Market reshaping after Fed comments

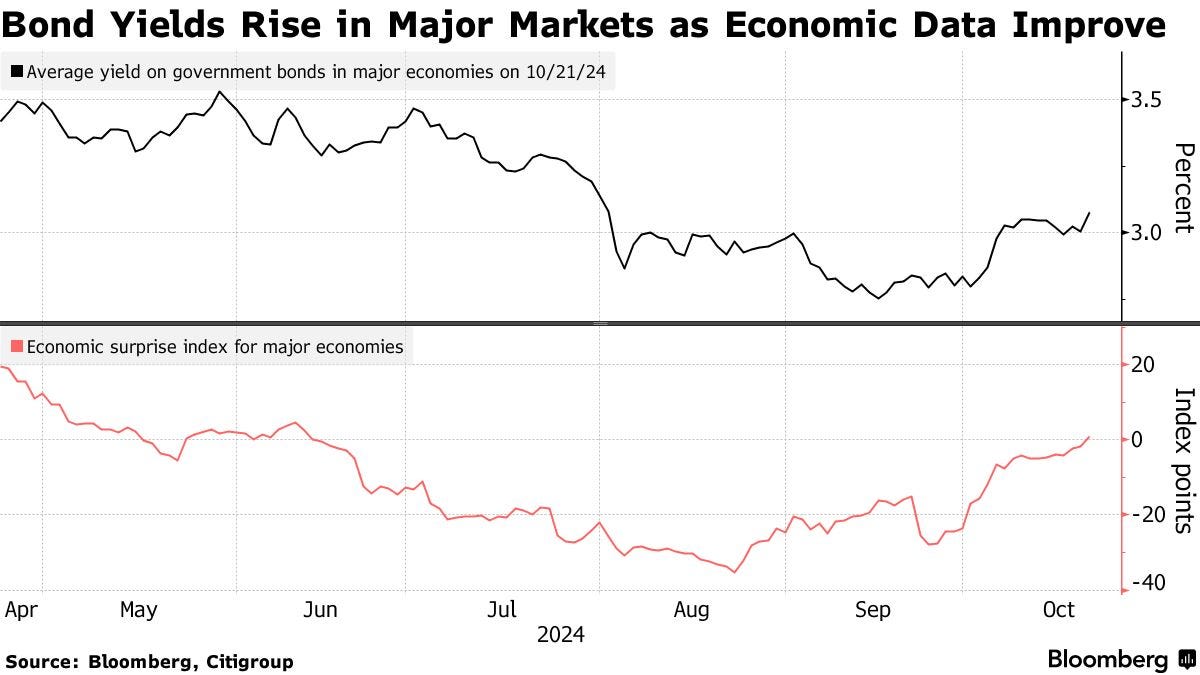

Recent cautious comments triggered a bond sell off

Bonds crashing?

Investors mulled cooling expectations of US rate cuts after Fed’s Logan, Kashkari and Daly comments, that were on the wires. Dallas Fed President Logan reiterated she expects gradual rate cuts if the economy meets forecasts, noting the Fed will need to be nimble with monetary policy choices. Minneapolis Fed President Kahskari said that a rise in the budget deficit would mean that on the margin interest rates would be higher. He noted the Fed wants to avoid a recession, adding the Fed saw signs of labour market weakening, which is why they cut by 50bps. Going forward, the Fed will look at all the data to decide on rate policy. Schmid called for a cautious, gradual and deliberate approach to rate cuts, while he prefers to avoid outsized rate cuts and noted that they are seeing a normalisation of the labour market, not a deterioration. Kansas City President Jeffrey Schmid was more outspoken with markets taking note of his comment that he favours a slower pace of interest-rate reductions given uncertainty about how low the US central bank should ultimately cut rates

Bonds from Japan to US are falling as investors mull prospects of slower US interest-rate cuts, a trend that risks upending debt positions everywhere. At the heart of the global debt selloff is investor soul searching around Federal Reserve rate-cut expectations and whether once again they appear overdone. A robust US economy, firming odds of a Donald Trump election victory and cautious comments from Fed officials on the pace of monetary easing muddies the prospects of gains for bond traders everywhere. US 10-year yields rose a further one basis point to 4.21% in Asia Tuesday.

