Market capitulation? July left us worrying signals

The ripple effects of political unrest and disappointing tech earnings

July rollercoaster and the $2 trillion shakeup

July has been nothing short of tumultuous, marked by significant political events, large market moves, corporate earnings surprises, and important economic data releases.

The political landscape has been a major driver of market activity, particularly the attempted assassination of former President Donald Trump at a campaign rally. This event has not only heightened political tensions but also impacted market perceptions regarding the upcoming U.S. presidential election. Investors have reacted strongly, with many betting on a potential Trump victory, which they anticipate could lead to tax cuts, increased trade tariffs, and deregulation. This followed the someway expected President Joe Biden's withdrawal from the presidential race and the swift consolidation of Democratic support behind Vice President Kamala Harris initially provided a boost to Tech stocks.

However, this early enthusiasm was short-lived, due to the disappointing earnings reports from industry giants such as Alphabet and Tesla. These underwhelming results cast a shadow over the entire sector, raising questions about the sustainability of the much-hyped Artificial Intelligence trade. Investors began to scrutinize whether the massive investments poured into AI technologies by these companies would yield the anticipated returns. This scepticism wasn't confined to the Tech sector; it reverberated across global markets, contributing to a broader sense of unease among investors.

As the month progressed, market volatility intensified, culminating in a dramatic event on July 24th when the S&P 500 posted its largest one-day decline since December 2020. This sharp downturn marked the end of a remarkable 356-day streak without a 2% daily decline in the index. To put this into perspective, it was the longest such streak since before the Great Recession, narrowly surpassing a similar period of stability observed in 2017/18.

The magnitude of this correction in the Tech sector is worth noting. The Nasdaq 100 Index has plummeted by 10% in just over two weeks, bringing to a formal correction. Even more striking is the fact that the Magnificent 7 stocks have collectively shed a staggering $2.6 trillion in market value over a mere three-week period, representing a 13% decline from their peak. While this represents the most substantial loss for these stocks in several years, it's important to maintain perspective. In the broader context of the Nasdaq's 22% gain over the past 52 weeks, this pullback, while significant, still falls within the realm of a correction rather than a full-blown crash.

NASDAQ crushed the 100 day last week and futures are below the 200 day. Note NASDAQ is down to the big trend line that has been in place since early 2023 (Refinitiv).

In response to these market dynamics, hedge funds have significantly reduced their exposure to the Tech sector over the past two months. This de-grossing represents the most substantial reduction in Tech exposure observed in about a year, highlighting the extent to which these sophisticated investors have been rattled by recent events.

However, amidst the turmoil in large-cap Tech stocks, an intriguing countertrend has emerged. July witnessed one of the sharpest rotations from the Tech sector to Small-Cap stocks in recent decades. For the first time in 2024, the Russell 2000, a key barometer of small-cap performance, has substantially outperformed both the S&P 500 and the Nasdaq 100. The magnitude of this rotation is particularly striking when comparing the Nasdaq 100 to the Russell 2000: the ratio between these two indices has plummeted from approximately 10x to 8.4x, representing a massive 16% decline. To put this in historical context, we haven't seen a shift of this magnitude since the burst of the Dot-Com Bubble in 2000.

The catalyst for this rotation into more cyclical pockets of the market appears to have been a June inflation report that showed cooling price pressures. This data stoked speculation that the Federal Reserve might initiate interest rate cuts as early as September, a prospect that typically benefits smaller, more domestically-focused companies. In the wake of this report, the Russell 2000 surged by an impressive 10%, while financial and industrial companies within the S&P 500 saw gains exceeding 3.5%.

Moreover, Japan situation is contributing to this market. The JPY one way positioning has been aggressively cut. The JPY moved some 15% over 3 months back in late 2022. The current move is around 12%, but has materialized over 1 month. The excess in the world's carry trade has partly been washed out. Dare some "mean reverting" trades?

These moves reversed after new economic data and the Fed meeting on Aug 1st. Fed Chair Powell delivered the message markets wanted (and needed) to hear and rate cuts will almost certainly start in September. But markets now fear that the Fed is falling behind the curve and any rate cut may arrive too late to contain the economic and profit damage.

