A Tale of Two Markets: Euphoria in Equities, Fear in Fixed Income

A disconnect is visible in the current market status, let's have a look

Macro overview: new equity highs amid complacency

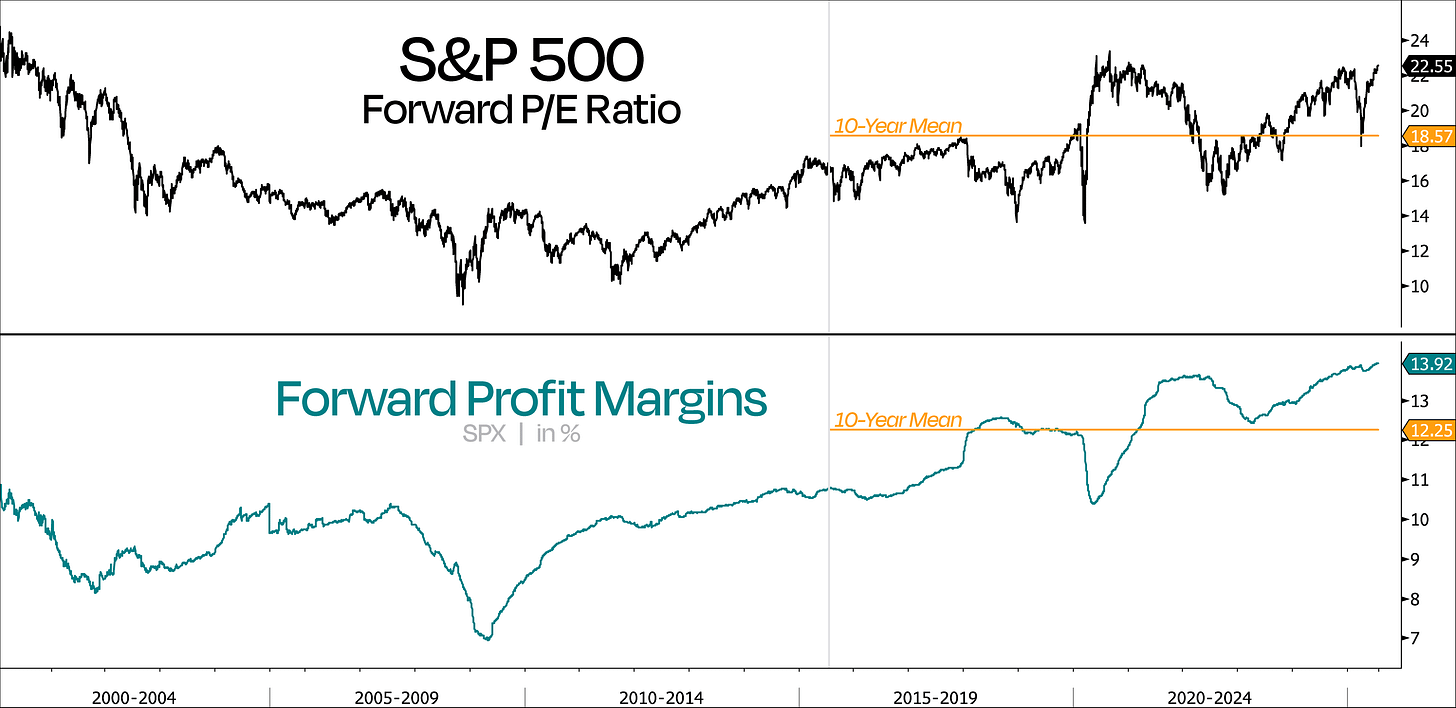

In July 2025 global equities reached record highs and bullish sentiment driven by expectations of favorable trade resolutions, economic resiliency and the anticipated short-term fiscal stimulus from the forthcoming "One Big Beautiful Bill Act" (OBBBA) in the United States. This surge in risk assets, notably the S&P 500 which closed at new record highs and now up 11% from its April lows, has occurred despite the overall increase in U.S. tariffs since the pre-Trump era, betraying what we believe is a significant degree of investor complacency.

Earnings season has been remarkably strong, with nearly 82% of S&P companies beating estimates, putting Q2 2025 on track for the highest earnings surprise rate since Q3 2021 (although the bar for the estimates was recently lowered). This "risk-on" tone has broadened beyond technology, with industrials and materials also joining the rally.

