Fixed Income Monthly Report - November 2023

Preview of our monthly publication with macro themes and single bond ideas

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Underlying you can find a summary of what you can find inside this report.

November 2023 edition

The obsession about the Fed being done raising rates

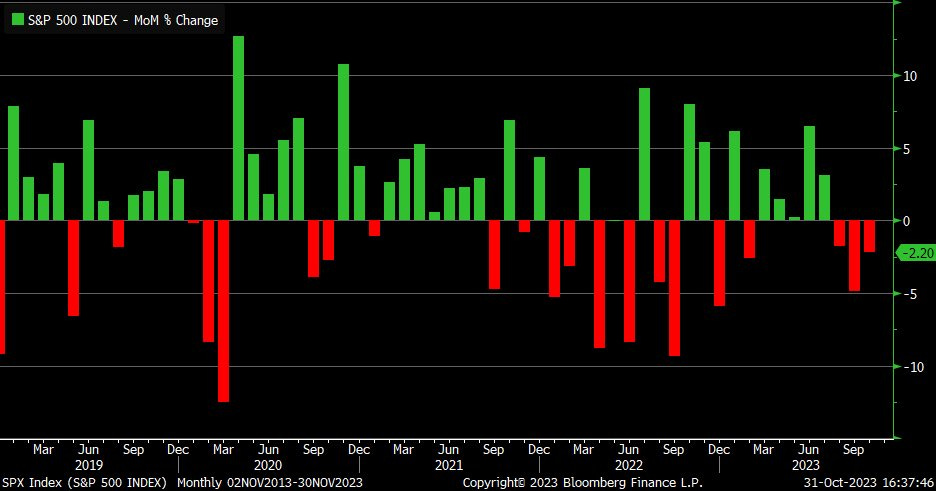

Bonds and stocks fell simultaneously in October as bond yields rose sharply and heightened geopolitical uncertainty weighed on market sentiment. Stocks have fallen in three consecutive months, for the first time since 2020, as bond yields continued their upward march. Commodities were the notable outperformer, as energy prices rallied and investors fled to gold as a safe haven.

Global equities declined in October, with both the S&P and Nasdaq dropping more than 10% from their July highs, entering correction territory. The S&P 500 fell 2.2% in the month, the Nasdaq fell 2.8% and, similarly, the Euro Stoxx fell 2.6%.

Also the bond market saw weakness in October, leading to a notable steepening of the yield curve, in a fast disinversion move. The rout in the bond market saw global bonds down 1.2%. US Treasury yields all increased by double-digits, with the 30-year logging the largest rise of 31bps. The 10-year, 20-year and 30-year both eclipsed 5% for the first time since July 2007, ending the month at 5.21% and 5.04%, respectively.

Not surprisingly the rise in yields hurt stock sentiment. The market had to adapt to the idea of a Federal Reserve stubborn in maintaining higher interest rates for an extended period. This was accompanied by positive economic surprises, such as strong retail sales and Q3 GDP. Factors like rising term premia, increasing Treasury issuance, Quantitative Tightening and softer foreign demand were also crucial. Geopolitical risks came into focus again following a terrorist attack on Israel by Hamas on October 7th.

Finally, the U.S. earnings season kicked off. The blended earnings growth of about 2.8% is beating pre-season (low) expectations, but the magnitude of those surprises has so far run below the 5-year average.

The seasonality calls for a year-end rally

We still believe there are good chances for year-end market rally. The seasonality analysis tells us that statistically November has been a good month for stocks dating back to 1970, with an average appreciation of 1.9%. And considering what we saw last week, we can say November started on the right foot with an early Santa rally in the making.

Investors often lean on technical indicators when they’re feeling cautious and want to know if price trends are being sustained. The S&P 500 has clawed back about half of last month’s 10% decline from its July high, but investors still face geopolitical risks, rising volatility and elevated inflation, underscoring expectations that the Federal Reserve is poised to keep interest rates high.

The S&P 500 currently sits at around 4,365, and chartists are monitoring the 4,355 level, which marks a 50% retracement from the peak-to-trough decline from its July highs to October lows. If it holds above that, the 4,400 level, where the index hovered during its mid-October highs, is the next number to watch, according to Keith Lerner, co-chief investment officer at Truist Advisory Services.

However, any further market advance into year-end would likely require that yields don’t move much higher. As Canaccord pointed out, for a more significant and sustainable advance in the broad market there needs to be a dramatic change in the tone of the bond market that is likely to come from either a financial market event or extreme weakness in the economic data. This could create an opportunity and a multi-year advance.

We keep our view that the next few weeks will be positive for the markets. At the same time investors should use market spikes to lighten the portfolios and increase quality and cash. We see a fairly high likelihood of a recession coming in 2024 with negative consequences on financial markets performance.

