Bond market is not excited as equities

Treasuries are reaching stressful levels and bond volatility is surging

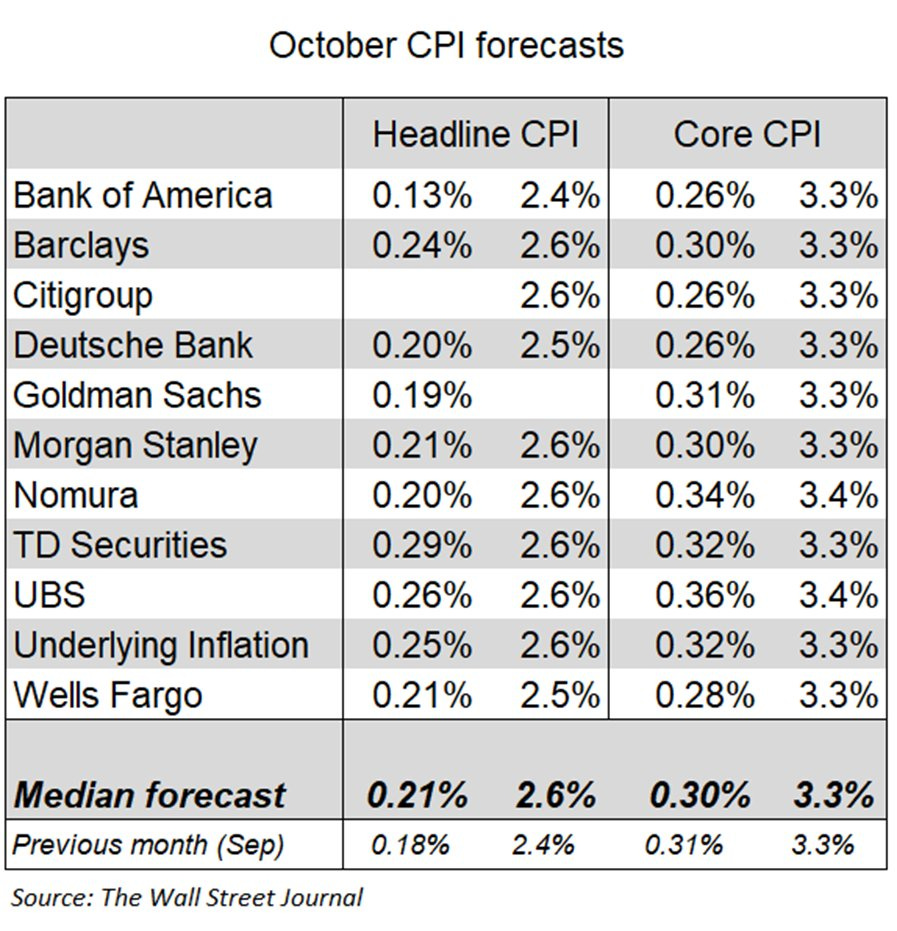

Today, is CPI day. Economists who produce detailed inflation forecasts expect the October CPI to show a firmer increase in core prices, with the median forecast pointing to a 0.30% rise (+3.3% Y/Y). The headline CPI is seen rising 0.21% (+2.6% Y/Y). Here is a forecast from major banks:

Treasury yields resumed their rise ahead of today’s data, which could further erode confidence in Federal Reserve interest-rate cuts over the next year.

Two-year yields (more closely tied to the Fed’s decisions than longer-maturity debt) reached the highest level since July, and 3- to 30-year yields rose at least 10bps.

Among the drivers for the yields rising, there was Tuesday’s slate of corporate bond issuances, on pace to be the biggest in two months with at least 13 offerings. The selloff defied signs that record-high levels for US equity benchmarks are stoking demand for bonds. Case in point: Record inflows at exchange-traded funds that aim to benefit from bond-market gains last week.

David Rogal, fixed-income portfolio manager at BlackRock, referring to the October consumer price index data:

“The bond market is set up for a stronger CPI number. Even with certainty on the election result, there’s still a fair amount of uncertainty on policy and how that impacts markets. […] The front end of the curve now has made a substantial adjustment to the point where I do think it is very close to fair value”.

Scott Kleinman, co-president at Apollo Global Management:

“Inflation is not tamed, We’re going to have to live with a higher rate environment for a lot longer”.

Meanwhile, Richmond Fed President Thomas Barkin reiterated the message that Fed Chair Jerome Powell delivered last week after policymakers cut interest rates by a quarter point. Barkin said he was looking at two scenarios for the economy: as election uncertainty fades, companies could begin investing and hiring again, leaving the Fed to focus on upside inflation risks. Or, companies could respond to margin compression from weaker pricing power by firing workers, which would elevate employment risks for the Fed.

But in a context where US Economic Optimism Index soars to highest level in more than 3 years…

… the benchmark 10-year Treasury yield broke through another key resistance level, which could put a 5% mark in reach and would likely spell trouble for stock investors.