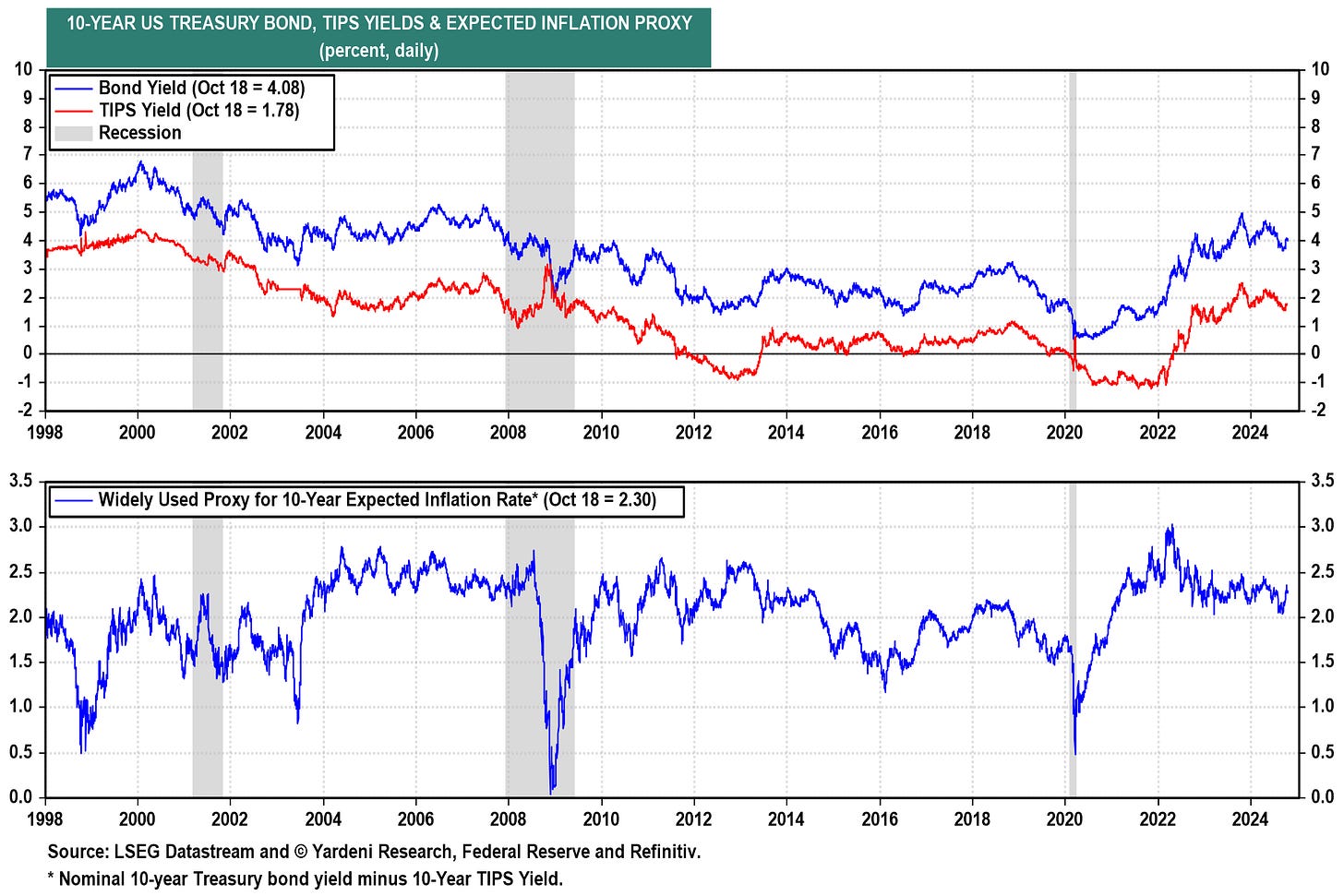

“We will see 4.5% probably early next year” for US 10-year yields, said Ed Yardeni, founder of Yardeni Research, speaking in an interview on Bloomberg Television. Yields rising to 5% would “depend a great deal on the election results — if we do get a sweep by the Democrats or Republicans, it almost doesn’t matter. Either way we are going to have wider deficits,” he said.