Despite the recent market turbulence, it's crucial to note that overall market sentiment and asset allocations remain bullish (yet). The current positioning stands in stark contrast to the market lows observed in October 2022, suggesting that many investors view the recent pullback as a potential buying opportunity rather than the beginning of a more protracted downturn. Moreover, it seems that investors have not fundamentally altered the underlying bullish momentum that has characterized much of 2024. Given the investment mandates of large-cap portfolio managers, hedge funds, and pension funds it's likely that flows into large-cap stocks will persist, even in the face of short-term volatility.

But risk is high: VVIX is reaching levels that were only seen during the peak of the COVID-19 crisis, a time when genuine concerns about the future of humanity were prevalent.

As we look ahead, the market appears poised for continued volatility. While the S&P 500 may experience a short-term bounce in the coming weeks, there are indications that further corrective action may be necessary before this period of adjustment is complete.

Fed: the telegraphed September cut

The dominant narrative in recent weeks has been the increasing likelihood of a Fed pivot towards a more accommodative monetary policy. This shift in expectations has been primarily driven by a series of encouraging economic indicators, particularly those related to inflation.

Adding to this narrative, the release of robust US GDP data a couple of weeks ago demonstrated the resilience of the American economy despite ongoing concerns about corporate earnings. This economic strength, paradoxically, has fueled expectations that the Fed might maintain its current interest rates in the short term while still leaving the door open for a rate cut later in the year, possibly as soon as September.

The final piece of the puzzle came with the latest Personal Consumption Expenditures (PCE) index release, which showed core inflation rising at its slowest pace in over three years. The PCE price index, a key inflation metric closely monitored by the Fed, has shown signs of moderation. June's modest 0.1% increase in the PCE index, coupled with a three-month annualized core inflation rate dipping below the Fed's 2% target, has bolstered the case for a potential rate cut in the near future. This data point has reinforced the cooling inflationary environment narrative, further fuelling optimism about a potential Fed pivot.

Concurrently, economic activity growth has been decelerating significantly, with labour market metrics worsening. Many signs of excess demand that previously concerned policymakers have been fading, suggesting that the economy is becoming less “coiled”.

The cooling inflationary environment, combined with decelerating economic activity growth and normalizing labour market metrics, has led to a growing consensus toward a September cut. The prevailing view suggests that the Fed's next move will likely be a 25bps cut in the federal funds rate, potentially following the September 17-18 meeting of the FOMC. However, it is worth noting that a portion of the market is pricing in a more aggressive easing, with the probability of a 50bps cut rising to 30% from a previous 15%, as there are increasing expectations of a more recessionary environment ahead.

This disparity in expectations also highlights the uncertainty surrounding the pace and extent of potential monetary policy easing. It also underscores the challenges faced by the Fed in navigating a complex economic landscape while balancing the risks of premature policy loosening against the potential for overtightening.

A key debate among market participants and economists centres around the concept of “long and variable” lags in the impact of restrictive monetary policy. Some argue that more rate cuts might be necessary this year to avert a recession later in 2024 or in 2025. On the other hand, there are concerns that if the Fed adopts an overly dovish stance, it could potentially stoke inflationary pressures in 2025, particularly if certain political scenarios unfold, such as an extension of tax cuts or increases in tariffs.

Fed Funds Futures, markets are now pricing-in a 76% probability of a 50bp rate cut in September. Besides, markets are also beginning to price-in a possible 125bp in rate cuts by end-2024, from 75bp a week earlier. Bond traders are now pricing in a series of deep cuts by the Fed through year-end, betting that authorities will need to ease aggressively to stave off a recession. Bill Ackman said on X the Fed was too slow to raise rates, and now it’s too slow to lower them as well.

Following the soft US jobs report, there has been an aggressive repricing in money markets, which now see 117bps of rate cuts by year end, and 43bps in September. From banks, BofA expects the Fed to start cutting rates in Sept. (prev. Dec.) with 25bps, and also sees a cut in Dec. Goldman Sachs expects the Fed to dispatch an initial string of consecutive 25bps cuts in Sept., Nov., and Dec. (prev. cuts every other meeting), while both Citi and JPMorgan see the central bank cutting 50bps in Sept. and Oct.

