Fixed Income Monthly Report - January 2024

Preview of our monthly publication with macro themes and single bond ideas

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Underlying you can find a summary of what you can find inside this report.

January 2024 edition

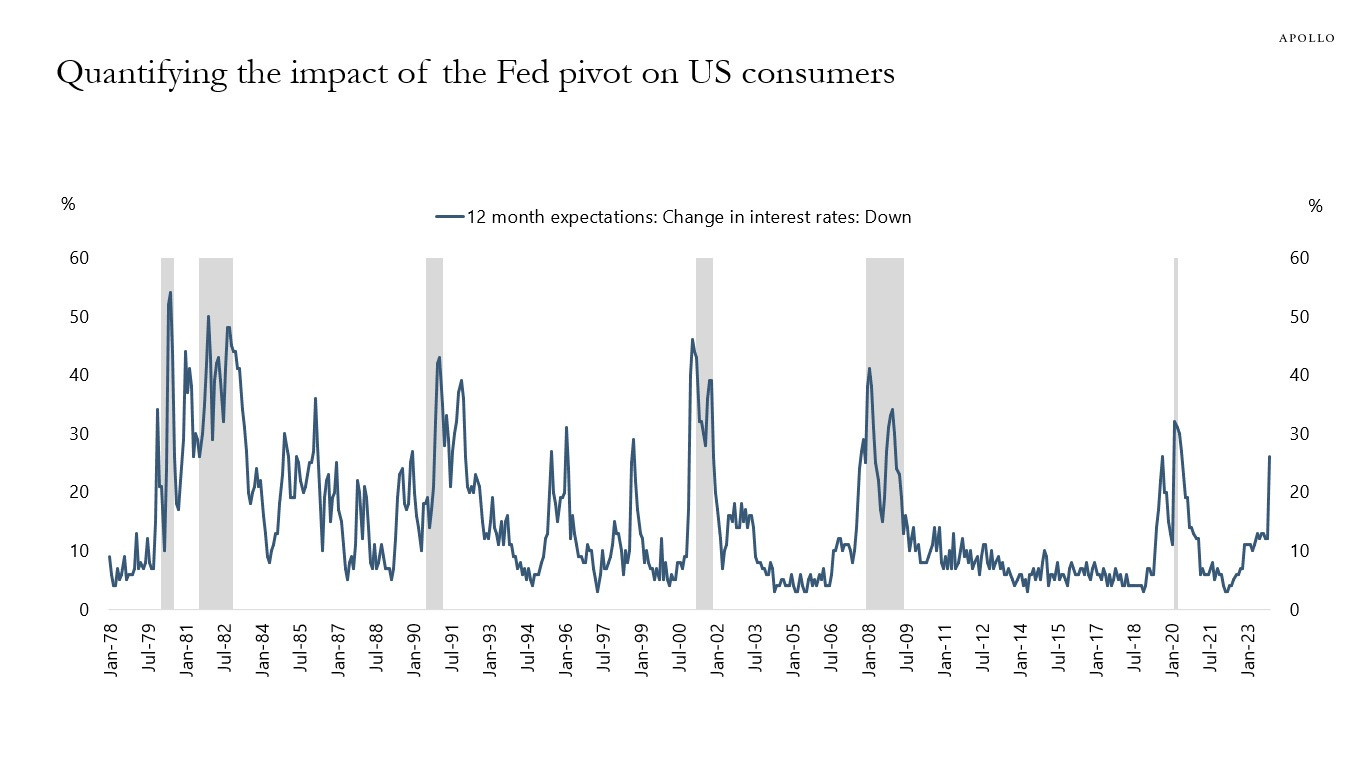

Rates expectations got overly optimistic

Global markets recorded their strongest year since 2019 following a robust two-month rally, driven by investor confidence that major central banks have concluded their interest rate hikes and are poised to implement rapid cuts in the coming year.

The Fed reinforced this trend in mid-December, as its policy projections indicated substantial rate cuts in the upcoming year. Currently, traders are factoring in the likelihood of six rate cuts (!) by both the Fed and the ECB by the end of 2024. This represents a significant shift from earlier concerns about "higher for longer" borrowing costs, which had triggered a global bond sell-off in the autumn.