A big wave of Treasuries is flooding the market with less buyers

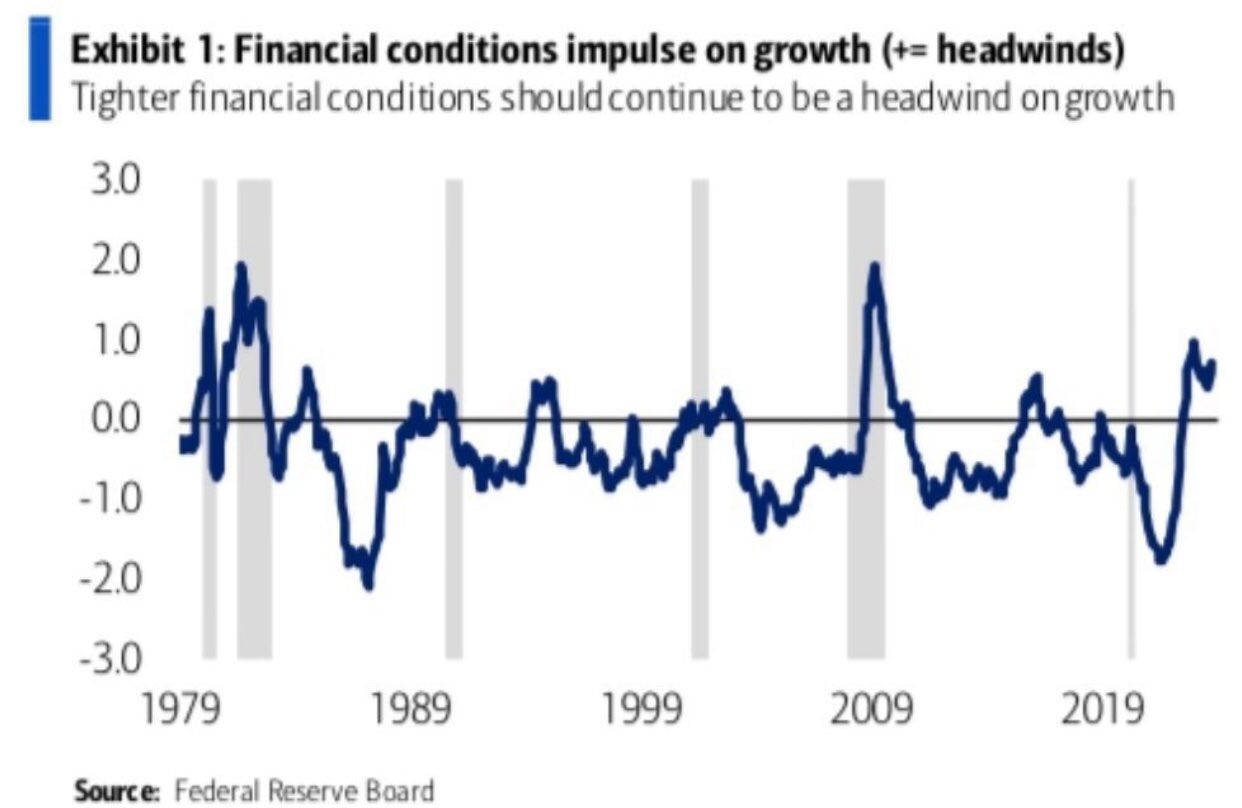

Monetary and fiscal policy are unlikely to provide relief and could tighten further. More specifically, while the Fed may be done hiking for now, it is a long way from easing. While Fed Chair Jerome Powell and fellow policymakers have indicated the surge in longer-term Treasury yields may reduce the case for continuing to hike the central bank’s benchmark interest rate, they made no such suggestion for the Quantitative Tightening. Instead, they said the process could keep going even after rate cuts have begun.

Central banks will have to keep their rates in a restrictive territory for longer than anticipated by the markets (to break the wage-price loop).

Anyway, with rates that climbed at the fastest pace since 1982 we believe the Fed may come under pressure to reconsider: the Fed tightening over the past 18 months is just now starting to be felt across the economy. At stake is the threat of surging borrowing costs ushering a harder landing for the economy, an outcome that would imperil riskier assets such as equities and corporate credit.

One of the worst selloff of longer-term Treasuries in more than four decades is also putting a spotlight on the market’s biggest missing buyer: the Federal Reserve. The Fed is shrinking its portfolio of government securities at a $720 billion annual pace, making the Treasury Department’s job of funding a near-$2 trillion federal deficit harder.

In the year through August, foreign official accounts sold $137 billion of Treasuries. If we consider the QT effect brought by the Fed, that’s dwarfed by the $663 billion reduction in the Federal Reserve’s Treasury holdings in the past 12 months. It’s also less than the $159 billion reduction in non-MBS Treasury and agency holdings at US banks in the 12 months. Add it all together and you have almost $1 trillion of lost demand for US Treasuries.

