Fed can't cut yet - putting pieces together

Inflation is cooling down, but Powell is not satisfied with a single data reading

Key Takeaways

Inflation eased a bit: US May Core CPI M/M rose 0.2% (from +0.3%) with the Y/Y +3.4% (prev. 3.5%, exp. 3.6%)

Fed leaves rates unchanged for 7th straight meeting

Officials raise 2024 inflation forecast from 2.4% to 2.6%

Median forecasts shows just 1 rate cut in 2024 and 100bps of rate cuts in 2025

Median 2024 Core PCE inflation estimate up from 2.6% to 2.8%

Powell: Inflation has eased substantially but remains too high (target remains 2%) and unemployment rate remains low

US inflation stepped down for a second month in May: core consumer price index — which excludes food and energy costs — climbed 0.2% from April, while the Y/Y measure rose 3.4%, cooling to the slowest pace in more than three years. The figures, taken with the deceleration in the core CPI in April, may represent the early stages of inflation resuming a downward trend. But policymakers have stressed that they’d need to see several months of price pressures receding before they consider lowering interest rates, especially with the latest jobs report reigniting the debate over how restrictive policy actually is.

Core services played a particularly prominent role in May’s soft core CPI print. Core services inflation rose only 0.2%, a significant cooling from the 0.4%-0.7% monthly pace over the past six months. Within core services, key contributors to the slowdown were auto insurance (-0.1% vs. 1.8%) and airfares (-3.6% vs. -0.8% prior). Recreation services (-0.2% vs. 0.3% prior) and other personal-care services (-0.3% vs. 1.1% prior) also saw price declines. A clear theme is that households are cutting back on discretionary spending. On the other hand, the moderation in rent inflation has been gradual. Shelter prices rose 0.4% for a fourth straight month, flagging a risk that the disinflation process for housing rents may take longer than anticipated.

After data, stocks opened higher and Treasuries rallied across the curve, pushing both two-year and 10-year yields down about 14bps. Traders fully priced in two rate cuts by the Fed this year, with the first move coming in November — two days after the presidential election.

But in these many basic necessities, inflation remains at high numbers:

Car Insurance Inflation: 20.3%

Transportation Inflation: 10.5%

Hospital Services Inflation: 7.2%

Car Repair Inflation: 7.2%

Electricity Inflation: 5.9%

Homeowner Inflation: 5.7%

Rent Inflation: 5.3%

Food Away From Home Inflation: 4.0%

Thus, Fed decided to keep rates unchanged at 5.25-5.50%, as expected with the vote unanimous, while the statement noted there has been modest (prev. a lack of) further progress towards the 2% inflation objective and it repeated that it does not expect it will be appropriate to reduce policy target range until gaining greater confidence inflation is moving sustainably towards 2%.

Fed’s updated dot plots now signal only one rate cut in 2024 vs. three in the March projections and four policymakers even saw no rate cuts this year, while seven pencilled in just one cut and eight expect two rate cuts this year. Looking ahead, the 2025 median dot plot increased to 4.1% from 3.9% and the 2026 dot was unchanged at 3.1%, but the longer run rate ticked up again to 2.8% from 2.6%.

Powell said during the press conference that the economy has made considerable progress and continued strong job gains in the economy, as well as noted that inflation has eased substantially but is still too high. Powell said the Fed is maintaining a restrictive stance of policy and recent indicators suggest economic growth is still expanding at a solid pace. Furthermore, he said they remain highly attentive to inflation risks and so far have not greater confidence on inflation in order to cut, while he noted that SEPs are not a plan or any kind of decision and that the assessment of policy will adjust. During the Q&A, Powell said that all agree the Fed is data dependent and he'd look at all Fed forecasts for the rate path as plausible, while he wants to gain further confidence on rates, but not going to say how many more months of good data is needed and noted that policymakers are not trying to send a strong signal with forecasts. Powell said they will be monitoring the labour market for signs of weakness, but not seeing that right now and they do not have the confidence right now that would warrant loosening policy.