In August, when the 10-year Treasury yield was 3.88%, Yardeni research wrote:

"Bond investors may be expecting too many interest-rate cuts too soon if in fact August’s economic indicators rebound from July levels and the Fed pushes back against the markets’ current expectations for monetary policy. So we are expecting to see the 10-year Treasury yield back in a range between 4.00% and 4.50% next month."

They were right about the economy and bond yields, even if the Fed's reaction function turned out differently: instead of remaining moderately hawkish, Powell turned extremely dovish in his August 23 Jackson Hole speech, driving the bond yield down to 3.62% on September 16. On September 18, the Fed cut the federal funds rate by 50bps.

Yardeni research thinks that it was “too much, too soon”, reiterating their view that the yield would climb back up over 4.00% on better-than-expected economic data and on a none-and-done outlook for rate cutting by the Fed over the rest of the year (and, in fact, the 10-year yield rose to 4.18% this week, up 56bps since September 16).

T. Rowe Price sees US 10-year yields climbing to 5% next year on risks of shallower rate cuts and as growth improves.

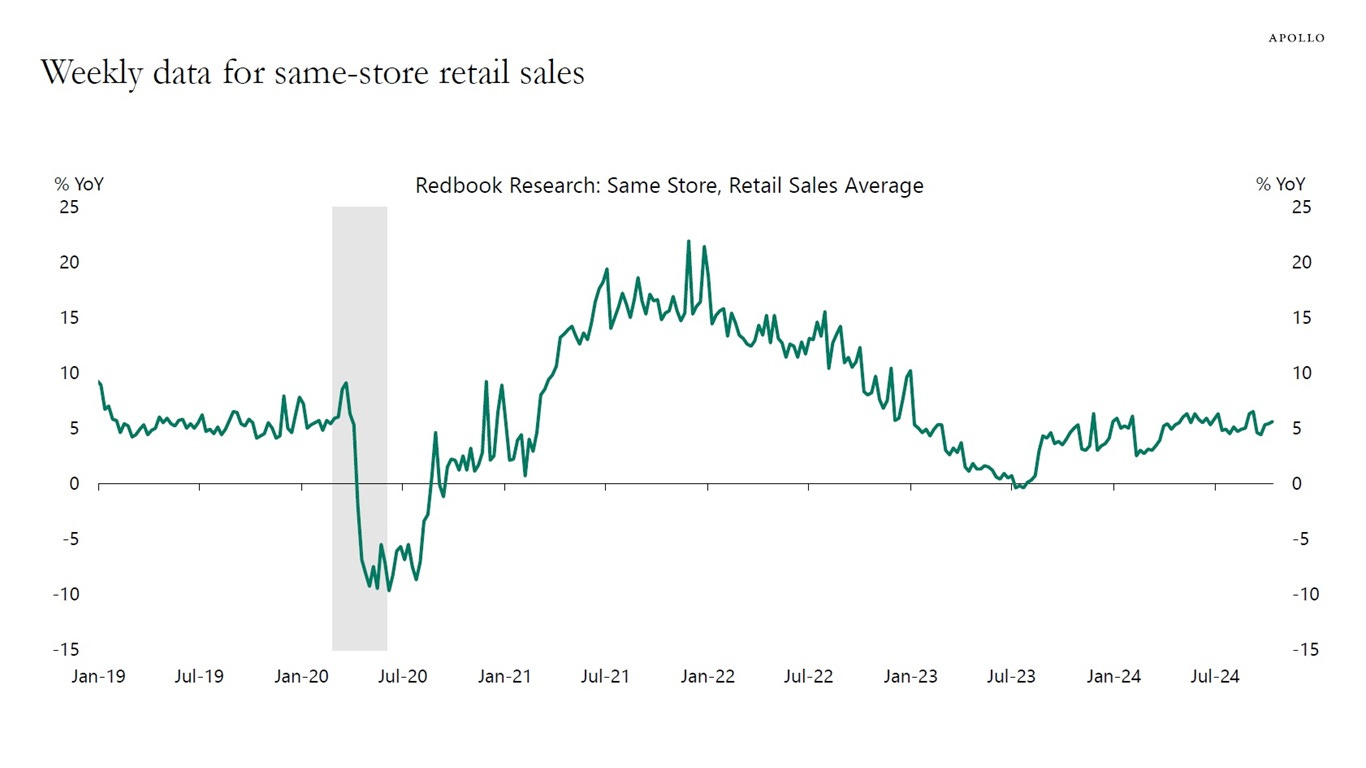