However, this bullish equity performance stands in stark contrast to the bond markets, where yields in the U.S., UK, Europe, and Japan are reflecting palpable concerns over debt sustainability. Simultaneously, pronounced shifts in global capital flows and reserve management strategies are underway. The U.S. dollar has depreciated by 11% year-to-date, and oil prices have fallen by 30%, while gold has ascended to become the second most held reserve asset globally, surpassing the Euro, and Bitcoin reached new record levels. This indicates a significant flight to perceived safety and a diversification away from traditional reserve currencies.

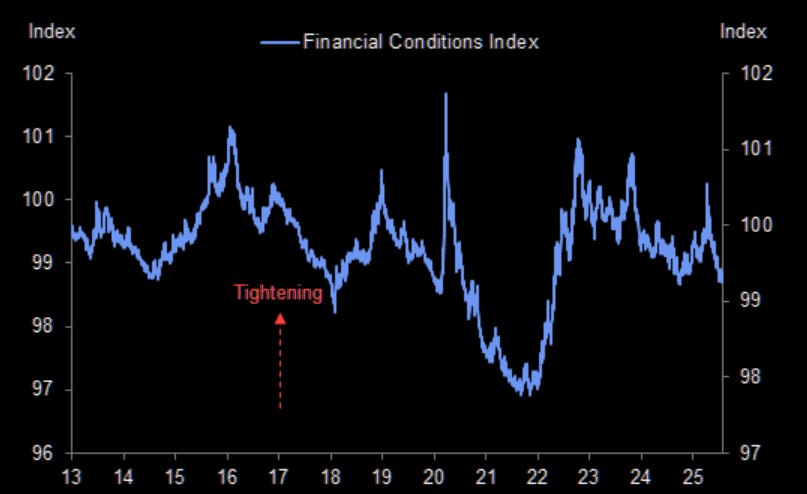

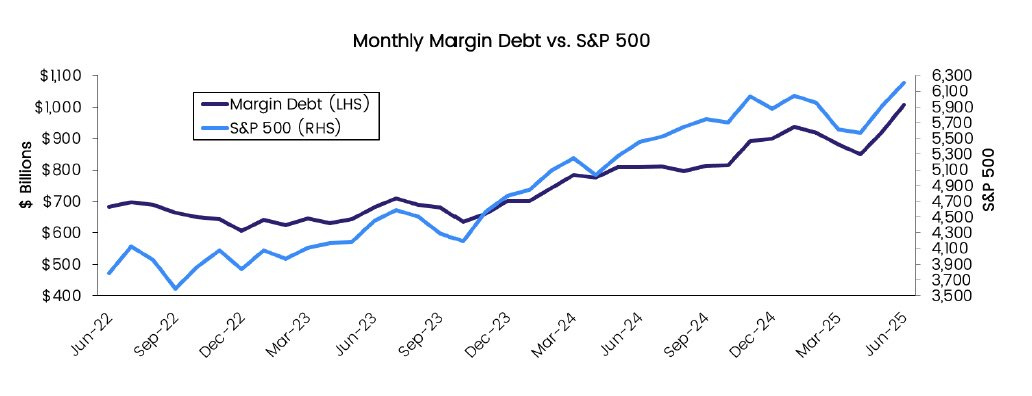

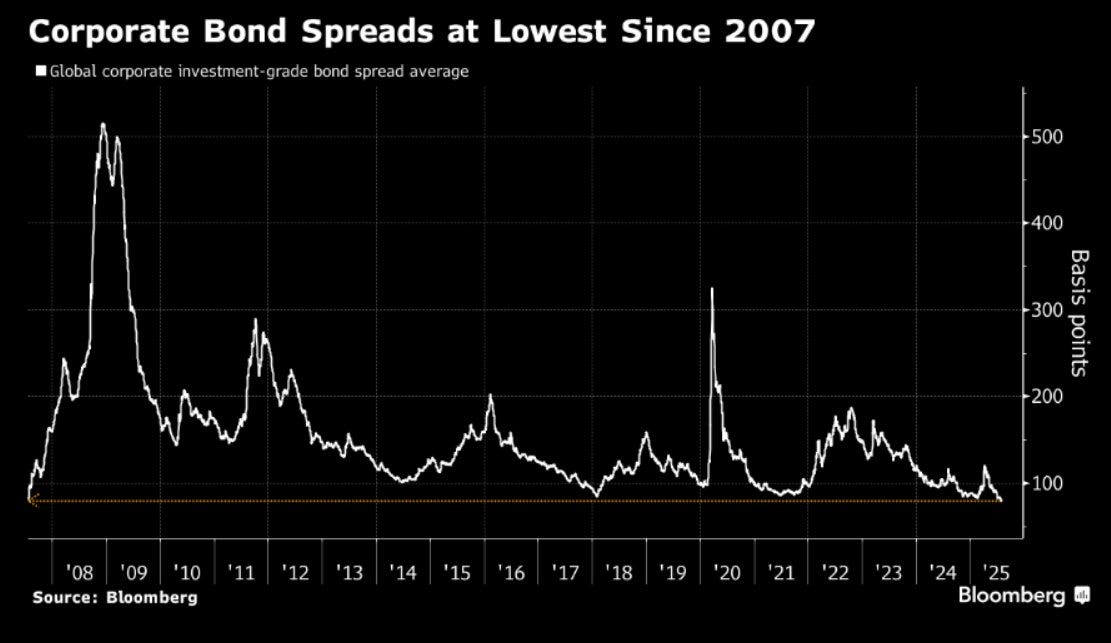

Financial markets, meanwhile, are not behaving as if policy rates are restrictive. Record-high margin debt, a resurgence in "meme stock" manias, and historically narrow junk bond spreads are all indicators of exceptionally loose financial conditions.

Financial conditions, as evidenced by record-high margin debt at $1.01 trillion (for the first time in history) …

… and historically narrow junk bond spreads, remain exceptionally loose, calling into question about the "restrictive" nature of current monetary policy.

The spread between BB-rated junk bonds and Treasury securities has narrowed to 1.64%, a level alarmingly comparable to periods immediately preceding the Dot-com implosion and the 2007 financial crisis, suggesting investors are taking substantial risks for minimal additional yield. While some sectors like commercial real estate face significant headwinds, the broader financial