A wild month - Tariffs, recession, tensions

A look at all factors that shaped markets in April

In April global financial markets continue to be dominated by persistent uncertainty, primarily driven by the ongoing trade negotiations between the United States and China, spearheaded by President Trump and President Xi Jinping respectively. Equity market movements appear largely reactive to rumors and official statements concerning potential tariff adjustments.

Despite any potential short-term market relief rallies, underlying caution is warranted due to the significant global economic impact of these trade tensions. While recent US economic data might seem resilient, potentially skewed by businesses front-loading activities to get ahead of tariff implementations, negative consequences, particularly for the labor market, are anticipated to emerge more clearly later in the spring, likely around mid-May or early June.

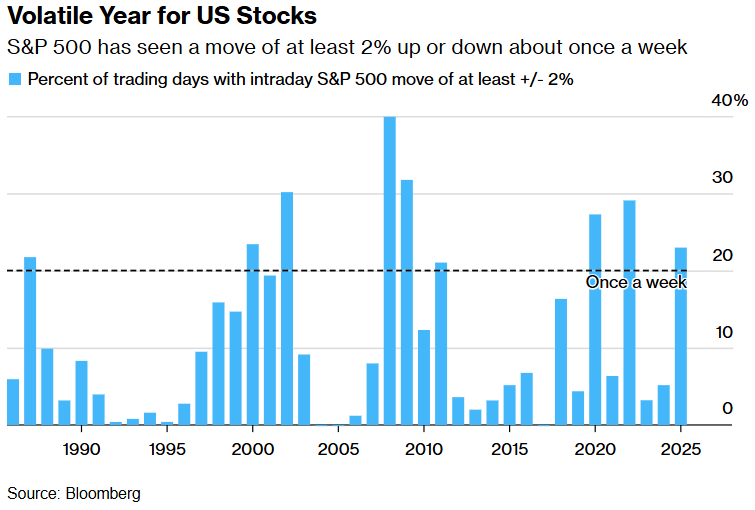

Reflecting this underlying fragility, during April the S&P 500 experienced significant volatility, declining 19% from its peak on February 19 to a trough on April 8, marking one of the fastest drawdowns exceeding 15% in modern history. Even more crazier, the S&P rebounded 20% in the following weeks: this has been one of the largest and fastest market reversal since 1950 outside of the COVID-19 period.

The shadow of Tariffs and recession fears

The spectre of a US recession looms large, fueled significantly by President Trump's aggressive tariff policies. Goldman Sachs maintains a 45% probability of a US recession within the next twelve months, stressing that substantial tariffs remain a key economic drag despite ongoing negotiations. Apollo is even more bearish, predicting a recession, potentially accompanied by stagflation, arriving as early as June, citing a sharp decline in earnings outlooks since 2020, collapsing new manufacturing orders, rising input prices, record-low consumer confidence, and mass layoffs already occurring in sectors like trucking and retail.

Supporting this grim outlook, various indicators paint a concerning picture: corporate capital expenditure plans have sharply reversed, inventories are rising sharply even before the full tariff impact materializes, CEO confidence is declining, and US trucking sales dropped significantly in March.

Furthermore, the probability of a recession priced by market indicators, such as the S&P 500 earnings yield and BBB-rated corporate bond spreads, has tripled in recent weeks, reaching 60%, the highest level since 2022. Historically, when this metric has surpassed 80%, a US recession was already underway. The aggressive tariff stance, particularly the increase on Chinese goods to 145% in early April, has directly impacted trade flows, with cargo shipments plummeting by up to 60%. This drastic reduction, evidenced by Bloomberg data showing ship traffic down approximately 40%, threatens a significant supply shock to the US economy by mid-May, potentially leading to empty shelves, higher consumer prices, and shortages reminiscent of the COVID-19 pandemic, accompanied by layoffs.

