A market rollercoaster

A look at the past month, influenced by Fed’s tightrope walk amid economic uncertainties

April 2024 proved to be a challenging month for markets, marked by a flurry of corporate earnings reports, the first-quarter US GDP announcement, and the release of the Fed's preferred inflation measure. Corporate earnings exceeded expectations, albeit against a low bar, and the economy maintained its forward momentum, albeit at a reduced speed. However, persistent inflation pressures drove rates higher, complicating the backdrop for risky assets. Going forward, we could see higher volatility associated with Fed-policy uncertainty.

As a result, both stock and bond markets responded negatively with global bonds declining by 2.5% and developed market equities by 3.9% over the month. The S&P 500 retreated below the 5,000 mark for the first time since February, ending the market's five-month winning streak with a 4.1% drop. The Dow Jones Industrial Average recorded its worst month since September 2022, falling by 4.9%, while Europe's Stoxx index lost approximately 2%. While on rates, markets priced out one and a half rate cuts in the US this year and the timing of the first cut was pushed further out. 2-year Treasury yields rose 40bps to 5.0%, while 10-year Treasury yields rose 47bps to 4.7%.

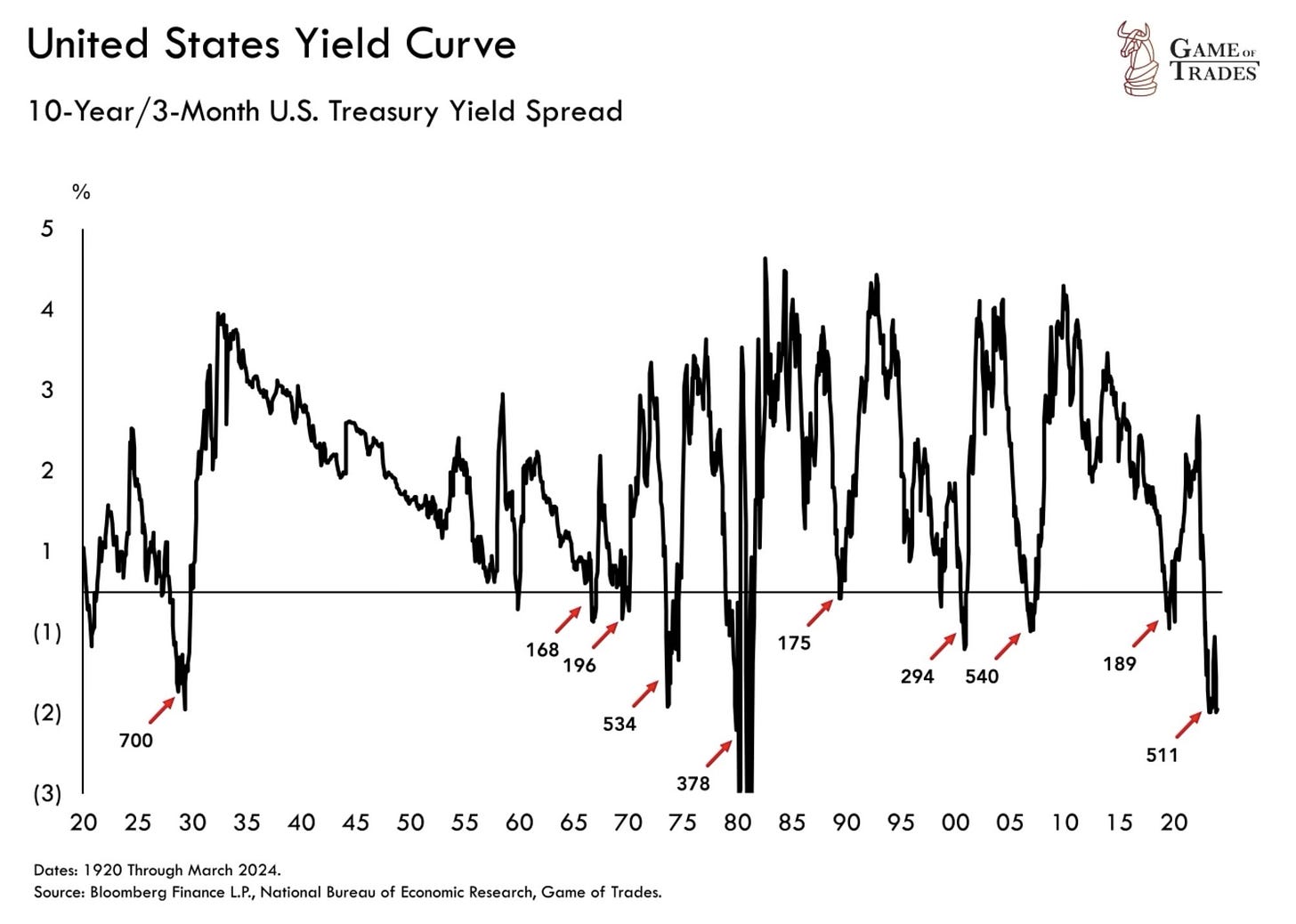

Moreover, the yield curve has been inverted for +500 days. This has only happened 3 times since 1920: 1) 2008; 2) 1929; 3) 1974. All 3 saw more than 50% market declines.

Market dynamics in April were primarily influenced by a revaluation of anticipated Federal Reserve rate cuts and a subsequent increase in back-end rates. The policy-sensitive US 2-year rate breached the 5% threshold, peaking at 5.03% – the highest level since November 2023. This surge was attributed to a hotter-than-expected employment cost index, which Rob Sockin of Citi likened to "a bad dream" for the Fed. Additionally, the ongoing lack of fiscal discipline is undermining the Fed's efforts to control inflation, leading to a more hawkish stance.

Morgan Stanley predicts that if yields remain at their current levels over the next three months, equity multiples could face a further downside risk of around 5%, assuming all other factors remain constant. This could result in the S&P 500 dropping to the 4,700 - 4,800 range. The bond market's initial dovish narrative shifted dramatically: by letting the bond market run with a very dovish narrative, we ended up with ~7 rate cuts for this year priced by early January and a 10-year yield of ~3.8%. While today the US Treasury 10 years is almost 100bps higher.