market is awash in liquidity, with major investment banks reporting significant YoY spikes in equities trading volume. This permissive financial environment, despite the Fed's stated restrictive stance, creates a critical feedback loop, as the rising stock market and accompanying wealth effect could further stoke inflationary pressures, which are already being fueled by goods prices via the ongoing trade war.

Tariffs, trade deals, and the looming volatility

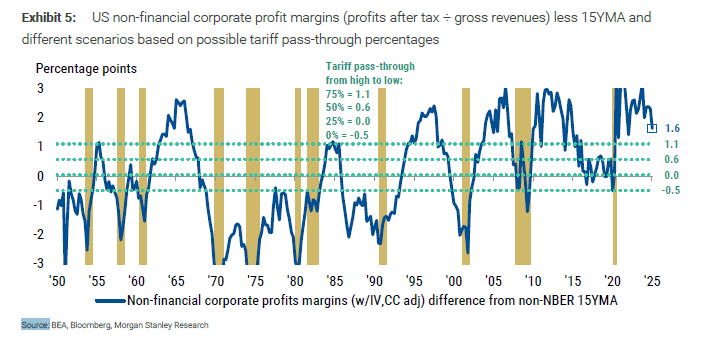

The perceived easing of U.S. tariff threats and the prevailing market euphoria, appears to significantly downplay the latent volatility stemming from the U.S. administration's continued pursuit of tariff policies. While the "One Big Beautiful Bill Act" and any inherent resilience in U.S. economic data could offer a near-term boost to risk assets, the fundamental economic reality is that the cost of higher tariffs must be borne by either U.S. corporations or consumers. If businesses absorb the costs, profitability will be squeezed; if passed on to consumers, disposable income will diminish. To date, evidence suggests that companies and importers have largely borne the brunt, and corporate forward guidance this earnings season will be crucial in revealing the true impact on profitability and capital expenditure plans.

Recent trade negotiations have yielded complex and, at times, contradictory outcomes. The U.S. and Japan reached a trade deal imposing a 15% tariff on most imports to the U.S., including cars, with a commitment from Japan to establish a $550 billion fund for U.S. investments, albeit largely in the form of loans rather than direct equity.