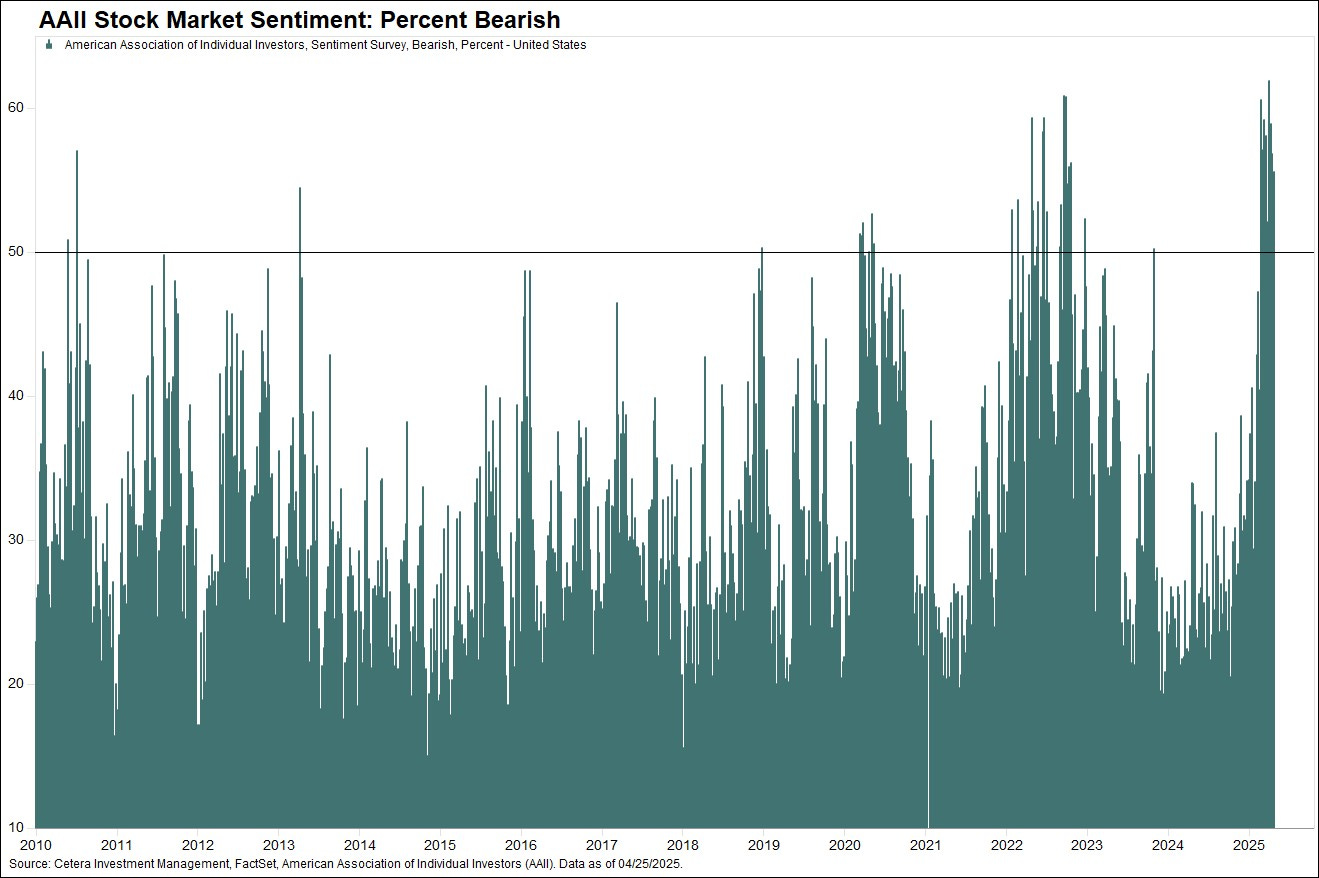

The World Trade Organization warns that overall US-China trade could shrink by as much as 80%, and a Bloomberg survey forecasts a 7% drop in U.S. imports for the second quarter, directly linking this decline to recession risk and heightened inflation. Consumer sentiment reflects this anxiety, with the University of Michigan survey showing a significant 8% drop from March to April, driven by renewed inflation fears and economic uncertainty. An unprecedented 44% of Americans now believe they will be financially worse off in a year, a level of pessimism not seen even during the Great Recession or the 1970s stagflation era. This pervasive uncertainty is causing businesses to cancel orders, halt shipments, and pause capital investment and hiring plans, adopting a wait-and-see approach focused only on essential activities.

