Global Economic shift: Central Banks' easing spark a market rally, with China joining the race

Analysing the effects on global markets and economic outlook

BofA Global Research said it all:

“’Markets stop panicking when central bank start panicking.’ First Europe, then the US and finally China, are all panicking slashing rates and easing across the board, in hopes of avoiding, or reversing, the inevitable. […] at a time when the global economy is supposedly slowing, the world stock market cap is set to surpass Oct’21 highs [...] Fed is cutting in 50s, central banks are cutting at the fastest pace since the covid crash in April 20 [...] and China just announced a stimulus equal to 3% of GDP, in short global policymakers are desperate to prevent rise in unemployment, fuelling further rise in political populism, and markets stop panicking […] which especially in China, they clearly have, if only for the time being. The result being: a blow-off top in equity markets around the world!”

Markets surge in an atypical September

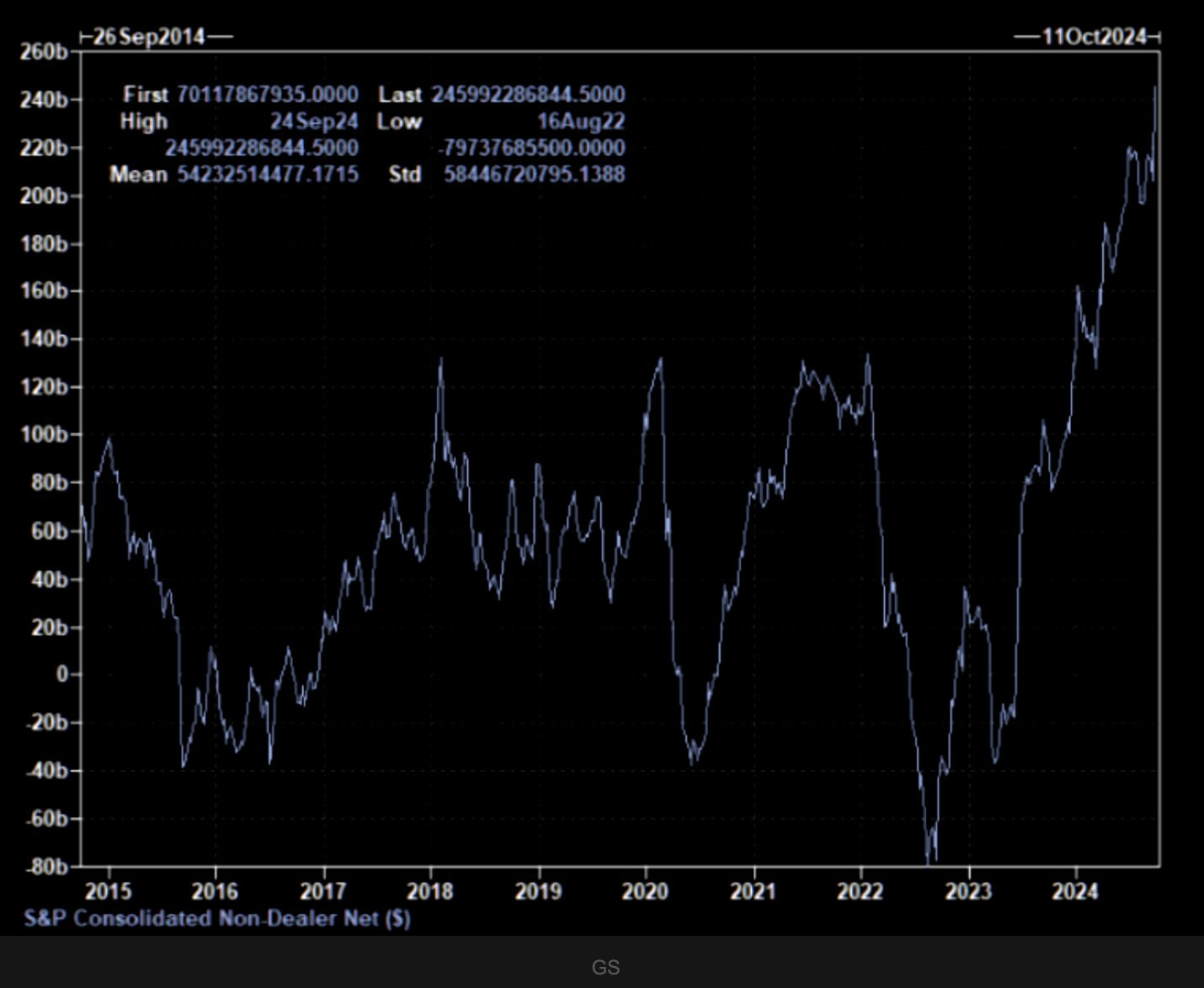

U.S. markets experienced a broadening rally in Q3, driven by optimism surrounding a soft landing, encouraging inflation data, and recent Federal Reserve rate cuts. Prior to September 18, financial markets were on edge, anticipating the Federal Reserve's crucial interest rate decision. The Fed's subsequent rate cut marked a turning point, initiating a long-awaited easing cycle. This move propelled major indices to record highs and set the stage for potential global policy shifts. The S&P 500 extended its year-to-date gains to above 20%, reflecting investor confidence in the Fed's ability to navigate the delicate balance between supporting economic growth and managing inflationary pressures.