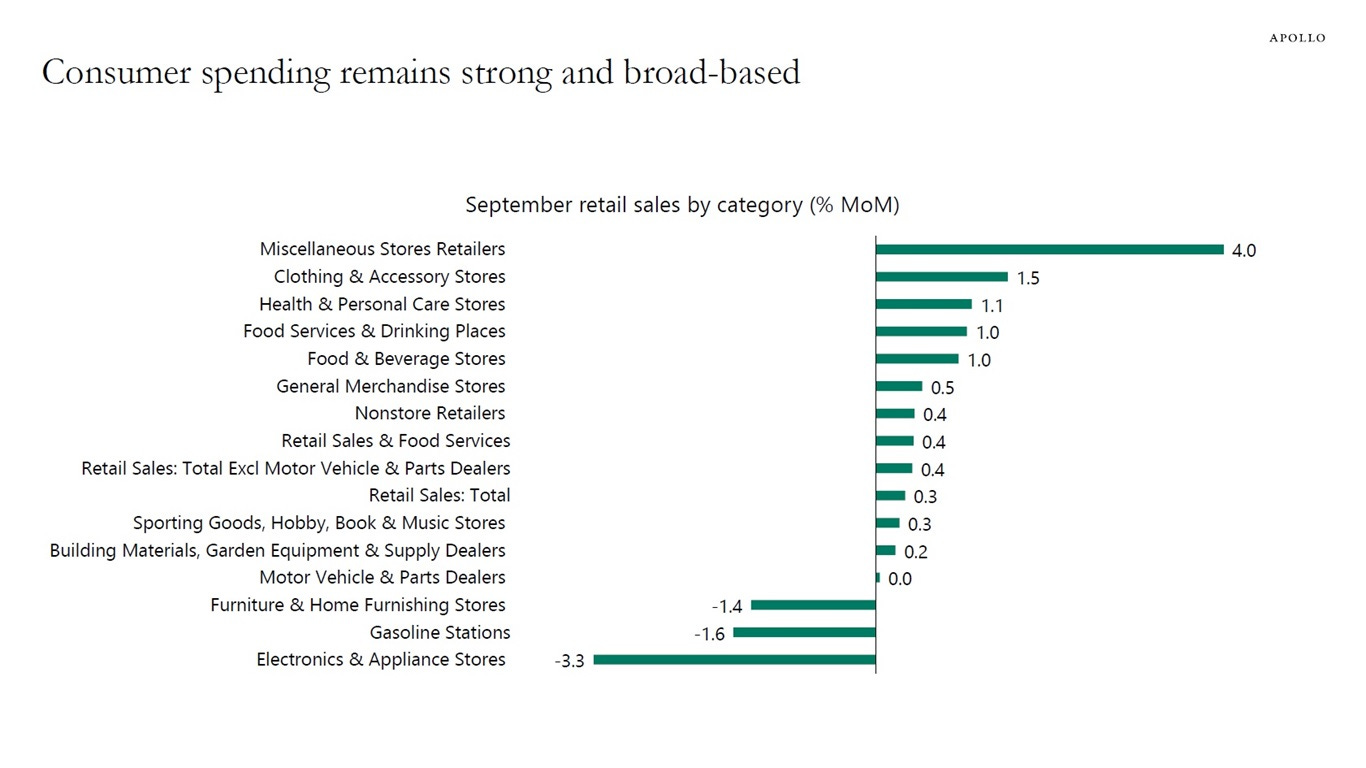

Apollo Management, on the other hand, is among those seeing the central bank potentially keeping rates unchanged at its next meeting. Torsten Slok sees a continuation of the “No Landing” scenario, as last week we got data for retail sales for September and the first two weeks of October showed that the US consumer continues to do well, driven by solid job growth, strong wage growth, and high stock prices and home prices.

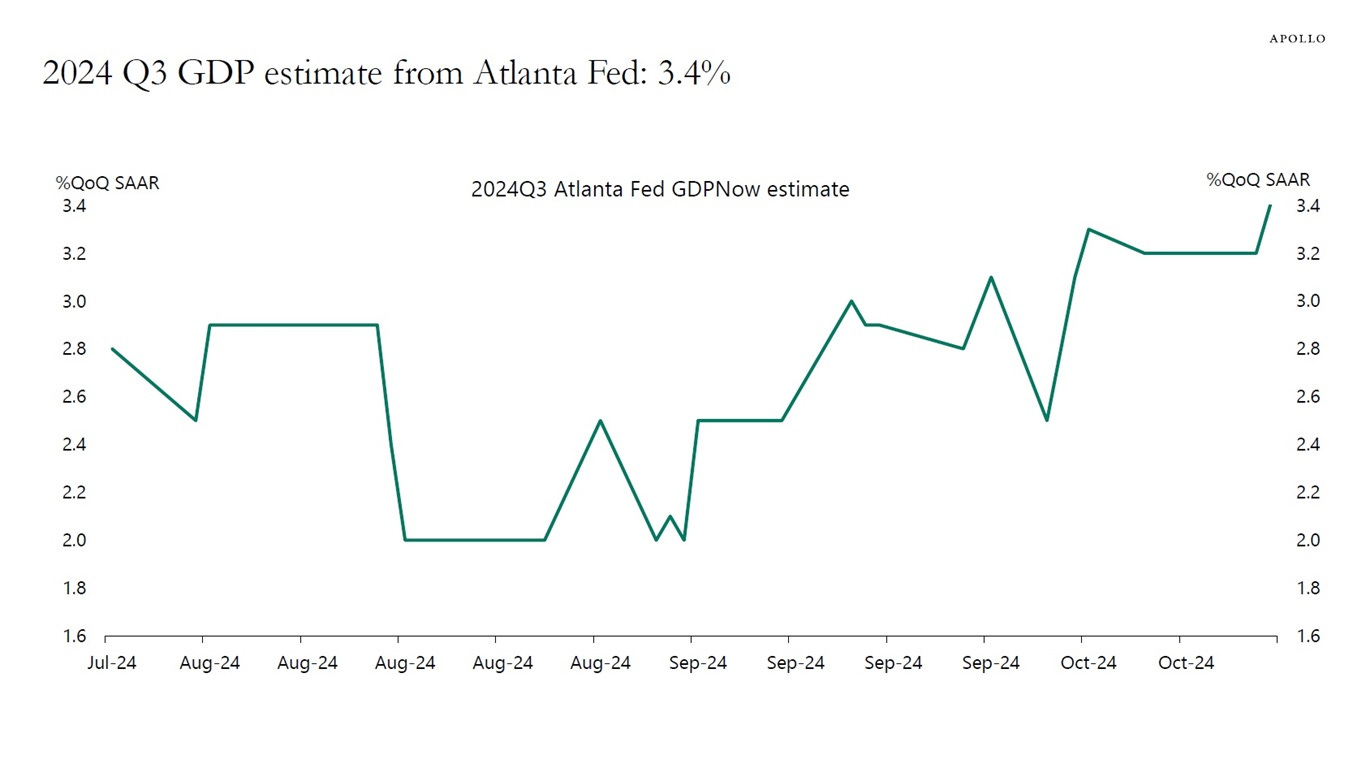

With the Atlanta Fed GDP estimate for the third quarter currently at 3.4%, the bottom line is that the expansion continues.

