if the Federal Reserve can’t cut interest rates this June, it might delay easing until March 2025. This came after the central bank revised up its inflation and growth projections and yet strengthened a dovish tilt to its policy stance. The bank delivered two consequential signals – a willingness to tolerate higher inflation for longer and an openness to slow the ongoing reduction in its balance sheet.

Reacting to these unexpected signals of monetary policy patience, markets pushed stocks and gold significantly higher to record levels. At the same time, last month bond prices fell as traders became less confident that the Fed might cut interest rates as early as June.

Rates: the 10-year yields continue to test the critical resistance at 4.35%, moving higher earlier in the session but closing right at the level yet again.

On the other hand, the US budget deficit, which provided ample support for economic growth last year, is likely to be smaller this year, posing an additional headwind to economic growth.

The biggest risks come from the unexpected. The main market narratives predicted a recession in 2023 and a soft or no landing in 2024. If commodity prices continue to increase (as we saw recently with soft commodity prices in cocoa and coffee), preventing swift rate cuts, and the US labor market weakens enough to dent consumer confidence, then the specter of stagflation (high inflation and low growth) could spook financial markets.

Furthermore, the wars in Ukraine and Gaza continue, and the direct involvement of Western countries in these conflicts cannot be completely ruled out, posing additional geopolitical risks.

Credit overview: a shift from risk to fundamentals

Bonds today are pricing a very calm inflation environment (2%) without much volatility. Currently, credit markets are adapting to increasingly accommodating monetary policies. However, the prospect of the Federal Reserve implementing an initial rate cut seems to be receding.

This changing scenario could potentially set the stage for a significant downturn in junk bonds as the market’s focus shifts from a risk-oriented approach back to core fundamentals. This shift is especially likely if the Fed opts for a more hawkish policy stance.

Investment Grade bonds with tight levels offer limited upside due to the duration risk, particularly as a recession is not anticipated in the near term. The long-term segments of both US Treasuries and German Bunds could witness an upward trajectory, possibly driven by a rise in structural inflation. This inflationary pressure could stem from an increased supply due to escalating fiscal deficits, such as those linked with augmented defence spending and fiscal stimulus. Additionally, cyclical inflation may also turn with higher oil and food commodity prices.

Euro bond valuations remain attractive relative to the richly priced US and EM (particularly EM IG) bonds. Very tight US High Yield spreads indicate the possibility of much lower forward returns. Valuation spread percentiles indicate Euro bonds continue to have the lowest valuation in both IG and HY. EM IG bonds are now near the most expensive pricing in the last 10 years. These could imply more opportunities in European bonds. Considering credit risk, Euro bonds currently offer the highest risk-adjusted returns.

A deeper analysis should be dedicated to High Yields. Presently, there’s a noticeable trend among investors towards less discrimination between high and low-rated junk debtors. This could be an indication of an excess of capital in the system. The spread between bonds rated as BB and B has recently reached its narrowest since 2009, significantly below the decade average nearing 150bps. This mirrors the narrowing gap between BBB and B rated bonds, which hit a 2007 low earlier this month.

As pointed out by Goldman Sachs, the EUR CCC Index – the lower end of the High Yield market – experienced a nearly 8% drop two weeks ago, effectively wiping out its year to date gains. In a climate of pervasive and sometimes irrational optimism, this serves as a counter-narrative, highlighting emerging cracks in the system. Much of this underperformance can be attributed to a select group of distressed companies that have been attracting increased investor scrutiny. These companies, including global packaging firm Ardagh Group, French telecom giant Altice, and Swedish debt collector Intrum, appear to be the first signs of a looming wave of challenges for heavily indebted borrowers.

These borrowers, who previously managed their interest payments in a zero-rate environment, are now finding themselves in a precarious position due to a sudden increase in those payments. When these distressed companies are excluded, the performance of High Yield credit appears as optimistic as the thriving equity markets. As demonstrated by research from Barclays, spreads for non-distressed issuers have now fallen below 300bps, and a third of the High Yield universe is now below 200bps. This suggests a broader market that is priced for near perfection.

The key question we must consider is whether the recent blow-out in a handful of distressed credits is a temporary setback, akin to an SVB for the European High Yield market, or a sign of a more systemic issue. This issue could become more apparent if, as many predict, persistent inflation results in prolonged higher rates.

However, we should temper this notion as tighter spreads might not be as alarming when we factor in the higher proportion of BB-rated bonds (better quality) and the depressed bond prices. Additionally, early refinancing could offer some relief to investors.

As a matter of fact, we should take into account two factors. First, improved credit quality. BB-rated bonds – the better quality cohort – make up a higher proportion of the high yield bond market compared to 10 years ago and even more 20 years ago. A second factor for tight spreads is the fact that bond prices are trading well below par. It is rare for credit spreads to be tight and bond prices to be so low. This creates a pull to par effect. There is also the prospect of a beneficial effect from early refinancing, which would enhance investor returns.