Adani exposed? "A large, flagrant fraud in broad daylight"

Hindenburg Research posted two years of findings on Adani Group

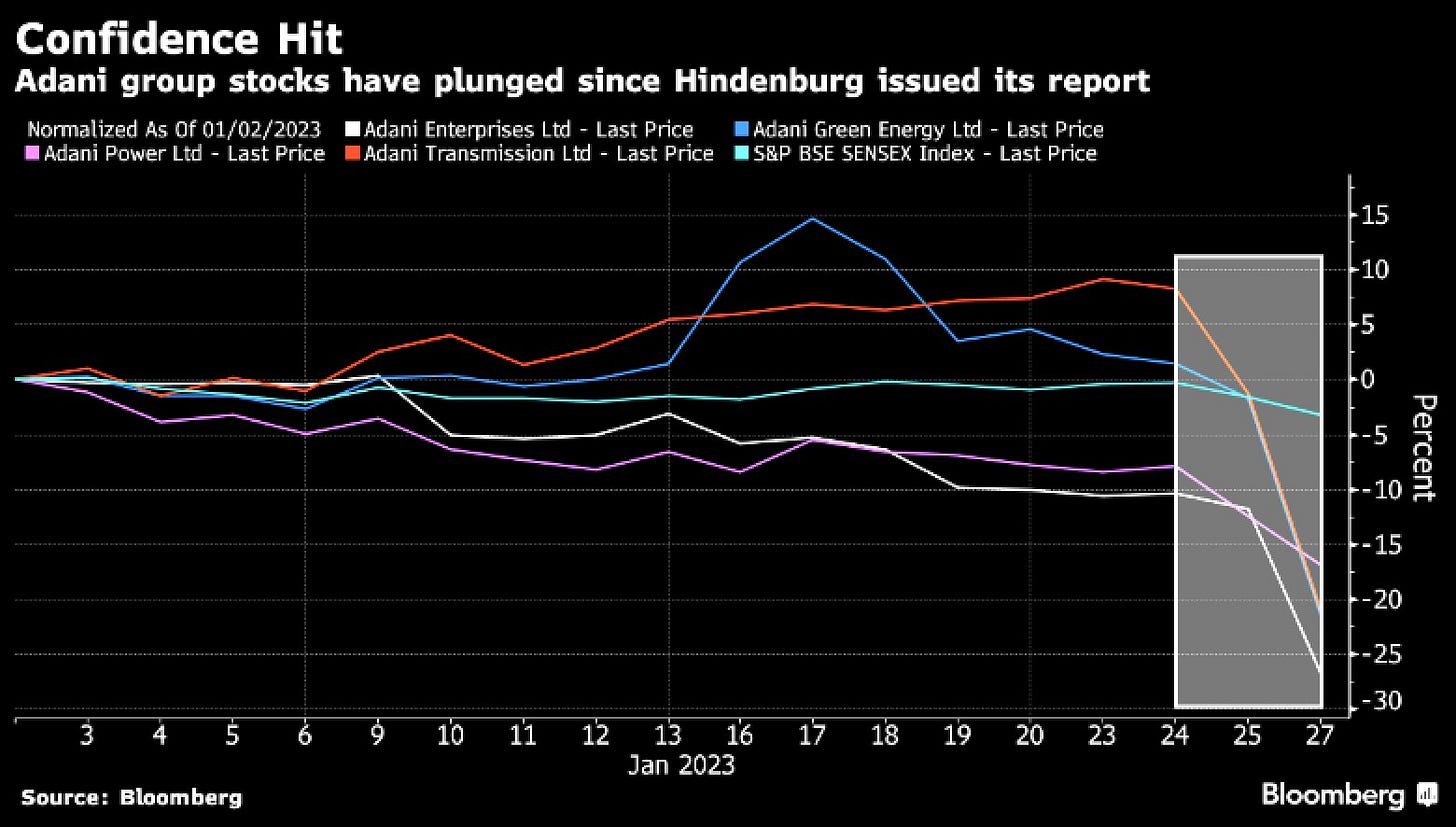

The well-known US activist investor Hindenburg Research LLC published a report saying Adani Group could be the biggest fraud in corporate history. Shares in Adani Group companies fell after Hindenburg Research LLC said it was shorting the empire’s stocks and accused firms owned by Asia’s richest man of “brazen” market manipulation and accounting fraud.

They talked with “dozens of individuals, including former senior executives of the Adani Group” and reviewed “thousands of documents”, arguing that even ignoring these findings, the financials of Adani Group have 85% downside purely on a fundamental basis owing to sky-high valuations.

Financial Red Flags

Near-term liquidity pressure: 5 of 7 key listed companies have reported a current ratios<1.

4 of 7 listed companies are on verge of delisting threshold due to promoter ownership of more than 75%.

5 CFOs changes in last 8 years (potential accounting issues?)

Unreliable Auditors

The independent auditor for Adani Enterprises and Adani Total Gas is a tiny firm called Shah Dhandharia. Shah Dhandharia seems to have no current website. Only 4 partners and 11 employees.