Similarly, a framework deal between the U.S. and the EU aims to avert a broader trade war, setting a 15% tariff on most EU exports to the U.S. (excluding steel and aluminium, which remain at 50%) and a commitment from the EU to purchase $750 billion in American energy products and invest $600 billion in the U.S. However, this agreement, announced on July 28, 2025, faces substantial scrutiny and implementation challenges. It is currently a non-legally binding political statement due by August 1, requiring a complex and lengthy ratification process involving the European Parliament and individual member states. The deal has drawn widespread and sharp criticism across Europe due to perceived imbalances, with critics arguing it reflects an asymmetrical power dynamic. French ministers, for instance, have already called for further talks to rebalance trade relations, suggesting formal conclusion could take weeks or months, with Prime Minister François Bayrou calling it a "dark day" and a sign of "submission". German Chancellor Friedrich Merz stated he was "not satisfied" but conceded "that achieving more just wasn't realistic," warning of "significant damage" to the German economy. Meanwhile, Swedish MEP Karin Karlsbro asserted that "free trade principles... are being systematically dismantled."

Furthermore, the feasibility of the EU's $750 billion energy purchase commitment, implying $250 billion annually, is questioned by analysts given historical energy trade figures. The EU is the U.S.'s largest trading partner, with a goods trade surplus of approximately $235-250 billion in 2024, though the U.S. holds a surplus in services trade with the bloc. These complexities suggest that the formal conclusion of the agreement could extend for weeks or months, and its ultimate impact remains uncertain.

These fluid tariff landscapes and the potential for retaliation across various economic blocs present considerable downside risks to global growth projections. The still-evolving nature of these policies requires a granular assessment of final tariffs to accurately estimate growth forecasts. The market's declining expectations for U.S. profits compared to April, now closer to more conservative estimates, coupled with these trade negotiations and broader geopolitical risks, could put on pause the current bull. Moreover, the seasonally lower liquidity typical of August could amplify market volatility if these risks fully materialize.

Therefore, a more nuanced stance on risk, supported by ample safeguards, is warranted, particularly for investors in expensive segments of the market such as U.S. equities, where the stock market remains richly valued with little margin for error from companies' forward guidance.

A "Bad News Is Good News" Rally: The Weak Jobs Report and What It Means for You

This week, markets did something that might seem a little backwards: stocks, gold, and crypto all shot up, despite some pretty weak economic news. Why? Because investors are now betting that the Federal Reserve is much more likely to cut interest rates.

It all started with the latest jobs report. On Friday, we got some numbers that painted a picture of a slowing economy:

Fewer jobs created: July's non-farm payrolls added only 73,000 jobs, far below the 110,000 expected.

