Fixed Income Monthly Report - March 2024

Preview of our monthly publication with macro themes and single bond ideas

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Underlying you can find a summary of what you can find inside this report.

March 2024 edition

Navigating euphoric markets in search of balance

The narrative of resilience in the US economy, marked by robust employment and consumption levels, extended from January into February. The most notable shift was the market’s expectation for the first rate cut from the Fed/ECB/BOE, which moved from March to June, indicating a hawkish shift in market sentiment. The US economy continued to exhibit “goldilocks”-style growth, characterized by a strong labour market without a significant resurgence in inflation.

Simultaneously, the equity bull market remained relentless, consistently reaching new highs. In February, US equity indices closed at record levels, with the Nasdaq Composite, Nasdaq 100, S&P 500, and DJI all setting new all-time highs, while the Russell 2000 reached a new 52-week high. NVIDIA was a significant contributor to these indices, with its stock rising over 28% in February, adding $275bn in market cap following its earnings report on Feb. 21, bringing its total market cap to nearly $2 trillion.

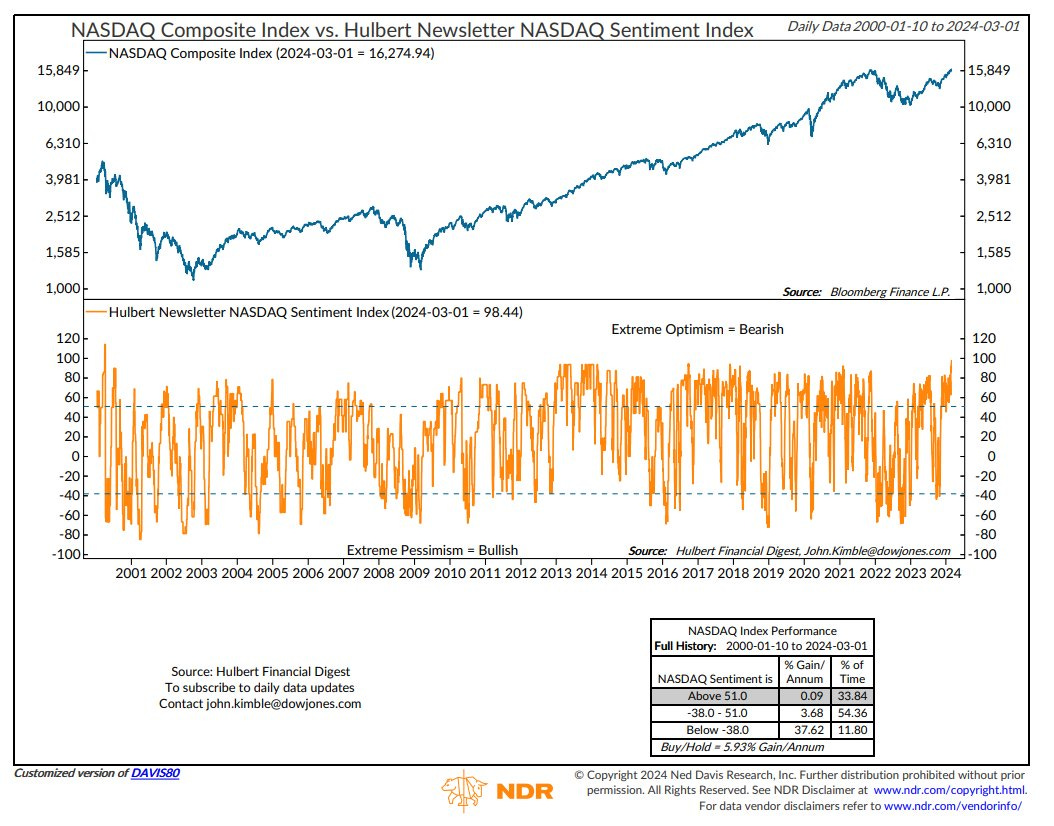

Ned Davis Research: Nasdaq's record high was accompanied by a near-record high sentiment reading for the composite. Reversals from extreme optimism can be bearish developments. But we typically go with the flow until a reversal from an extreme, which has not yet occurred.

Conversely, the US bond market pulled back in February, with yields rising in response to hawkish interpretations of the January FOMC meeting, leading to a broad repricing of Fed rate-cut expectations. Fixed income markets faced pressure as investors continued to delay interest rate cuts further into 2024. US Treasuries fell 1.3% in February, with the yield on the benchmark U.S. 10-year Treasury hitting 4.32% (now at 4.15%), up from 3.88% at the beginning of the month. Overall, the Bloomberg Global Aggregate fell 1.30% in the month, while the less rate-sensitive High Yield bond market fared better, gaining 0.77% over the same period.

The bond market’s losses since 2021 have been so severe that they all but wiped out any extra gains over cash over the past decade. The Bloomberg US Aggregate Index, which includes Treasuries and investment-grade corporate debt, returned 15% to investors in the 10 years through February, compared with 14% in Treasury bills, the equivalent of cash.