The audit partners at Shah Dhandharia who respectively signed off on Adani Enterprises and Adani Total Gas’ annual audits were as young as 24 and 23 years old when they began approving the audits.

Fake and Unreliable Foreign Investors

5 out of 5 FIIs invested in the Adani group have 97% of assets concentrated in Adani Stocks. This is a blatant case of concentration risk and exactly the opposite of what FIIs usually do.

The CEOs and MDs of these FIIs were previously involved in multi-billion dollar international fraud. One of them has a close alliance with a notorious stock manipulator Ketan Parekh.

These funds seem to be stock parking entities of the Adani group and manipulating delivery volumes of Adani Stocks. Also, involved in 'Wash Trading' i.e buying and selling the same stocks to pump intraday trading volumes.

Family Holdings & Related Party transaction

Gautam Adani's brothers Rajesh & Vinod and brother-in-law Samir Vora are in top management positions in group companies and offshore entities. All three of them have been accused of serious fraud and arrested in past.

Vinod Adani controls 38 Mauritius companies with no signs of operations, or employees. They all are registered at the same address and have no meaningful online presence (fake websites with copy-pasted information).

These companies have moved billions of dollars into Indian Adani entities without related party disclosure and the nature of the deals. The funds then seem to be used to engineer Adani's financials and make it look creditworthy and fit for loan against stocks.

Adani Group – How The World’s 3rd Richest Man Is Pulling The Largest Con In Corporate History. Full Report

Prior to Hindenburg Research, CreditSights defined Adani group “deeply overleveraged” in a report published in early December.

With a fundamental analysis, CreditSights understood that Adani Group has pursued an aggressive expansion plan that has pressurized its credit metrics and cash flows, venturing into unrelated, highly capital intensive businesses. Adani’s objective was to achieve market dominance crushing competitors, even if they had to make imprudent financial decisions.

“We remain cautiously watchful of the Group’s growing expansion appetite, which is largely debt-funded”.

Shares in Adani Group companies lost US$ 12bn in market value after US investor Hindenburg Research said it was shorting the conglomerate’s stocks and accused firms owned by Asia’s richest man of “brazen” market manipulation and accounting fraud. Bonds dropped sharply by over 15 points and shares of Adani-related entities slumped. In a thread of tweets, Hindenburg Research said that the findings of its "2-year investigation" in addition to speaking with dozens of individuals, including former Adani Group executives as well as a review of documents showed that the group "engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades". It added, "Adani family members allegedly cooperated to create offshore shell entities in tax-haven jurisdictions like Mauritius, UAE & the Caribbean to generate forged import/export documentation, generate fake or illegitimate turnover and siphon money from the listed companies". It also said that key listed Adani companies had "substantial debt" that has put the group on a "precarious financial footing".

Adani Group is now exploring legal action against US investor Hindenburg Research after its report accused firms owned by Asia's richest man of “brazen” market manipulation and accounting fraud.

Jatin Jalundhwala, legal head for the Adani Group said in a statement:

“The volatility in Indian stock markets created by the report is of great concern and has led to unwanted anguish for Indian citizens”.

The selloff in Gautam Adani’s corporate empire accelerated on Friday, erasing almost US$ 45bn of market value in less than two sessions as Asia’s richest man struggles to contain the fallout from a scathing report by US short seller Hindenburg Research. Shares in Adani Enterprises, the group’s flagship listed company which is conducting the equity offering, fell as much as 10 per cent in Mumbai to a low of Rs3,050.

Yesterday, Adani Group responded to Hindenburg Research’s note with its dollar bonds recovering by ~5%. Adani Group dismissed the claims as baseless, saying that it was timed to damage its reputation ahead of the planned US$ 2.5bn share issuance of Adani Enterprises. Besides, it added, “We are evaluating the relevant provisions under US and Indian laws for remedial and punitive action against Hindenburg Research”. The report has “adversely affected the Adani Group, our shareholders and investors. The volatility in Indian stock markets created by the report is of great concern” Retorting to Adani Group’s response, Hindenburg Research said, that they would “welcome” threats of legal action, adding that they fully stood by their report and believed that any legal action taken would be “meritless”. Further, Hindenburg added, “If Adani is serious, it should also file suit in the US where we operate. We have a long list of documents we would demand in a legal discovery process”.

Hindenburg Research countered:

Even billionaire US investor Bill Ackman said that he found short-seller Hindenburg Research's report on India's Adani Group "highly credible and extremely well researched”.

"Adani's response to Hindenburg is the same as Herbalife's response to our original 350-page presentation. Herbalife remains a pyramid scheme. I found the Hindenburg report highly credible and extremely well researched.

We are not invested long or short in any of the Adani companies or Herbalife, nor have we done our own independent research”.

Conclusions

We believe the Hindenburg Research report highlighted important key points that have been touched in the past also by other analysts. The company appears to be highly leveraged and we recognize a significant credit risk.

We think it is better to stay away from this credit as, in our experience, things can go much worse before to get better. Investors are not compensated by the uncertainties that the company could face ahead.

great research wins ... sometimes it takes time, but it does ... thank you for this coverage!