Economic shifts: Fiscal Reforms, Trade Wars and Investor Sentiment

An overview of what is driving this sell of in bunds and tech

Germany’s Fiscal Overhaul and Global Bond Market Turbulence

Germany’s fiscal policy transformation has been one of the most significant events of the past decade. Traditionally known for its restraint and adherence to the “debt brake,” Germany has shocked both domestic and international markets by proposing a €500 billion fund aimed at revitalizing its defense and critical infrastructure sectors. This pivot is largely motivated by geopolitical imperatives – namely, the need to counter emerging threats from Russian aggression and to provide for long-term economic rejuvenation amid changing global realignments.

The announcement has prompted a dramatic re-pricing of sovereign risk. In the immediate aftermath, the yield on German 10-year bunds escalated by 30 basis points, reaching 2.85% – a level not seen since late 2023, and the largest daily move since 1998. Similar upward pressure was witnessed in longer-term securities as well, with the 30-year yield climbing to 3.15% and the 2-year yield increasing to 2.9%. Bund futures plummeted as market participants factored in the risk of higher future borrowing costs and the potential for fiscal imbalances. As noted in several market commentaries, this episode is reminiscent of the turbulence experienced during major historical fiscal shifts.

This sudden revaluation in Germany’s cost of borrowing soon sent shockwaves through the global bond market. Investors began reassessing risk on a global scale, prompting correlated sell-offs in other sovereign bonds. For instance, Japan’s 10-year Japanese Government Bond (JGB) yield shot up to 1.5%, marking a 16-year high – a testament to the contagion effect emanating from Europe. Meanwhile, U.S. Treasuries were not immune; the 10-year Treasury yield edged upwards, registering a figure of 4.29%.

The synchronized movement in yields underscores a new era of global financial connectivity, where fiscal policy changes in one of the world’s largest economies can prompt a broad re-pricing of risk. Analysts at Goldman Sachs have expressed concerns that if such upward pressure on yields persists, it might trigger sovereign debt sell-offs – especially in Eurozone economies that lack the fiscal robustness of Germany. They warn that the fiscal expansion, though intended as a stimulant, might sow the seeds of longer-term instability if not accompanied by disciplined fiscal management.

The ripple effects of these developments extend far beyond the bond markets. Increased borrowing costs and elevated yield levels can discourage future investments and complicate refinancing options for both public and private sectors. As European governments now face the dual challenge of pursuing growth through fiscal expansion while containing the risk of fiscal imprudence, the uncertainty in emerging and peripheral economies becomes an ever-more pressing issue.

Trade Wars and Their Cascading Economic Consequences

Under President Donald Trump’s administration, the United States reinstated aggressive protectionist measures that led to a series of tariff hikes. Notably, a 25% tariff was imposed on imports from Canada and Mexico, while additional trade barriers were erected against Chinese goods. These policy moves were ostensibly designed to protect domestic industries but, in practice, have exacerbated international commerce tensions.

The retaliatory measures have been swift and severe. China, one of the major targets of U.S. tariffs, responded by applying a 15% tariff on a range of U.S. agricultural exports – soya, pork, and wheat being among the most affected commodities. While these moves have forced a series of adjustments across multiple markets, the economic fallout is proving to be heftier than anticipated.

Economists at Goldman Sachs estimate that U.S. GDP could contract by as much as 0.6% over the coming quarters as a direct consequence of these tariffs. Consumer prices are projected to rise by between 0.5% and 0.7%, contributing to inflationary pressures that compound existing economic challenges. The situation is anticipated to be even more severe for Canada and Mexico, with expected GDP declines ranging between 2% and 3%, as these economies are more heavily reliant on trade with the United States.

The automotive industry is a particularly stark illustration of the sectoral impact. According to research from Bernstein, the imposition of tariffs on vehicles imported from Canada and Mexico is expected to drive up the price per vehicle by as much as $2,700. For General Motors, this price premium could wipe out up to 65% of its free cash flow, making it increasingly difficult to invest in new technologies and maintain competitive global pricing.

In reprisal, China has taken vigorous steps to shield its economy from the adverse impacts of these conflicts. The state unveiled a fiscal stimulus package of 1.3 trillion yuan, channeling vast resources toward high-technology sectors such as artificial intelligence, quantum computing, and renewable energy. The policy has not only stabilized the markets in the short term but also reshaped investor confidence in China’s ability to lead in the next wave of technological advances. Market indices, such as the Hang Seng Tech Index, rallied by over 5%, signaling that investors interpreted these measures as part of a broader long-term strategy aimed at reducing dependency on traditional industrial bases.

China's tech sector is experiencing a surge, with a basket of major tech firms increasing by over 40% this year, fueled by AI breakthroughs and supportive policies from Beijing, and Goldman Sachs has raised its 12-month target for the MSCI Emerging Markets Index, citing AI’s influence. An equal-weighted basket of China’s seven tech heavyweights including Alibaba and Tencent – dubbed the “7 titans” by Societe Generale – has gained more than 40% this year. That compares with an about 10% drop in an index of the Magnificent Seven stocks.