Why is the incoming data so strong? Because the list of tailwinds to the economy keeps growing:

A dovish Fed

High stock prices, high home prices, and tight credit spreads

Public and private financing markets are wide open

Continued support to growth from the CHIPS Act, the IRA, the Infrastructure Act, and defence spending

Low debt-servicing costs for consumers with locked-in low interest rates

Low debt-servicing costs for firms with locked-in low interest rates

Geopolitical risks easing

US election uncertainty will soon be behind us

Continued strong spending on AI, data centres, and energy transition

Signs of a rebound in construction order books after the September Fed cut

These 10 tailwinds are increasing the likelihood that the Fed will have to reverse course at its November meeting.

BlackRock Investment Institute is among those underweight shorter-maturity Treasuries.

“We don’t think the Fed will cut rates as sharply as markets expect. An aging workforce, persistent budget deficits and the impact of structural shifts like geopolitical fragmentation should keep inflation and policy rates higher over the medium term”.

But not everyone is expecting the selloff to gain momentum. The Fed and Reserve Bank of New Zealand, among others, are in the midst of rate-cutting cycles, which should generate an underlying bid for bonds. “We probably see a slight correction from here,” said Lucinda Haremza, vice president of fixed-income sales at Mizuho Securities in Singapore. There’s “risk of a stronger rally on rising Middle-East tensions or a Harris election win,” she said.

Stanley Druckenmiller has taken a significant short position (15-20% of his portfolio) against U.S. Treasury bonds, essentially betting against the prevailing market expectation that interest rates will fall. He argues that inflation could surge to 1970s levels, which would prevent the Federal Reserve from lowering interest rates as much as markets anticipate. Although the specific details of his trade (like bond duration) aren't public, his concerns appear to stem from both potential inflation risks and what he calls "bipartisan fiscal recklessness" regarding government spending and national debt. This is a very contrarian position vs current consensus.