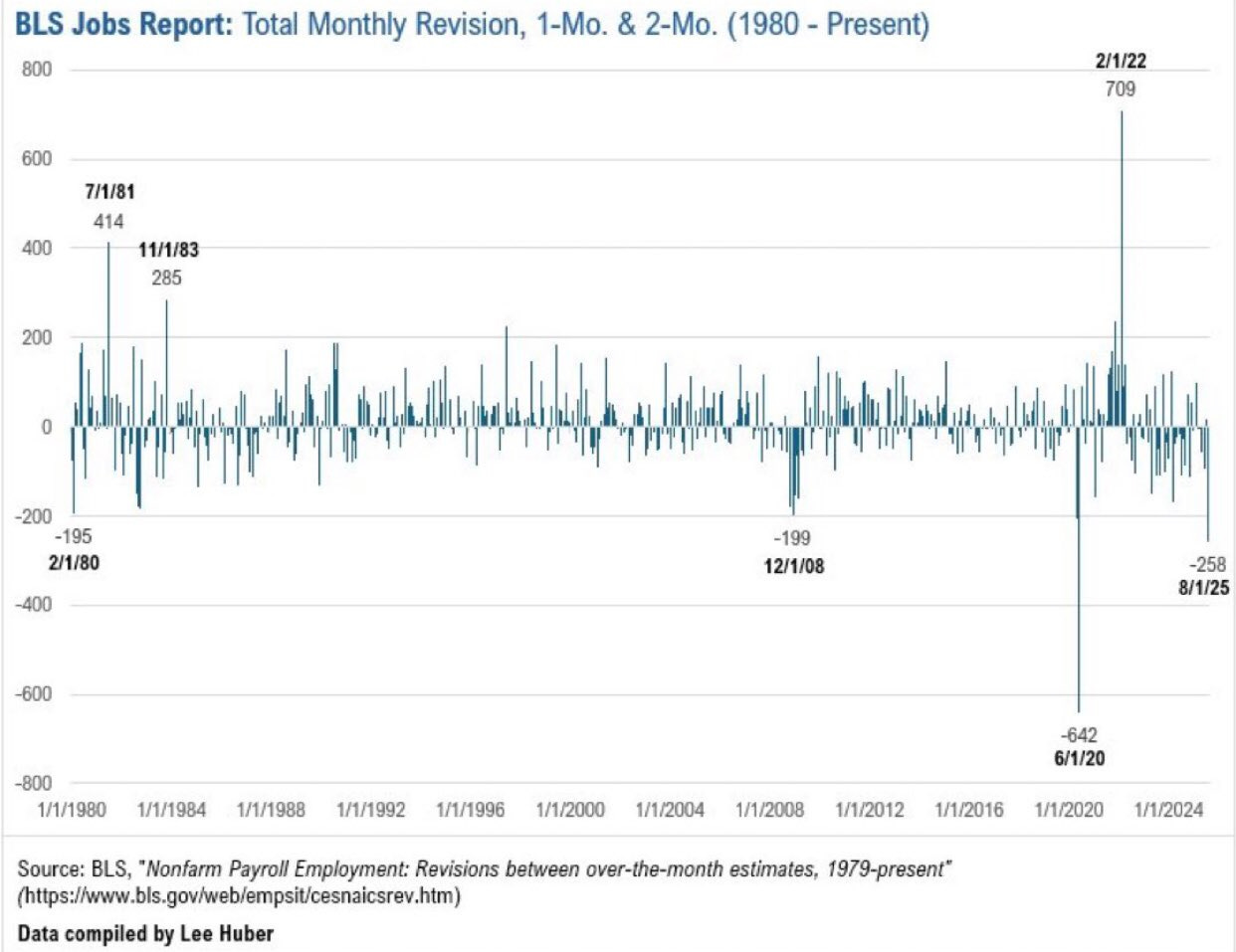

Revisions to previous months: The revisions to May and June's numbers were a real shocker, with 258,000 jobs wiped out. Goldman Sachs noted that a downward revision of this size is extremely rare outside of a recession: i.e., the largest from 1960.

Unemployment ticking up: The unemployment rate rose slightly to 4.2% from 4.1%.

This data suggests that the labor market, which has been a bright spot for a long time, is finally losing steam. And for the market, that's not necessarily a bad thing.