The decline in rates since the end of last year sparked a significant rally in risky assets, creating a wealth effect and easing financial conditions. This rally contributed to stronger growth and higher-than-anticipated inflation, which now challenges the Fed's ability to maintain its previous dovish stance. Consequently, the bond market has reversed its cut expectations, now pricing in just 1.5 cuts for the year.

In light of recent data reversals, there is (excessive) speculation about whether the Fed might need to increase rates again. The pendulum has swung from earlier optimism about rate cuts to the current consideration of resuming rate hikes. This shift back to a hawkish mode presents a headwind for valuations. Therefore, we believe we are entering a more turbulent phase in the market, driven by uncertainty regarding the Fed's policy direction.

Fed can’t cut soon

The cautious Fed rhetoric from the FOMC meeting last week, coupled with recent macroeconomic data, has reinforced the view that a central bank rate cut may be delayed. This aligns with our perspective since the end of last year.

During the FOMC meeting last week, the Fed maintained its rates at 5.25-5.50%, as anticipated, and announced a reduction in the pace of its balance sheet contraction by lowering the Treasury redemption cap from $60 billion to $25 billion per month starting June 1st, a decision made unanimously. The FOMC highlighted the absence of further progress towards the 2% inflation target, maintaining its stance that economic activity has continued to expand at a solid pace, with strong job gains, a low unemployment rate, and easing yet elevated inflation over the past year.

Chair Powell, in his press conference, emphasized the economy's significant progress towards its dual goals and the substantial easing of inflation over the past year, although he noted that inflation remains too high and further progress is uncertain. Powell indicated that the Fed does not foresee rate cuts until there is greater confidence in approaching the 2% inflation target. He also mentioned that gaining this confidence would take longer than expected and clarified that slowing the pace of QT does not imply a smaller reduction in the balance sheet but aims to ensure a smooth transition for money markets.