DataTrek Research compared the current investment climate to a mix of the pre-1987 crash and the late 1990s tech craze. The Fed has signalled lower interest rates due to cooling inflation, and generative AI has emerged as a novel, attention-grabbing technology. Retail investors have re-entered the market, and expectations and optimism are high. The market is now heavily positioned for a goldilocks outcome.

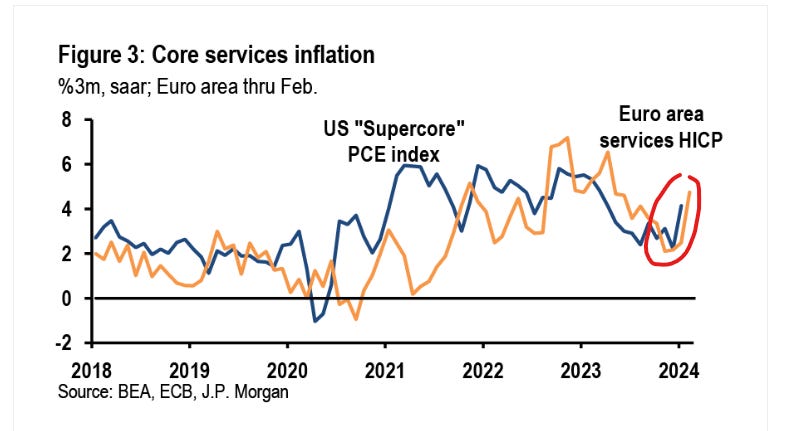

However, inflation risks are tilted to the upside due to loose financial conditions, tight labour markets, and easy fiscal policy, which could keep the Fed on a higher path for longer. Inflation could remain stubborn even after a significant global slowdown. Recent US data indicate that the pace of disinflation is slowing amid sticky services inflation and resilient job markets. The Fed’s approach may be more cautious than what the market is pricing in for interest rate cuts.

Major central banks are in a critical phase of their battle against inflation as they consider how soon they can reduce interest rates without risking a resurgence of consumer price pressures. Despite the strong performance of the US economy, an expansionary fiscal policy persists, which slows the process of reducing inflation and could delay the Fed’s shift to a more accommodating monetary policy.

Question is… are we still in a disinflation phase?

With steady rates and a better-than-expected corporate earnings season now behind us, stock markets may struggle to find their next catalyst in the coming weeks. The global consensus is that the era of aggressive monetary tightening is over, and 2024 is expected to be the year of rate cuts in the US and globally. On the other hand, financial conditions are already easing, alleviating recession fears. As the likelihood of softer economic growth increases, financial conditions will likely ease further, potentially limiting the number of Fed rate cuts as the market may pre-emptively adjust.

Looking ahead, we acknowledge that the market is divided on both growth and inflation, making the job market (e.g., NFP) and CPI the most potent macro catalysts in March. The market could be preparing for a pullback as investors recalibrate growth/earnings expectations, and some indicators flash sell signals. A momentum factor unwind could exacerbate losses.

Valuations are stretched, but there are exceptions

Risky behaviour appears to be on the rise, with markets betting on the continued strength of the US economy and consumers. However, we maintain a degree of scepticism about this narrative, emphasizing that the risk of a recession should not be underestimated. If data suggests anything other than a soft landing, it could potentially trigger significant market panic.

The Q4 2023 earnings season revealed mixed fundamental trends across both the US and Europe. Interest coverage continues to deteriorate and is expected to do so as borrowers refinance the maturity wall over the next 24 months. However, robust margins are preventing leverage from deteriorating.

At the same time, we perceive valuations as stretched, with both spreads and equities already reflecting a high probability of a soft landing, thereby limiting upside potential. We anticipate that bad news and market disappointment would be necessary to widen spreads.

TS Lombard's macro team: not a bubble yet. 1) Equity markets are bulled up on tech, concentrated and expensive, but breadth has widened and valuations are justified by fundamentals. 2) We are missing one key ingredient for an equity bubble: leverage.

In this context, an uptick in yield offers an entry point for duration, despite fewer anticipated rate cuts ahead. With equities and credit pricing in little to no risk of recession, underappreciated growth risk can provide a rationale for bonds to fully utilize their diversification benefits.

We believe that longer term Investment Grades have discounted a soft landing more than other segments, and positioning is very long. Despite this, it makes sense to consider a slightly longer duration, which would be beneficial in the case of a slower economic growth. We see the sweet spot for duration in the 5-7 years bucket. Carry remains compelling.

We remain optimistic about Emerging Markets and are strategically bullish. We see good economic growth prospects overall, and some of these markets could also benefit from the depreciation of the dollar, which could occur during 2024. Recently, our focus has been on Latin American corporates, especially those in the Crossover/High Yield segments.

We continue to prioritize safety, with our preference leaning towards quality and high carry. Simultaneously, we continue to consider specific alpha stories in the deeper part of the credit market, such as subordinated bonds and High Yields/Emerging Markets.

Traditional recession signals have been flashing for several months. There is still a possibility that a downturn and broader recession could occur later in 2024. In such a case, there would be meaningful corrections across credit and equity markets, which have largely discounted a soft landing scenario.