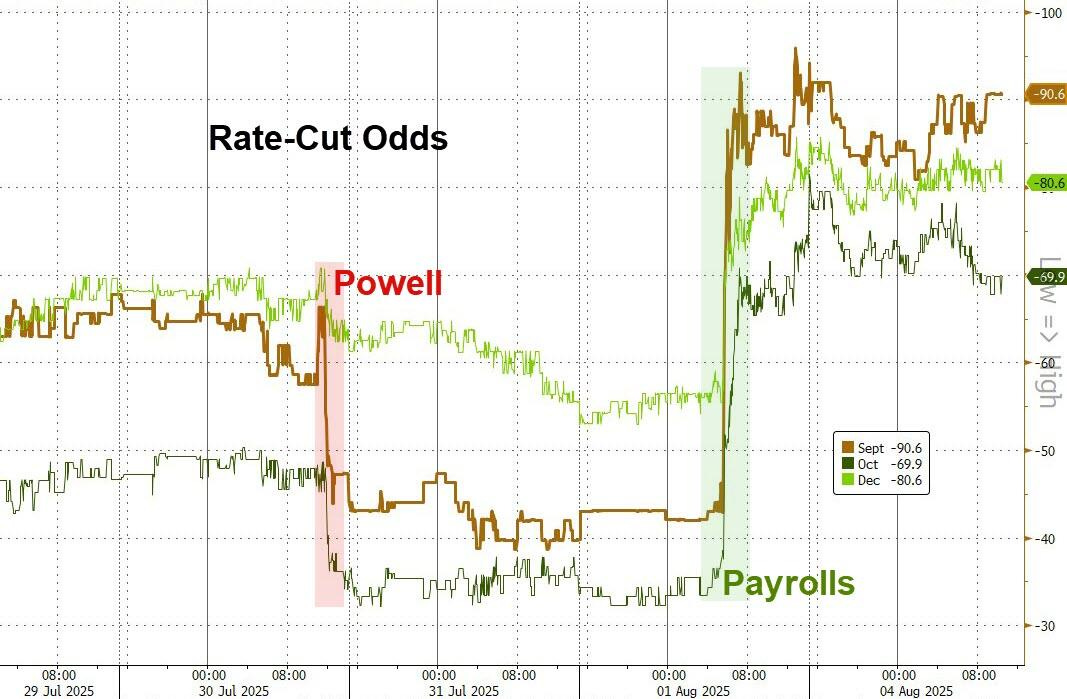

This slowdown gives the Fed a strong reason to ease its monetary policy. Before the jobs report, a September rate cut was a possibility. Now, the market has fully priced in a cut with nearly 95% certainty. The odds of a second cut by December have also more than doubled. This shift in expectations sent shockwaves through the financial world. The dollar weakened, a sign that can be good for global markets because a weaker dollar makes U.S. exports more competitive. Treasury yields also dropped significantly on 2-year and 10-year notes, a sign that bond investors are expecting lower rates in the future. Finally, stocks rallied, as many believe that if the Fed cuts rates, it will make borrowing cheaper and boost corporate profits, especially for major tech companies that are still performing well.

Adding to the uncertainty is the political fallout. President Trump's dismissal of the Bureau of Labor Statistics (BLS) head, citing political bias over the revised numbers, has introduced another layer of unpredictability. This kind of political friction around economic data could create more volatility in the future.

Credit and Interest Rates: resilience amidst debt concerns and shifting policies

The fixed income landscape in July 2025 demonstrated notable resilience in key segments, even as it navigated persistent inflation risks and broader concerns regarding debt sustainability and monetary policy. Medium-term corporate bonds, as tracked by the Vanguard Intermediate Corporate Bond ETF (VCIT), have been the top performers year-to-date, with a 5.4% advance, slightly outpacing inflation-indexed Treasuries (TIP). This performance reflects a market dichotomy: while some investors' fears of materially higher inflation stemming from the administration's tariffs appear to be fading, others point to underlying concerns about an economic slowdown or even stagflation, driving demand for safe-haven bonds.