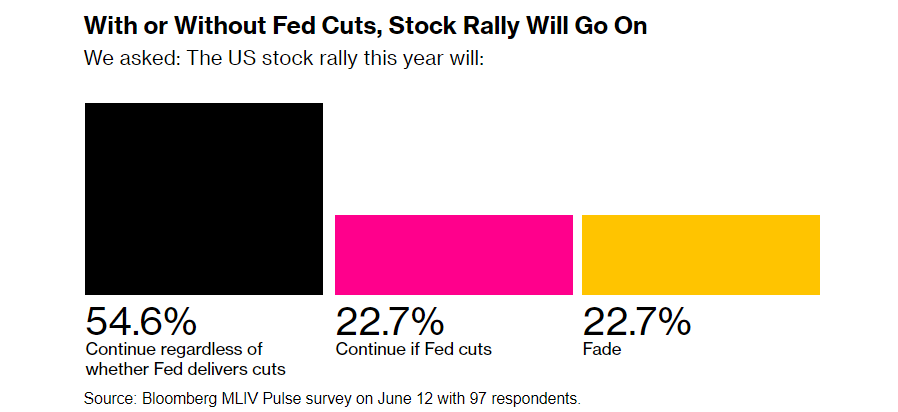

Bloomberg MLIV Survey

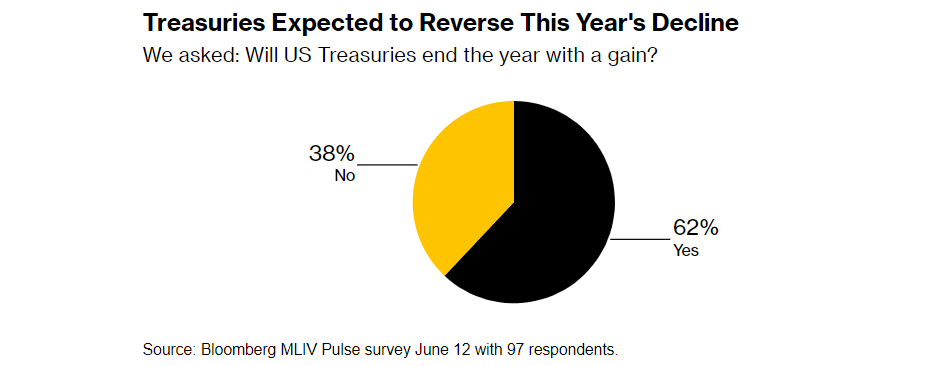

Investors shed their fears of a hawkish Federal Reserve, signalling that slower inflation means a soft landing remains in play. More than half of the 97 respondents to the survey said the 14% surge in the S&P 500 during 2024 will extend regardless of what the Fed does, with nearly a quarter saying central bank easing is needed for stocks to thrive. Investors were even more certain Treasuries will extend their rebound, with 62% forecasting what would be a second-straight annual gain. The Bloomberg US Treasury Index notched a decline of at least 0.8% year-to-date as of Wednesday.

After the decision and Powell’s remarks, the US equity benchmark closed 0.9% higher to top 5,400 for the first time. Ten-year yields fell below 4.25% to levels not seen since early April.

Investors’ confidence in the equity market’s resilience remains focused on the artificial intelligence boom as shares of Nvidia, Apple and other key mega tech companies surged higher. About half the respondents said non-tech stocks would either lag or fall further behind this year, regardless of whether borrowing costs fall. A further 34% said they would catch up only after the Fed actually starts rate cuts. The dramatic slowdown in inflation pressures may have helped convince survey respondents that the worst is over for bonds, especially with regard to any risk of a hawkish Fed.

The key concern for Treasuries may now be the looming prospect of greater debt issuance. A majority of survey participants expect a swelling deficit to have a significant impact on longer-term bonds, no matter what the central bank decides. The supply issue will diminish the effect of rate cuts, according to more than a third of respondents, while 22% said it will overwhelm policy action. The remainder said they are not concerned about the matter.

What does the street think

Academy Securities' Peter Tchir points out we learned more from CPI than from The Fed.

CPI sparked a rally in bonds and stocks this morning that lasted until the Fed. The “dots” pushed one rate cut from this year into next. Largely expected, especially since the dots didn’t have today’s CPI print. Powell, apparently, wasn’t as dovish as market had priced in as stocks and bonds both gave up some gains as the press conference ended. He did seem to focus more on jobs than inflation (makes sense as avoiding a recession in an election year is likely high on his priority list). The media and Powell seemed as confused by Friday’s job report as we were. He seemed to talk about longer term averages, etc. But he didn’t mention the discrepancy has been pretty consistent, the birth/death model is disproportionately large, or the massive amount of part-time vs full-time jobs. Takeaway was jobs cooling but not problematic, but the Fed is prepared to react if job market weakens.

Not quite “mission accomplished” on the inflation front but almost. I was confused on rent increase lags (and still don’t understand why we don’t have something remotely resembling real-time, market based data, for that). Also it seems to be clear if we are high because of lags, the real inflation problems were much higher than official reports (why surveys show inflation as bigger problem than 3% would indicate)

I do think bond yields can trade higher from here 4.3% to 4.5% has been a great trading range. Shift will focus to the deficit and the “successful” auction bounce we had on 10s makes limited sense to me. We will have auctions week after week, month after month, with no indication size of auctions will do anything but grow over time.

It would be nice to see the underperformers catch up or take leadership, but seems like the narrow leadership continues.

JPMorgan’s Bob Michele and Mohamed El-Erian also see the Fed a bit confused. In fact, Michele saw a straightforward takeaway for himself after the Fed signalled one rate cut in 2024 yet forecast little difference in the US economy between now and the end of the year. Where does that leave Wall Street?

“What that tells me is the bond market is in the hands of people like me. This is a confused Fed.”

In the wake of today’s Fed policy decision, Michele said he has a sense of where the economy stands, and can gauge supply and demand dynamics to determine fair value for benchmark rates.