Trump’s first 100 days: uncertainty amplified

The initial 100 days of President Trump's second term have significantly exacerbated market volatility and economic uncertainty. This period ranks among the most chaotic and destabilizing in recent history across various metrics, including sentiment and global trade. The stock market's performance during this window has been notably poor; the last comparable underperformance was under President Nixon in 1973 when the S&P 500 fell nearly 10%.

The core driver of this market turmoil is the pervasive uncertainty stemming from the administration's actions, particularly the real-time redrawing of the global trade map. Wall Street is clearly worried, as reflected in falling earnings estimates, rising inflation expectations, and bond market jitters over potential stagflation triggered by tariffs.

While the administration exercised its "put" by announcing a 90-day reciprocal tariff pause, which allowed markets to recover roughly half their losses, we believe that significant economic damage, both short and long-term, has already been inflicted, the full extent of which remains unknown and may take months to become fully visible.

President Trump's approval rating stood at 39% at the 100-day mark, the lowest for any president at that point in the last 80 years, suggesting the political fallout from the economic disruption. Despite declaring negative polls "fake news," the administration may feel pressure to shift blame, potentially leading to further erratic policy pronouncements on immigration or trade.

The administration's "America First" approach has shaken confidence in the US's traditional role and the stability of its financial markets, alienating allies and competitors alike. Concerns are mounting about the sustainability of US debt given policy decisions impacting Treasury market stability, incompatibility between tax cut promises and debt management needs, and the potential long-term impact on the US dollar's global standing.

Monetary policy expectations diverging

Regarding monetary policy expectations, the Federal Reserve (Fed) is anticipated to remain reactive, requiring clear evidence of economic deterioration, specifically a weakening labor market with rising unemployment, before implementing rate cuts. However, should a recession materialize, the Fed is expected to cut rates swiftly and deeply.

Market pricing currently reflects this expectation, indicating investors are discounting a materially more aggressive easing path than before the election, with federal funds futures suggesting cuts from the current 4.33% down to 3.50% by YE 2025 and further down towards 3.0% in the first half of 2026. Importantly, at the end of April, the Fed’s target rate remains firmly in the 4.25%–4.50% range. However, the U.S. 2-Year Treasury yield, widely regarded as the bond market’s most reliable signal of near-term Fed policy expectations, has plunged to just 3.70%, nearly 75 basis points below the lower bound of the Fed's target range. When it drops below the Fed’s policy rate, it implies market participants are pricing in multiple rate cuts ahead. In this case, the market is telegraphing 2 to 3 rate cuts within the next year. Such a move would likely only occur in response to significant macroeconomic stress, including: a deterioration in labor markets (rising jobless claims, falling participation); a deepening earnings recession (as signaled by Amazon, Airbnb, and the recent Q1 GDP contraction of -0.3%); or a liquidity event, such as stress in funding markets, foreign capital flight, or credit dislocations. If the Fed refuses to move in line with that reality, it risks triggering an unnecessary recession.

Despite the resilience of recent "hard" economic data, which contrasts with weaker "soft" sentiment indicators, and patient commentary from Fed officials, the baseline forecast still anticipates 125 bps of cuts in 2025, starting potentially in June, although risks are skewed towards a later start. The complex challenge facing the FOMC is that higher tariffs threaten both sides of its dual mandate – potentially weakening employment while also raising prices. This complex situation leads to market dislocations, such as investors simultaneously pricing in more Fed cuts alongside higher US inflation expectations, a combination seemingly at odds with the Fed's recent reaction function. Front-end yields are pricing a much stronger chance of a slowdown compared to risk assets, indicating another market inconsistency.