A market where longer-dated yields climb in the absence of notable rallies means that QT is potentially problematic. The Fed’s portfolio runoff will place downward pressure on bank reserves. That may trigger problems for the financial system. It also could force more bank hedging and unrealized losses for financial lenders, and higher bond yields. That has the makings of a vicious cycle.

What will governments and central banks do when we encounter a recession?

Credit: use rebounds to lighten risk

Fixed income markets were broadly negative as rates moved higher in the month. As we said, longer dated yields rose the most due to reduced demand and the prospect of increased supply.

Yields were driven up by a combination of buoyant economic data making “higher for longer” rates look increasingly likely, and concerns around the sustainability of government finances. A move higher in yields was seen throughout the global government bond market and in credit, where the latter saw widening spreads dented monthly returns for both Investment Grade and High Yield bond markets.

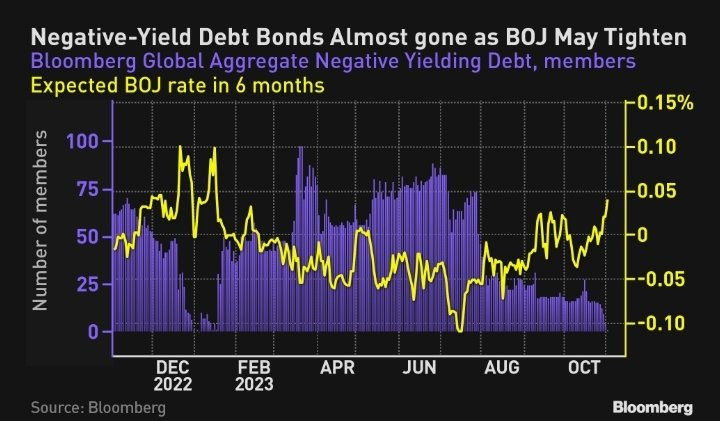

We are also monitoring the latest Bank of Japan monetary policy moves because, together with the Fed, it is a very important actor for the global financial markets with huge potential impact, due the gigantic balance sheet and holdings.

In Japan, government bonds were down 1.6% in October. Despite efforts to defend its accommodative stance earlier in the month, the BoJ tweaked the YCC policy at its October meeting, with the 1.0% upper limit becoming only a “reference”. The Bank of Japan allowed more flexibility in its yield cap, saying that the target level of the 10-year Japanese government bond yield will be held at 0%, but will allow the upper bound of 1% as a reference. However, BoJ still maintained its short-term interest rate target at -0.1% and maintained 10-year JGB yield target around 0%. 10-year Japanese government bond yields moved higher throughout the month as persistent price pressures led the market to question the sustainability of the BoJ’s yield curve control policy.

Markets saw a sharp turnaround last week. This shift in sentiment started when the Treasury’s refunding announcement came in lower than expected and alleviated some concerns around supply as an ongoing technical headwind. That was followed by a dovish interpretation of the FOMC meeting by the markets and the final push came from jobs data on Friday which missed expectations and signalled that the labour market is starting to loosen as high interest rates penetrate.

In our view this presents a good opportunity for investors to reduce positions that are now trading at better levels.

For the next few days we expect a rise in yields to the heavy bond supply: while last week we had the lowest amount of G7 debt sales in 4 weeks, this week is a very different story, $120bn for sale.

Looking into the next few months, we continue to expect a more challenging market in 2024. Given the pivot in rate expectations to “higher-for-longer”, borrowers will have to replace lower-coupon maturing bonds with significantly higher-coupon new debt.

There are three major factors that are going to affect the High Yield.

The maturity wall approaching. The higher-for-longer thesis creates a huge refinancing risk in 2024-2025.

Debt sustainability. With rates at this level the leverage becomes secondary, and interest coverage ratio plays a more important role. There are plenty of companies in the B- rating spectrum that won't be able to service their debt. In addition, in the current bear steepening environment low-rated companies will suffer from bigger impacts on coverage ratios when refinancing, and are more at risk of a potential hard-landing.

Government bonds supply. The increasing budget deficit in the US might become a problem. If they continue to issue Treasuries at the current pace, that will push rates even higher, and then inflation might start increasing again due to concerns over the deficit, an awful mix for fixed income.

We are not overweight for the High Yield segment, and while there are opportunities, investors have to be very selective: nowadays avoiding the losers is just as important as picking the winners.

On the other hand, we cannot stress more that, at the moment the high-quality corporate bonds are one of the most attractive places to be. We have an overweight rating on these securities where high-quality credit profile, diversification, and liquidity are the factors where to focus now.