Defying typical seasonal September trends, markets posted notable advances. The S&P 500 (+2.1%) recorded its first September gain since 2019, while Bloomberg's global bond aggregate (+1.7%) saw its first September increase since 2016. U.S. Treasuries (+1.2%) marked their fifth consecutive advance, a feat not seen since 2010. The U.S. Treasury 10y-2y spread turned positive over the month of September, the first time the rates curve disinvert since July 2022.

Economic data continued to show a mixed but generally resilient picture. The U.S. economy shows signs of slowing, while the Eurozone displays tentative recovery, and China faces ongoing challenges. However, the global economy has demonstrated greater resilience than initially anticipated. A stronger-than-expected U.S. Q2 GDP report and a four-month low in weekly jobless claims have further bolstered market confidence.

Historically, the initiation of rate-cutting cycles has benefited long-term equity investors, despite initial adjustment periods. The current steepening of the yield curve and increased interest in small-cap stocks suggest growing optimism about the longer-term economic outlook. Nevertheless, the future remains uncertain, with numerous variables still in play. The recent news of potential escalation of the conflict between Iran and Israel is adding a significant layer of uncertainty.

The Fed kicked off the rate-cutting cycle with a bang

In a pivotal move that marks a significant shift in monetary policy, the Federal Reserve initiated its first rate-cutting cycle in over four years this September. The Fed's decision to cut the federal funds rate by 50 bps to a range of 4.75% to 5% caught many analysts off guard, as most had anticipated a more modest 25 bps reduction. This aggressive start to the easing cycle underscores the Fed's commitment to staying ahead of the curve and avoiding potential economic pitfalls. With more confidence that the inflation battle has been won, the Fed signalled further bold action in the coming months, appearing keen to step off the brake and get interest rates down to a “neutral rate” closer to 3% as soon as possible.

We have interpreted this as a recalibration in order to buy some insurance. The rationale behind this bold move lies in the substantial moderation of inflation and growing concerns about the state of the economy. While Fed Chair Jerome Powell emphasized that the economy remains “strong overall” with “resilient” consumer spending, the central bank's actions suggest a heightened focus on potential downside risks, particularly in the labour market. Powell's repeated use of the term “recalibration” to describe this policy shift may well join the pantheon of memorable Fed-speak alongside “transitory” and “irrational exuberance.”

Market projections now anticipate further cuts totalling 210 bps by end-2025, potentially bringing the federal funds rate below 3%. This trajectory implies a 40% recession probability over the next 12 months, aligning closely with the Bloomberg Economist Survey's 30% estimate. The market prices a 50% chance of additional 50 bps cuts at both November and December FOMC meetings, though Powell has attempted to temper these expectations. Notably, former Kansas Banking Commissioner Michelle Bowman cast the first dissenting vote on a Fed decision since 2005, highlighting the complexity of the current policy stance. However, some Fed officials, including Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee, have indicated that while inflation is indeed cooling, there is still some debate on whether the current economic trajectory warrants further aggressive cuts.

The Fed's proactive approach has increased the expectations of achieving a soft landing for the economy. By lowering borrowing costs for consumers and businesses over time, the projected series of rate cuts is expected to help reaccelerate growth in 2025.

Major financial institutions have weighed in on the Fed's actions and future outlook. Citi anticipates another 50 bps cut in November, followed by a 25 bps cut in December, citing expectations of a softening labour market. Morgan Stanley projects a series of 25 bps cuts, with two more expected this year and four in the first half of 2025. Goldman Sachs views the choice between a 25 bp and 50 bp cut in November as a close call, with upcoming employment reports likely to be the deciding factor.

While in Europe, the ECB has adopted a more cautious stance, implementing a second 25 basis point cut in September. The bank emphasizes data dependency, acknowledging downside risks to growth.

In this shifting landscape, close attention to key economic indicators, particularly those related to the labour market, will be crucial. While main central banks are likely to maintain a data-dependent approach, their recent actions suggest a willingness to act decisively when deemed necessary.

China is having its own “whatever it takes” moment

In September, Chinese stocks experienced an unprecedented turnaround and one of the biggest short-squeeze in the financial markets history. The CSI 300 Index, which had plummeted over 45% from its 2021 peak to mid-September, surged up to 6.5% on Monday – its largest single-day gain since 2015 – and has rallied about 25% from its recent lows. Trading volumes in the Chinese stock market hit a record-breaking 1.9 trillion yuan, surpassing the previous high set in 2015.