DRW thinks that rates have to come down soon:

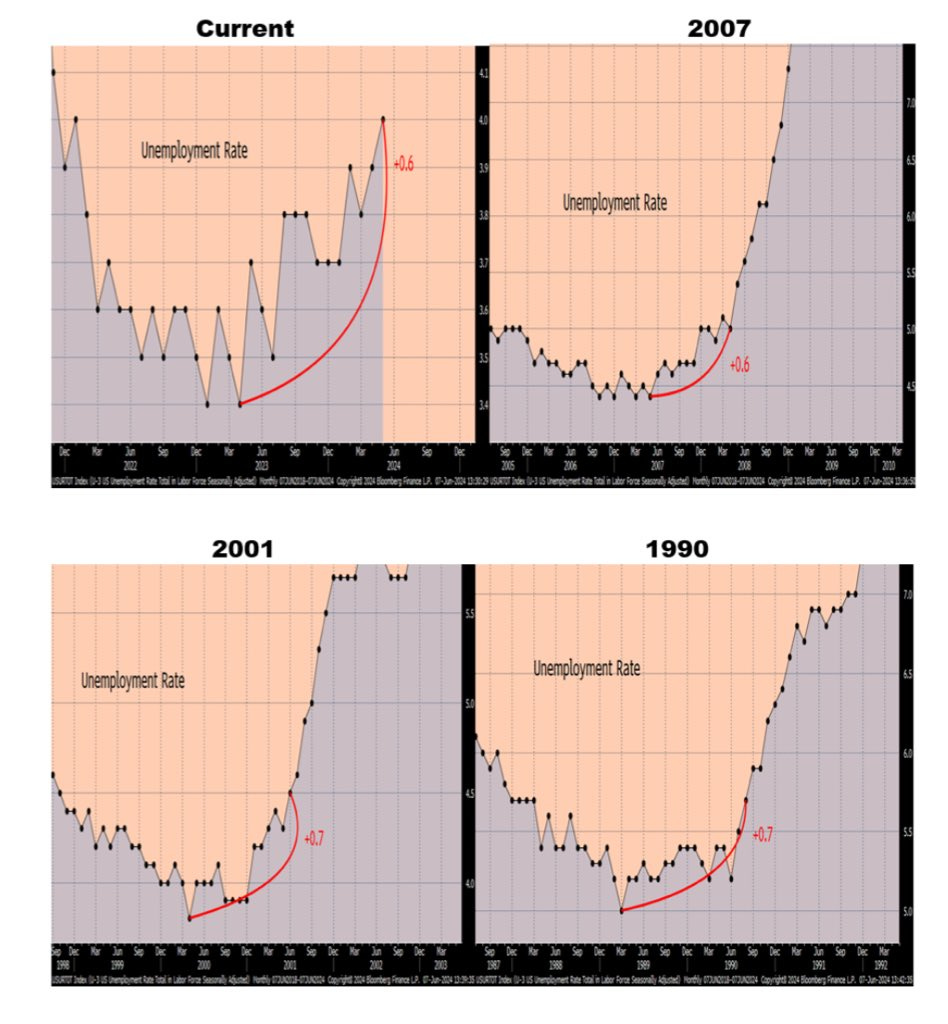

“Powell has no room to get hawkish. Unemployment Rate is six tenths off the cycle low. In the last four cycles (omitting the pandemic stuff) when the Rate was up six tenths, momentum took over and the rate rose from that point on with a fury”.

Steve Blitz also sees cuts sooner rather than later:

“The disinflation in May CPI is overstated relative to real growth in activity, and lower goods prices only spur activity by raising real wages in a full employment economy. Nevertheless, the core pace has settled around 3.5%, low enough for the Fed to cut 50bps off the funds rate, at least. And this should be done sooner rather than later given the Fed's stated bias to avoid recession”.

Market is pricing for the Fed’s policy-rate path shifted lower after the softer-than-expected CPI report. Fed funds futures were pricing in a total of 51bps of cuts this year (vs. roughly 40bps before the release), and a roughly 85% chance of an initial rate cut in September (vs. a roughly 60% chance prior). Treasury yields fell seven to 16bps across the curve, with two-year yields down 15bps to 4.68% and 10-year yields down 12bps at 4.28%. The S&P 500 index opened 0.9% higher, and the US dollar weakened 0.4% against a basket of currencies.

BlackRock’s Jeffrey Rosenberg: the Fed’s latest projections make Treasuries maturing in two to five years attractive.

“You can step out of cash into that front end of the curve.”

On stocks, Goldman Sachs' Scott Rubner warns traders to watch for stock market weakness later this summer as positioning in US equities reaches its limit. The S&P 500 Index is up 14% in 2024, the best start to any election year on record and is currently trading above 5,400. While active investors keep buying stocks, Goldman’s models show that positioning among commodity trading advisers, or CTAs, is full. CTAs have the index’s short-term threshold at 5,243, its medium-term threshold at 5,037, and its long-term at 4,701, according to Goldman’s calculations. That means if the S&P 500 reaches those levels, CTAs will become sellers.

Meanwhile, Goldman Sachs…

"Our buyback desk is currently running at 1.6x ytd daily avg notional executed. It was by far the busiest our trading desk has been since MSCI rebal (when asset managers used rebal to move in and out of some sizable positions)..."