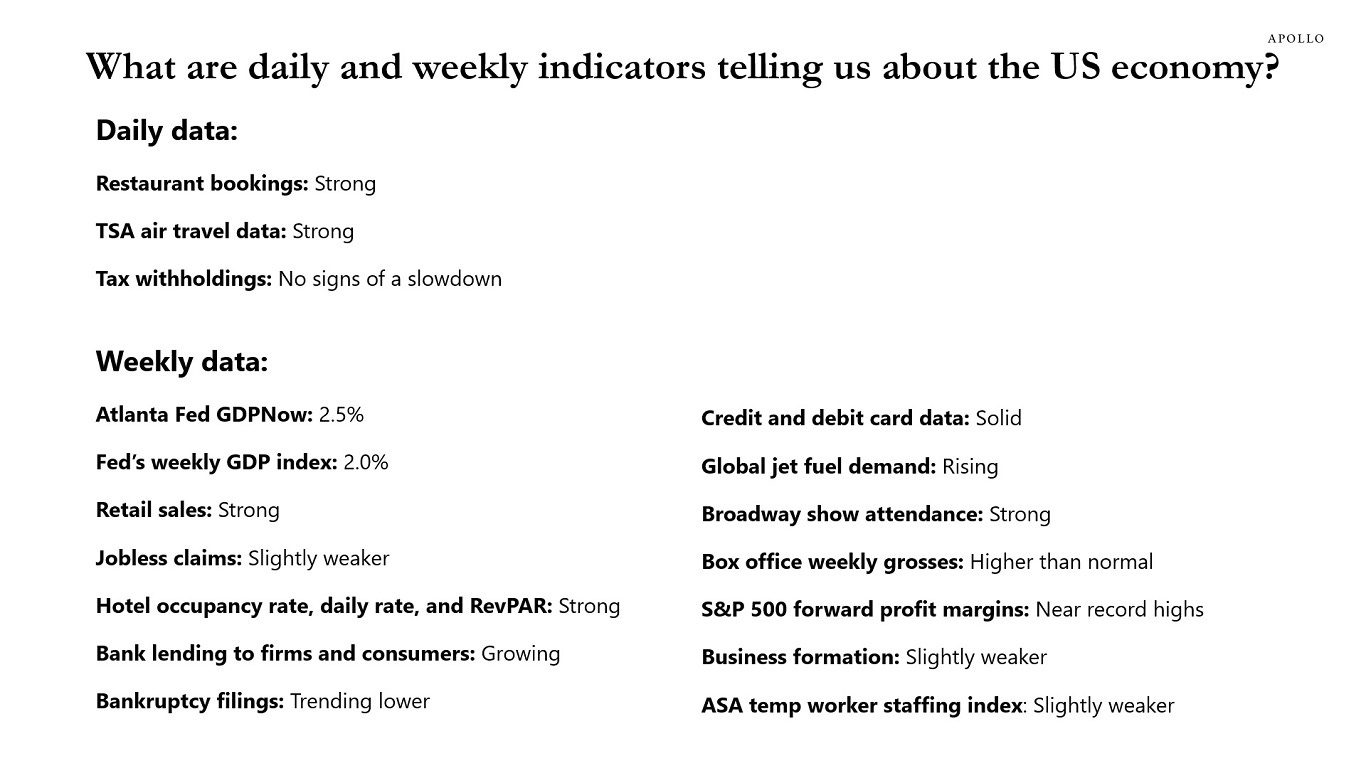

Apollo's Torsten Slok believes the economy is slowing, but we will still see a soft landing. The soft July employment report is inconsistent with the hard data for economic activity. There are no signs of a slowdown in restaurant bookings, TSA air travel data, tax withholdings, retail sales, hotel demand, bank lending, Broadway show attendance, and weekly box office grosses. Combined with GDP in the second quarter coming in at 2.8%, the bottom line is that the current state of the economy can be described as slowing, but still a soft landing.

While optimism persists for a 'Goldilocks' soft landing scenario, we find such expectations overly sanguine. Investors anticipate inflation cooling to manageable levels without triggering a recession, but this outlook may underestimate the economic challenges ahead. However, it's crucial to remember that the Fed continues to maintain a tight monetary policy stance in its ongoing effort to ensure price stability. While the tone has become less hawkish compared to 2022, the central bank is likely to keep conditions relatively tight until it is fully confident that inflation is under control.