In contrast to the Fed's reactive stance, the European Central Bank (ECB) and the Bank of England (BoE) face a more straightforward path towards easing. The ECB, in particular, is navigating a "perfect storm" for lower rates, as both growth and inflation outlooks have significantly weakened. Forecasts anticipate flat Euro Area GDP in the latter half of 2025, with inflation expected to fall due to cooling wage growth, Euro appreciation, lower energy prices, and supply chain adjustments. This has solidified a dovish consensus within the ECB, making a rate cut in June highly probable – likely at least 25 bps, potentially 50 bps – with further cuts anticipated later in the year. Similarly, the UK labor market is exhibiting increasing signs of weakness, reinforcing a dovish tilt in BoE communications. While markets currently price in a quarterly cutting cycle, a faster pace of consecutive cuts is plausible if the US slowdown proves more significant or UK labor market conditions deteriorate more rapidly, although near-term UK inflation data adds some uncertainty. A notable development outside the major blocs is the yield on 2-year Swiss bonds turning back negative, driven by a surge in the Swiss franc, fueling speculation that the Swiss National Bank (SNB) might revisit negative interest rates, a policy employed for eight years prior to 2022 to counter franc strength.

A significant structural theme emerging is the expected weakening of the US dollar over the longer term. The dollar is viewed as the primary adjustment mechanism for the US economy under the current tariff regime and associated uncertainty. The period of "US exceptionalism," characterized by strong asset inflows bolstering the dollar, appears to be unwinding after years of potential over-allocation to US assets. Flow data suggests a rapid slowing, or even active disinvestment, in US capital inflows, challenging the dollar's position, particularly given the US twin deficits. This potential dollar weakness contrasts with the relative clarity facing European central banks, suggesting divergent monetary policy paths and currency adjustments in the period ahead as the global economy digests the impact of trade policy shifts and slowing growth momentum.

Credit & Interest Rate: fragility emerged

The credit and interest rate landscape reflects the broader macroeconomic uncertainty and policy shifts. While credit spreads stabilized somewhat after initial shocks, it remains premature to declare a definitive return of risk appetite. The BBB-rated corporate bond spread, a key indicator of recession risk, surged 40 basis points over six weeks to 142, nearing its highest level since November 2023 and significantly above pre-crisis levels, although still below the peak reached during the 2023 Banking Crisis. Financial sector credit metrics appear stable for now, but face headwinds from commercial real estate exposures. Overall corporate refinancing pipelines are growing and capital market activities like M&A and IPOs are hampered by volatility, particularly in the US.

In the government bond market, significant volatility erupted in April, with 30-year US Treasury yields spiking dramatically from 4.30% to 5.00% over just three trading sessions – an exceptionally rare move. This sell-off strained the plumbing of the bond market, indicated by a widening spread between the Secured Overnight Financing Rate (SOFR) and the effective federal funds rate, and stress in leveraged trades like the “swap spread trade”, where the premium required to hold long bonds against swaps ballooned from 75 bps to 100 bps rapidly. This fragility, occurring against a backdrop of increasing government deficits and bond supply coupled with reduced bank absorption capacity due to regulation, highlights the market's dependence on leveraged players like hedge funds, who demand a premium in volatile conditions. The intensity of the sell-off and comments from Fed officials, like Collins stating the Fed was "absolutely ready to intervene to stabilize markets," raised the odds of Fed intervention, potentially through repo facilities or even Large Scale Asset Purchases (LSAP), akin to Quantitative Easing, to prevent market dysfunction, a measure not seen since the 1940s if aimed at controlling long-end yields driven by macro concerns rather than just technical factors. Concurrently, the US Treasury raised its Q2 net borrowing estimate significantly to $514 billion, up from $123 billion projected earlier, primarily due to a lower starting cash balance resulting from delays in addressing the federal debt limit, signaling a potentially large liquidity drain once the ceiling is raised.

Source: Ashenden Finance & various external sources