This remarkable rebound was triggered by China's leadership unveiling a comprehensive stimulus package to combat the nation's economic slowdown, demonstrating a resolute "whatever it takes" approach to revitalizing growth in the world's second-largest economy. The coordinated effort spans monetary policy, fiscal measures, and targeted support for key sectors, particularly real estate and the stock market.

Spearheading the initiative, the People's Bank of China (PBoC) implemented significant monetary easing. The central bank reduced its seven-day reverse repo rate from 1.7% to 1.5% and lowered the reserve requirement ratio for banks by 0.5 percentage points. These actions aim to boost liquidity and stimulate lending. The PBoC also cut the cost of medium-term loans to banks, further enhancing the financial sector's lending capacity.

In an unprecedented move, the PBoC announced direct interventions in the stock market during a rare public briefing. The central bank will allocate $114 billion equivalent to facilitate share buybacks, while regulators will inject $71 billion to support stock purchases by brokers, insurance companies, and funds. These measures seek to restore investor confidence and stabilize the volatile Chinese equity markets.

The struggling real estate sector, a cornerstone of China's economy, received particular attention. Regulators decreased the down payment requirement for second homes from 25% to 15% to stimulate demand. Additionally, the PBoC adjusted its loan support facility to encourage state-owned enterprises to acquire unsold housing inventory from developers. These initiatives, combined with allowing earlier refinancing of existing mortgages, aim to reduce housing oversupply and support financially distressed property developers.

Fiscal policy plays a crucial role in this stimulus package. The government is considering injecting up to 1 trillion yuan ($142 billion) into its largest state banks to boost lending capacity—the first such capital injection since the 2008 global financial crisis. China also plans to issue special sovereign bonds worth about 2 trillion yuan ($284 billion) this year to support growth initiatives.

The Politburo has pledged to intensify fiscal support and deploy "necessary fiscal spending" to meet the country's 5% economic growth target for the year, suggesting more direct government spending may be forthcoming.

These measures represent a strategic shift in China's macroeconomic policy, prioritizing economic stabilization and growth over debt concerns or financial risks. While this approach presents opportunities for investors, particularly in Chinese equities and real estate-related assets, the effectiveness of these measures in addressing underlying structural issues remains uncertain.

Goldman Sachs estimates that the PBoC's easing measures could boost real GDP by 40 basis points, though the impact of fiscal measures is harder to quantify. The bank maintains its 4.3% real GDP growth forecast for 2025 but acknowledges that recent policy announcements have widened the range of potential outcomes.

Credit overview: life in a rate-cutting cycle

The Fed's decision to implement its first rate cut since 2020 marks a significant turning point, signalling a shift from inflation combat to addressing concerns about a softening labour market. This has set the stage for a series of anticipated rate cuts through the end of 2025, offering relief to corporate borrowers grappling with high debt service costs.

Historically, fixed income tend to perform well during rate-cutting cycles. The Bloomberg US Aggregate Bond Index has averaged an 8.5% total return in the year following an initial Fed cut, while U.S. Treasuries typically experience yield declines of around 155 basis points. The Treasury yield curve is expected to steepen, with the 2s10s spread widening by an average of 72 basis points. Both Investment Grade and High Yield corporate bonds stand to benefit, with average returns of 8.3% and 6.3% respectively. Also Emerging Markets issuers may benefit from improving financing conditions as long as the U.S. achieves a soft landing.

Euro High Yield bonds face vulnerabilities due to tight spreads and significant near-term refinancing needs. However, the average 6% yield appears to compensate bondholders for these risks. Further, we should consider that, the European High Yield market has evolved, showing improved quality and strong technical support: i.e. BB-rated bonds comprise 33% of the market (versus 52% in the U.S.), while CCC-rated bonds have decreased to 7% (from 12% 15 years ago), with current pricing already discounting potential negative outcomes.

However, credit markets face persistent risks despite potential improvements. The Fed's approach to interest rate cuts could reignite inflation and require policy adjustments, while the upcoming U.S. elections may introduce market volatility and policy uncertainty. The U.S. labour market's resilience remains critical for maintaining consumer demand. In Europe, credit markets appear to overlook potential challenges such as slowing earnings, rich cyclical risk premiums, and high-yield valuations approaching cycle tights. Additional disruption could also come from increasing protectionism, a further slowdown in Chinese economic growth, and escalating conflicts in the Middle East that could impact energy prices and supply chains.

Credit conditions are expected to improve gradually, but investors should remain vigilant. The specter of a recession versus a soft landing scenario continues to loom large, with markets remaining hypersensitive to growth-related news. In the U.S., the speculative-grade corporate default rate is projected to fall to 3.75% by June 2025, down from 4.6% in June 2024 (S&P projections). However, consumer-facing sectors remain vulnerable due to concerns about labour market resilience and increasing delinquencies.

Source: Ashenden Fixed Income Monthly Report

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Feel free to ask us more information: write to us at research@ashendenfinance.ch