The growing consensus that borrowing costs will fall sharply in 2024 has sparked a strong bond market rally. The US 10-year Treasury yield, which had soared to highs of 5% in mid-October has fallen to 3.87%, tightening by over 60bp in a span of just two weeks, and is now down 110bp from those levels. Consequently, corporate bonds and other risk assets have experienced a broad rally, resulting in one of the fastest recoveries for the overall bond market.

Meanwhile, the MSCI World index has surged by 16% since late October and is up 22% – its best performance in the past four years. The S&P 500 index, which has risen 14% since October and 24% on the year, has ended the 2023 just shy of its all-time record. However, December proved to be the time to shine for small caps, as the S&P SmallCap 600 posted a 12.6% gain.

The Bloomberg global aggregate index of government and corporate debt is up 6% last year, having been down about 4% in mid-October. This has been realized through considerable volatility during the year.

These gains accelerated during the past weeks and have been driven by a dramatic shift in interest rate expectations, following a slew of recent data showing inflation falling faster than expected. The bond market rally has been mostly driven by market forces: once the Fed signalled a pivot, it really put investors into a positive frame of mind. That was a big deal and it was unexpected.

Maybe this trend is likely to continue a bit entering into 2024. But it is crucial to recognize that markets may be overly optimistic in assuming that inflation will consistently trend lower without the U.S. economy slipping into a recession. As a result, any unexpected data point could trigger significant volatility. We would anticipate that some of the frothiness around rate cuts will start to fade a bit in the new year.

January 2024 is expected to be an active month, with the U.S. Congress returning to address issues concerning Ukraine, Israel, and the U.S. border. Moreover, the looming possibility of a government shutdown exists if a new budget (or stopgap bill) is not agreed upon by January 19. Adding to the market’s activities is earnings season, starting on Jan 12 with the big banks.

We still expect a slowing growth ahead

The year 2023 was a difficult one in the West as major central banks tightened monetary policy much more than previously expected in light of rampant inflation. The majority of developed economies initiated and are on the way to conclude their tightening cycles. They are now waiting for the full impact of those hikes to be felt due to the “long and variable” lags through which policy changes affect the broader economy. Notwithstanding the very high level of interest rates, both the U.S. and the Eurozone avoided recession.

Looking at the upcoming year, the primary emphasis seems to be on the cutting cycle and its extent. Disinflationary forces are strong and entrenched, stemming from a much calmer energy situation globally, notwithstanding the Gaza conflict, but also because China’s export prices continue to grow negatively. According to the market expectations, this means that the Fed and the ECB should have the necessary room to cut interest rates quite rapidly, possibly 150 basis points for the first and 125 basis points for the second.

If central banks successfully cut interest rates and achieve a soft landing, it could mark one of the most significant moments in the history of central banking. However, should inflation surge again after the rate cuts, markets would certainly fall.

While policymakers remain hesitant to entertain the idea of implementing cuts due to the potential risk of unintentionally easing financial conditions, nearly all recent economic indicators suggest that the next course of action for the majority of G10 central banks will involve a downward adjustment.

One year ago, our outlook on the impact of monetary tightening on the real economy, especially in the U.S., was overly pessimistic. We believed that the depletion of fiscal stimulus, coupled with the adverse effects of persistently high inflation on purchasing power and the erosion of savings amassed during 2020, would render the economy particularly susceptible to the rising interest rates. That was not the case. Thanks to the solid financial standing of the corporate sector, employment has demonstrated remarkable resilience.

However, looking at 2024, we foresee a moderation in consumer spending and, consequently, a noteworthy deceleration in overall economic growth. We expect a decline in real disposable income, with the softening of employment income growth outpacing the easing of inflation. Furthermore, the positive impulse on consumer spending derived from unwinding excess savings appears to be exhausted.

Fixed income markets see at least six rate cuts by the Fed in 2024 in a baseline scenario that foresees no recession or even stagnation. In the absence of any deterioration in employment conditions, a policy rate cut can only be justified by inflation converging on its target.