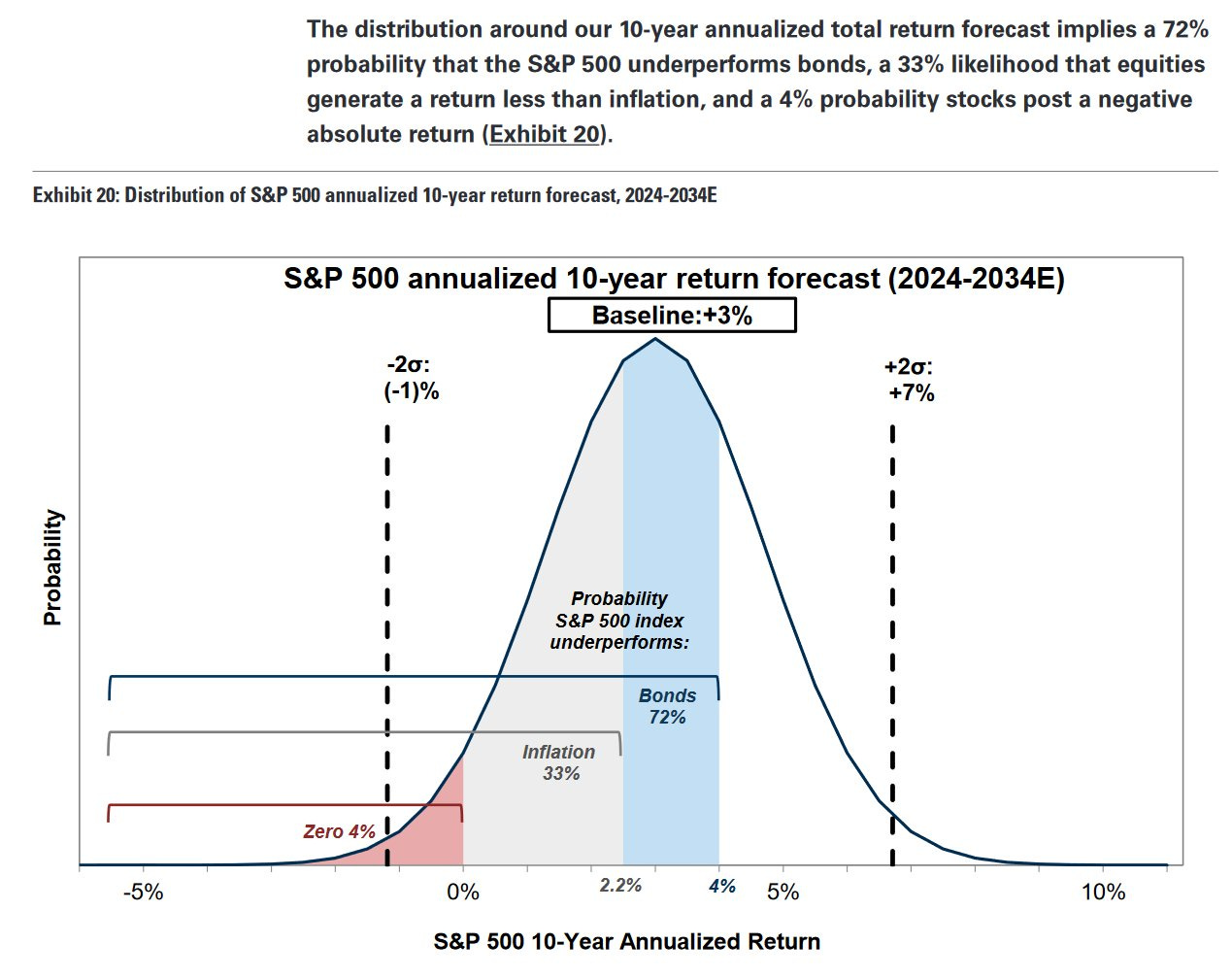

Goldman Sachs strategists calculate a 72% probability that 10 year treasuries outperform the S&P 500 over the next decade.

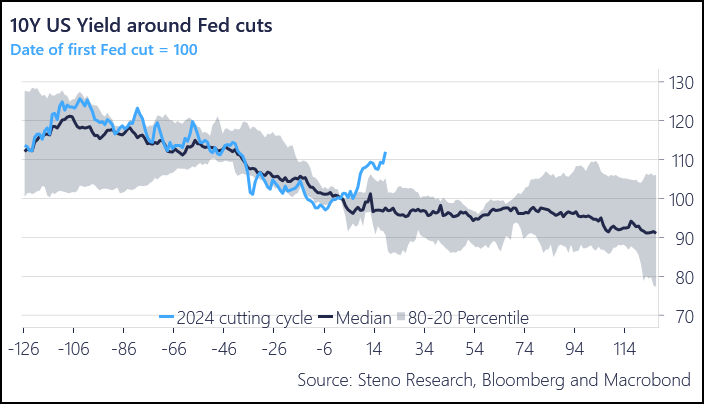

In any case, this move in bond yields after the 50bp cut is very out of the ordinary…