These trade disputes also exert downstream effects on global supply chains. With trade volumes contracting, industries from raw materials to finished consumer goods face disruptions that can lead to inefficiencies and cost escalations. The inherent uncertainty has forced companies to reconsider their supply chain strategies, often with an eye toward reshoring production or diversifying suppliers – a move that, while prudent in the long run, incurs significant short-term costs.

Shifts in Investor Sentiment and Market Volatility

In the face of these seismic changes, investor sentiment in 2025 has evolved into a delicate balance of cautious optimism and deep trepidation. Initially, Germany’s move to invest heavily in defense and infrastructure sent a wave of buoyancy through European equity markets. For a brief period, the Euro rallied strongly – registering its most robust three-day gain since 2015. Traders, captivated by the notion that fiscal stimulus could reinvigorate lagging economies, speculated that the Euro might climb an additional 10%, potentially reaching $1.20 against the U.S. Dollar.

Yet, as the ramifications of rising bond yields and intensifying trade disputes became clearer, the optimism began to give way to an overarching sense of uncertainty. In the United States, the equity markets have experienced a severe contraction. The S&P 500 has lost a staggering $3.4 trillion in market capitalization – a decline equated by many analysts to the steepest retracement since the political shifts of the Trump era. The CBOE Volatility Index (VIX), which gauges market fear, has surged to levels not seen since the height of the COVID-19 crisis. This combination of factors has emboldened institutional investors to adopt a cautiously bearish stance, with many funds rebalancing portfolios to hedge against further losses.

The average US stock is now 30% below its 52-week high, reached on average around September 21, 2024, indicating a broad market correction. The S&P 500 falls to a new low of 2025, below its 200D moving average for the first time since November 2023.

The Nasdaq 100 (QQQ) closed below its 200-day moving average, an important technical breakdown not happening since March 2023, declining by 10% from its all-time high.

U.S. Small Cap Stocks (IWM) are in a technical correction and closing in on bear market territory after plunging 15% from their November high.

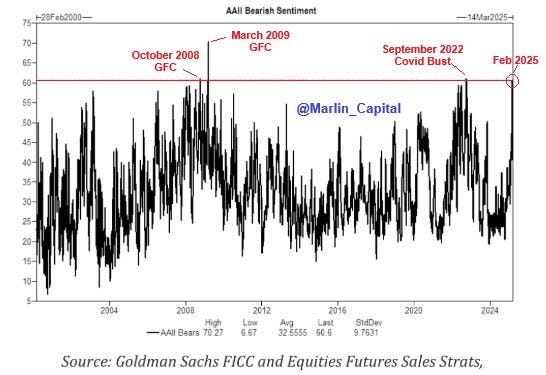

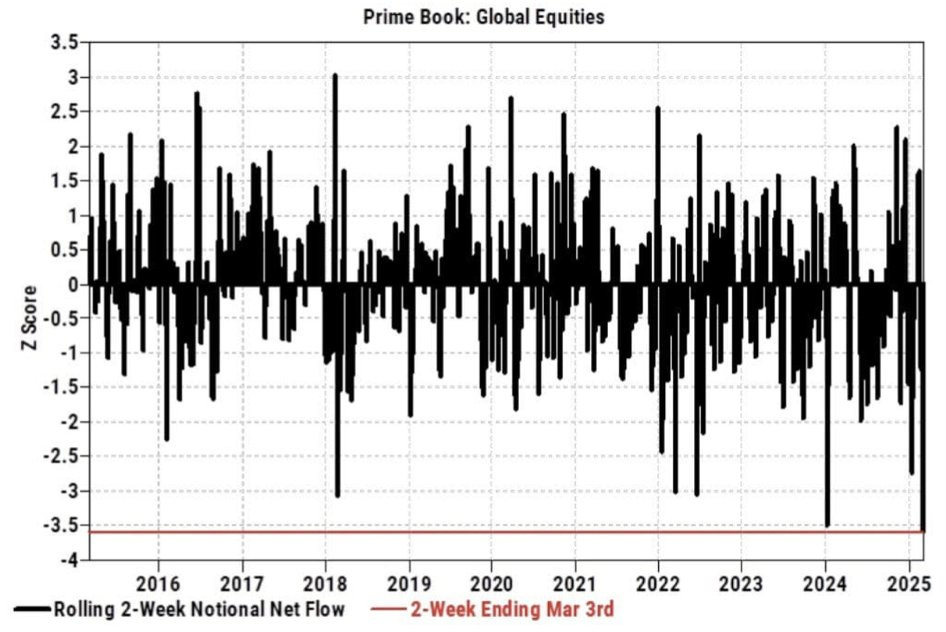

Not surprisingly, hedge Funds have dumped stocks over the last 2 weeks at the fastest pace in history. While retail traders are buying the dip in stocks this week to the tune of $3.5 billion according to JP Morgan.