This continued tight policy implies that we should expect relatively high interest rates, tighter lending standards, and potentially lower stock valuations ahead of us. Consequently, in our view, the risk of the economy slipping into a recession remains elevated, albeit not as high as previously feared.

Credit overview: no stress, yet

Turning our attention to the credit markets, we have observed some intriguing developments. High yield bonds, often considered a barometer of risk appetite, have shown remarkable resilience. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG), a popular proxy for the junk bond market, recently closed at an all-time high on a total return basis. This performance suggests that investors are maintaining their appetite for risk, despite the uncertain macroeconomic environment.

A closer examination of credit spreads reveals that high yield credit spreads remain near multi-year tight levels at 300bps. The current distress ratio of just 8% is below historical averages, supporting the market's expectation of better than average outcomes based on the current economic outlook. This suggests that while pockets of distress exist, they are not indicative of widespread credit deterioration.

The potential for a Fed pivot, coupled with resilient economic indicators, presents a complex but potentially rewarding environment. While risks remain, particularly around the pace of policy normalization and its impact on various asset classes, the overall picture suggests a cautiously optimistic outlook, at least in the short term.

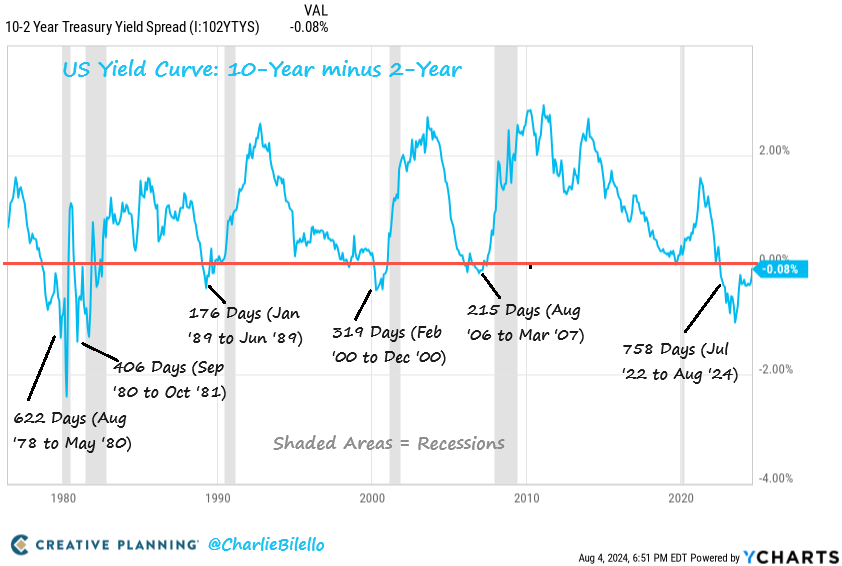

The longest yield curve inversion in history (758 days) is close to ending with the 10-year Treasury yield now only 0.08% lower than the 2-Year Treasury yield. Historically, the flip back to a positive sloping curve after a long inversion has occurred near a recession.

In addition, there is a speculation that US High Yield bonds are set for a “Trump trade”. Corporate bond investors are positioning themselves for a potential Donald Trump election victory, following recent events that have boosted his position in polls. US High Yield bonds are strengthening compared to European counterparts, and global junk funds are seeing increased inflows. Investors are attracted to US High Yield bonds due to their domestic focus and exposure to US economic activity. Trump's proposed policies, including lowering corporate tax rates (potentially to 15%) and implementing protectionist measures with high tariffs on imports, are driving this trend. US junk-rated borrowers are appealing because many have primarily domestic revenues. Investors are particularly interested in US industrial companies, manufacturers that could benefit from tariffs and looser regulations, and companies dealing with spare parts. Therefore, investors are adjusting their strategies based on the potential economic impacts of a Trump presidency, focusing on domestically-oriented US companies and industries that might benefit from proposed policies.

In conclusion, even if the face of the recent equity sell-off and some agitation on the interest rates front, we saw a resilient credit bond market. This has changed only toward the end of the last week. Our bias is for a bit more complex second part of the year, where we believe we are going to see a further deceleration of the US economic engine and a credit spreads widening. In this context, will be crucial to be selective.

Source: Ashenden Fixed Income Monthly Report

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Feel free to ask us more information: write to us at research@ashendenfinance.ch