Volatility magnifies the bond sell off

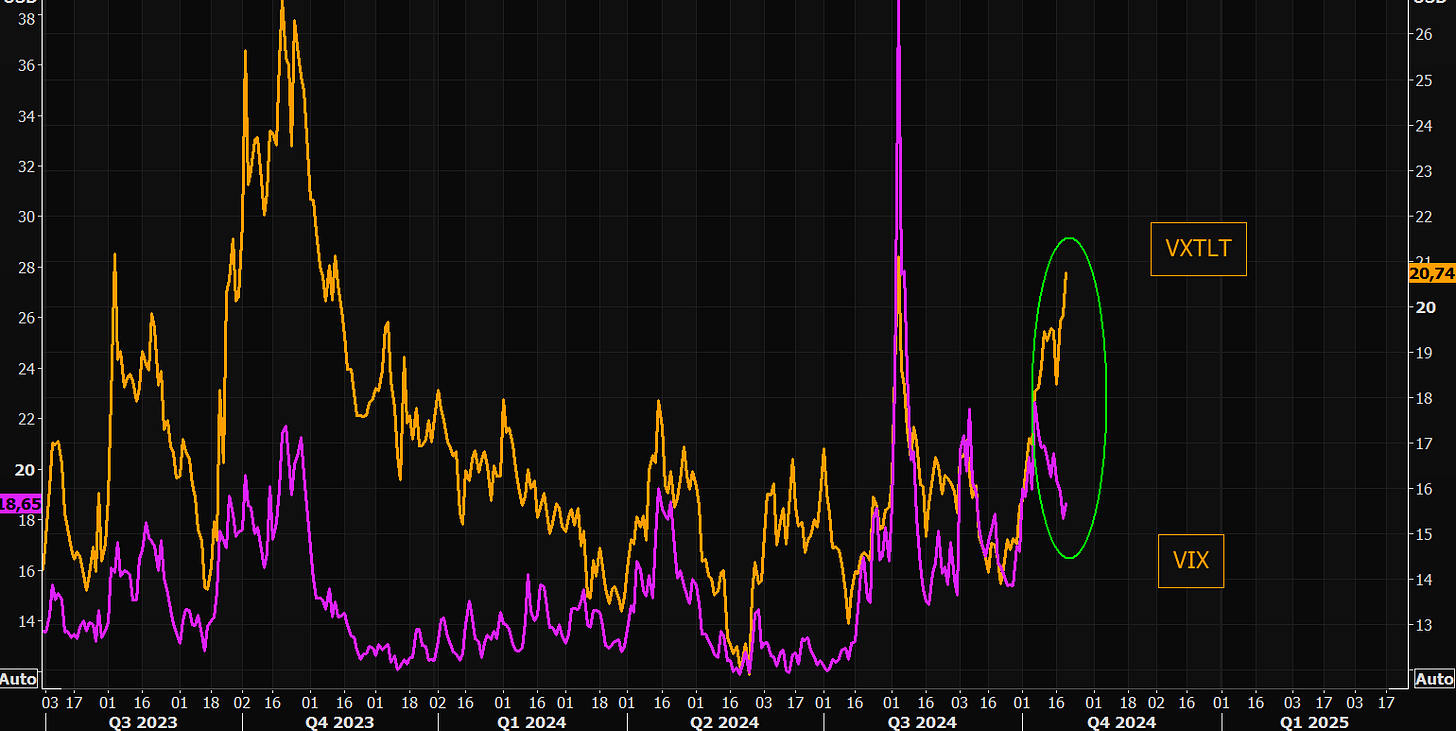

Stress in rates is huge. The VXTLT is printing early August panic highs basically, leaving the VIX way behind.

Volatility has a significant impact on this bond sell off, especially in these markets heavily driven by algorithms. When bond volatility rises substantially compared to equities, it implies that bond prices are experiencing larger and unpredictable movements: in this context, the algorithms (designed to optimize the risk/return profile) will consider bonds as riskier investments than equities. And since bonds are traditionally perceived as lower-risk assets, an increase in their volatility distorts this concept, making them even less attractive.

Seasonality is a thing also in bonds and a potential tailwind now. Looking at history via this chart of the 10 year seasonal trading, the top in rates are upon us.

Conclusions

We believe that rates can pullback a bit from the current levels and long term rates are interesting from a tactical perspective. In addition, the TLT (the iShares 20+ Year Treasury Bond ETF) is forming a interesting base around 92. We believe a good strategy is to buy the TLT and sell calls between 93 and 94 with 2 weeks expiry.