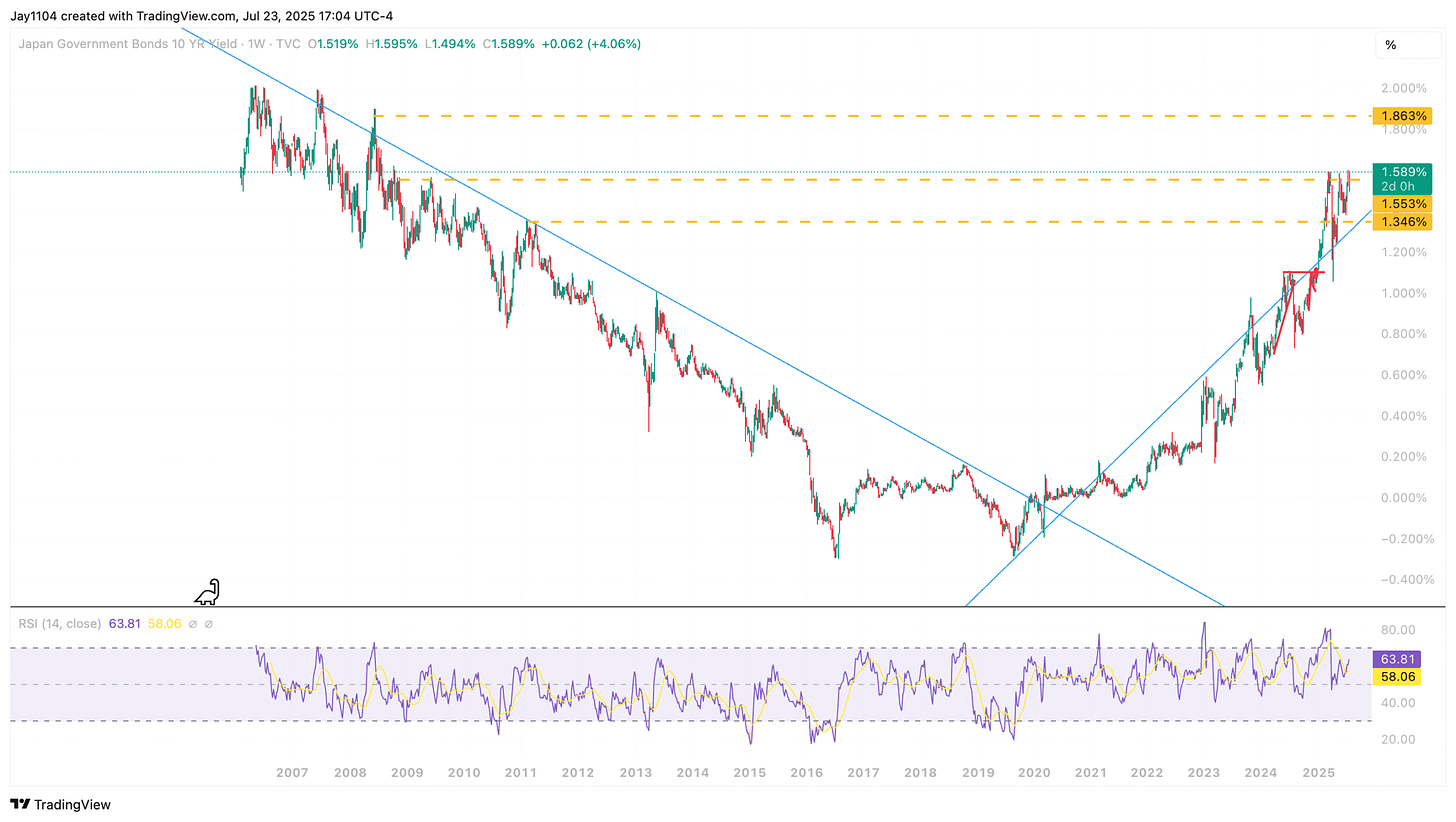

Bond yields in the U.S., UK, Europe, and Japan are reflecting growing unease over debt sustainability. In Japan, for instance, the 10-year government bond yield is trading near its highest closing level since 2008, following a 40-year bond auction that yielded a record 3.375% with the weakest demand since 2011. This has cascaded into global markets, with the US 10-year Treasury yield also seeing an uptick.

In the US Treasury market, yields have held a relatively narrow range despite record-setting equity performance. The crosscurrents of the trade war and solid economic data have limited conviction on the direction of the next significant move in US rates. However, we see a bias for early August to usher in a bond-bullish period for US Treasuries. This suggests that fading any backup in yields resulting from near-term catalysts could prove a strategic move, as the market is currently viewing these events as bearish triggers. Our overall fixed income strategy therefore should emphasize a slightly positive stance on US 5-year Treasuries and European duration due to continued disinflation trends.

The prevailing macroeconomic environment, characterized by resilient U.S. macro data and declining inflation, supports an easing trajectory for central banks such as the ECB and the Bank of England, with the Federal Reserve also expected to eventually resume easing.

So far there are no signs of an imminent recession in the U.S. and Europe, despite a likely slowdown in growth exacerbated by international trade uncertainties. This means that the fiscal lever becomes increasingly important to boost spending and address security ambitions, for instance, in Germany. This dynamic implies that pressure on the long end of the yield curve will persist, creating opportunities for steepening strategies.

Tactically, we hold a neutral stance on duration. Meanwhile, in corporate credit, generally sufficient liquidity and decent corporate fundamentals underpin a constructive outlook, primarily for Investment Grade securities, where carry remains attractive relative to sovereign yields, and for subordinated debt. Our focus is on identifying businesses with low leverage, medium-term maturities, and BBB and BB-rated debt. However, the potential for higher tariffs to lead to a deterioration in corporate fundamentals necessitates a continued focus on quality within credit portfolios. High-yield offers opportunities, but a selective approach across countries is paramount.

We also maintain a positive outlook on hard currency emerging market debt, preferring high yield over investment grade, with a selective stance in markets across emerging Europe and Latin America. Emerging markets have demonstrated resilience in the first half of the year, partly due to the front-loading of exports to the U.S. in anticipation of tariffs. While stronger EM growth versus developed markets is expected to persist amid a generally contained inflationary backdrop, developments related to U.S. trade deals with emerging markets, such as Indonesia, and new tariff announcements could introduce significant volatility. Therefore, our views across emerging markets also incorporate market liquidity, domestic consumption environments, and fiscal strength. For example, despite better-than-expected Chinese GDP growth in the first half of the year, which suggests the country may meet its government's growth target, headwinds to domestic consumption continue to persist.

Source: Ashenden Finance & various external sources