The post-November 5th election environment has introduced new worries about inflation and debt levels, particularly impacting investors who recently purchased long-term Treasury bonds. Franklin Templeton's CIO Sonal Desai suggests Treasury 10-year yields could reasonably reach 4.5% to 5%, or even higher if the US deficit significantly expands.

Major financial institutions including JPMorgan Asset Management and T. Rowe Price have joined in warning about rising Treasury yields, particularly in the context of a potential second Trump presidency's impact on debt markets. Investors have been monitoring Treasury movements carefully since the November 5th election, trying to gauge whether the Fed can maintain its interest rate reduction plans if the federal budget deficit continues to grow. The situation has been particularly challenging for market participants who invested in recent government auctions of 10- and 30-year maturities, as these investments are currently underperforming.

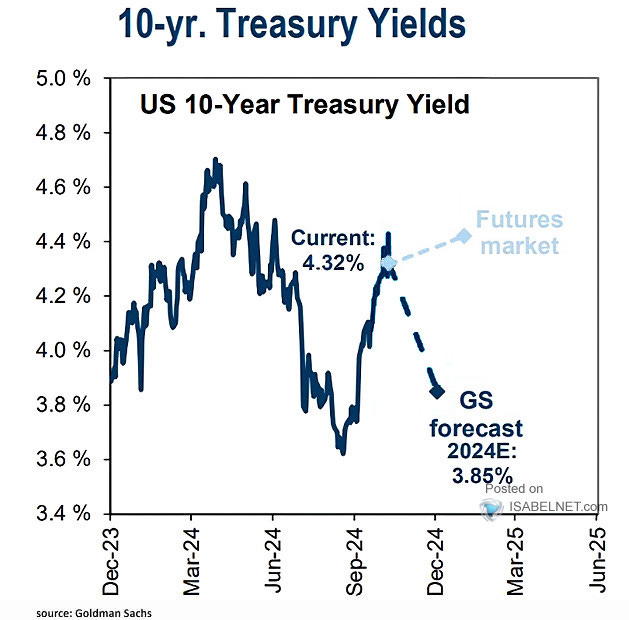

On the contrary, Goldman Sachs forecasts the 10-year U.S. Treasury yield to hit 3.85% by end-2024, diverging from current futures market expectations.

10 Year Yield reached back the top of the trendline. Will it break?

BofA sees continued pressure on UST yields as according to their model:

“CTAs (trend followers) continued growing 10yr US Treasury futures shorts [last] week, and our model’s positioning is now approximately equivalent to the stretched level where it was in May before unwinding on a better-than-expected CPI print that sent yields lower. Although markets have recently been more sensitive to labour market data than CPI prints, we will still be monitoring any impact that Wednesday’s CPI print has on CTA positioning. Our model indicates that UST futures price trend will likely continue falling next week outside of a significant decline in yields."

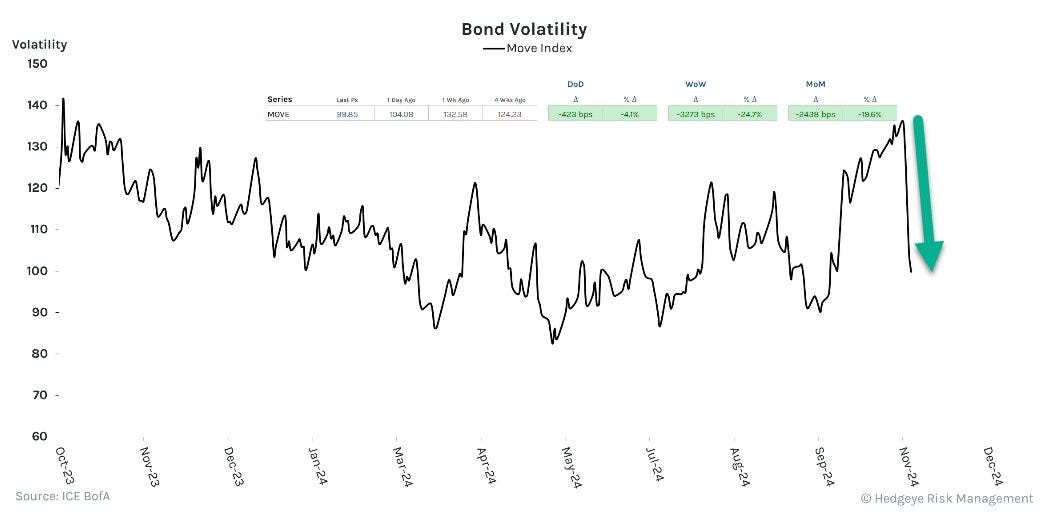

Bond Market Volatility just had its largest 5-day collapse we've ever seen.

U.S. high yield bond spreads have tightened to 2.56%, their lowest level in 17 years (last seen in 2007). This suggest investors are offered little yield compensation for taking the additional risk of owning lower quality bonds.