But… there are some good news from Goldman Sachs desk: CTA liquidation is almost over. “CTAs have sold 47bn global in the last week. Our calculations show 1w flat tape = 40bn to sell // 1m flat tape = 43bn to sell. That means that with spot here, this technical supply will be largely finished by next week”. A technical equity rebound could be in the making.

Additionally, commodity markets have portrayed a similar duality. Brent crude oil prices, long considered a bellwether for global economic health, have dipped to below $70 per barrel – the lowest level since 2021. Analysts attribute this decline to the reduced industrial demand stemming from ongoing trade conflicts and a global slowdown. Conversely, natural gas prices in Europe have experienced dramatic surges. These rises are primarily driven by geopolitical tensions that have undermined energy security and caused panic-buying ahead of potential supply disruptions.

In response to the heightened market uncertainty, corporations have adjusted their financial strategies. Increasingly, companies are engaging in share buybacks as a way to stabilize their stock prices and signal confidence to investors. Data from JPMorgan indicates that corporate buyback activity has increased markedly, with daily buyback flows now running at 1.3 times the average observed in the previous year. This trend suggests that, despite the prevailing pessimism, there is an effort on the part of market leaders to restore stability and foster a more favorable investment climate.

Street Reaction and Market Outlook

Beyond the raw data and policy analysis, the pulse of Wall Street reveals variety of opinions and strategic recalibrations. While JPMorgan’s trading desk has been vocal – bracing for an extension of U.S. stock losses and shifting defensive positions – the broader street reaction is decidedly multifaceted.

JPMorgan’s Perspective: JPMorgan’s trading desk is notably preparing for an extended period of weakness in U.S. equities. Their internal communications and trading adjustments point toward aggressive hedging strategies and a marked increase in allocations to traditionally safe assets like U.S. Treasuries and gold. They are rebalancing portfolios, anticipating that the volatility of the short-term market will continue to ramp up as geopolitical tensions and fiscal uncertainties persist.

Morgan Stanley’s View: In parallel, Morgan Stanley’s equity trading group has also signaled caution. Their analysts report that algorithmic trading systems are now reflecting broader market uncertainty, prompting a shift toward higher-quality, low-beta stocks. Morgan Stanley’s strategists are recommending a portfolio tilt towards defensive sectors – including healthcare, utilities, and consumer staples – which are traditionally less sensitive to macroeconomic headwinds. They observe that this rotation is partly driven by the rising VIX, which is now showing levels reminiscent of previous market downturns.

Goldman Sachs’ Commentary: Goldman Sachs has been equally concerned about the longer-term implications of sustained volatility. Their research highlights that continuously rising bond yields could trigger further risk repricing across assets, potentially leading to sovereign debt sell-offs in vulnerable economies. Goldman Sachs warns that if fiscal imbalances widen, market confidence could deteriorate sharply, resulting in deeper and more sustained corrections in equity markets. They note the growing premium on risk and the increasing cost of liquidity, which may force investors into more defensive stances.

Citigroup and UBS Insights: Additional insights from Citigroup and UBS indicate that institutional investors are reallocating capital away from cyclical stocks toward safe-haven assets. Citigroup’s market strategists observe that there is a notable increase in flows toward fixed income and precious metals, driven by a desire to hedge against further market unpredictability. Meanwhile, UBS has reported that hedge funds are dialing back exposure to high-volatility sectors and making a pronounced shift toward international diversification. They see the current environment as a critical inflection point, prompting a reassessment of risk models across the board.

Hedge Fund Perspectives: Some prominent hedge funds, including those with positions in global derivatives markets, are also recalibrating their strategies. According to industry chatter, these funds are reducing their exposure to leveraged positions and increasing allocations to options and volatility instruments. This cautious rebalancing reflects a consensus risk sentiment: short-term losses seem likely as market participants brace for potential policy surprises and further trade disruptions.

The global economic landscape of 2025 is defined by an intricate interplay of bold fiscal actions, escalating trade disputes, and a radical reorientation of investor sentiment. Germany’s €500 billion fiscal initiative – although aimed at stimulating growth and fortifying defense – has introduced significant volatility in a global bond market already sensitive to shifts in risk perceptions. At the same time, the domino effect of trade wars, accentuated by retaliatory tariffs and global supply chain disruptions, continues to strain economies and unsettle corporate earnings.

From a purely technical perspective, in the short term we expect a rebound on U.S. equity indexes and a rebound also for the Bund. It is less certain if this will be be a short-term bounce rather than a fundamental shift in market direction. A similar in the near term rebound for the Bund is possible, but we have to keep in mind that Germany's fiscal expansion is the primary driver behind the surge in Bund yields, and this policy is set to continue.