Despite a generally dovish tone from Powell (that deliberately refused to accept any real possibility that it would return to rate hiking) and an unexpected dovish adjustment in QT tapering (the market expectations were for a reduction to US$ 30bn from US$ 60bn, but the actual reduction is to US$ 25bn), the FOMC's statement included a hawkish acknowledgment of the ongoing lack of progress on inflation.

The Personal Consumption Expenditures (PCE) Price Index for March, the Fed's preferred inflation measure, slightly exceeded expectations at 2.8% year-over-year. This, along with earlier CPI data, indicates persistent inflationary pressures, challenging any expectations for aggressive rate cuts by the Fed. This is further complicated by weaker-than-expected Q1 GDP growth and disappointing manufacturing and services PMI figures, which have reached multi-month lows.

The combination of higher-than-anticipated inflation and slower economic activity complicates the Fed’s efforts to engineer a soft economic landing. The lack of confidence reflected in the latest "dot plot," which anticipated three rate cuts this year, underscores the challenges faced by the Fed in navigating the current economic environment. Central banks outside the U.S. may be in the same or a similar policy conundrum as the Fed, although the Bank of Japan remains a notable outlier, considering rate increases as the Japanese economy recovers from decades of deflation.

We expect the "last mile" of inflation to take longer and require some patience, but we see further progress ahead. The path toward the Fed's 2% target stalled in the first quarter, which, together with a resilient economy, means that policymakers have every reason to be patient with rate cuts. We anticipate that the first rate cut may occur in the latter half of the year, pending further progress.

Credit overview: capitalizing on potential pivots

We believe there is a scenario where we enter an economic slowdown and central banks are forced to cut rates swiftly, acting as a strong tailwind for fixed income markets as investors look to lock in higher yields. Given the current market setup and the proximity of the peak rate cycle, the potential upside is greater than the downside. For this reason, we see an opportunity to start complementing cash with intermediate- and long-term bonds. Timing is crucial, as markets often pre-emptively react to anticipated policy changes.

As investors adjust their expectations in response to potential shifts in monetary policy, close monitoring of economic indicators continues. However, this scenario must be balanced against a burgeoning deficit that constrains the US's fiscal flexibility in the event of an economic downturn. Additionally, a significant increase in bond issuance could test investors' appetite and might negatively impact sovereign credit ratings, as evidenced by Fitch's downgrade of the US from AAA to AA+ in August 2023.

The US Treasury has significantly increased its federal borrowing estimate for the current quarter to $243 billion, surpassing most predictions. This adjustment primarily reflects lower-than-expected cash receipts. An excess of Treasury issuance could counteract any Fed policy adjustments, maintaining high long-term yields and exerting pressure on global bonds.

In April, the benchmark 10-year Treasury yield reached a six-month high, driven by resilient US economic data that led traders to reduce their expectations for Federal Reserve rate cuts this year. Concerns about heavy debt supply could further diminish demand for US debt.

Developing-nation sovereign bonds slid by the most in seven months. Following a strong Q4 2023 and beginning of 2024, government bonds sold off on the back of strong economic data and upside inflation surprises, but risk assets reacted well as the soft-landing narrative remained intact. While assets have staged a rebound in early May, many money managers are rethinking their optimism after last month’s selloff.

In the corporate bond market, the first quarter saw two opposing forces affecting returns: rising government bond yields and tightening credit spreads.

Overall, credit markets have been buoyed by strong economic data so far. However, they could face challenges if bond yields rise significantly or if anticipated central bank cuts fail to materialize. In such a scenario, a higher interest rate environment could continue to strain weaker capital structures.

We believe the best risk/reward opportunities are now in higher-quality bonds (e.g. Investment Grade and Xovers), as recent spread compression has made valuations in higher beta segments less attractive. On the other hand, the recent bond sell-off opened a good window to add bonds with maturities above 5 years. In addition, we continue to see pocket of value in specific Emerging Market and High Yield bonds.

Source: Ashenden Fixed Income Monthly Report

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Feel free to ask us more information: write to us at research@ashendenfinance.ch