Market Turmoil from Basis Trade Collapse

Macroeconomic Implications (3-6 Month Outlook)

Bond Market Dislocation: Yields Surge and “Basis Trade” Unwinds

Treasury Yields Spike: U.S. government bond yields have risen sharply as leveraged “basis trades” blow up. A popular hedge-fund bet on Treasuries outperforming interest-rate swaps is unravelling. Banks are selling bonds to raise cash to meet clients’ liquidity needs and adding swaps, pushing swap rates far below yields. The basis trade, a strategy used by hedge funds to wager on the difference between cash Treasuries and futures prices, may be unwinding, causing yields to surge and potentially leading to a cascading effect in the Treasury market.

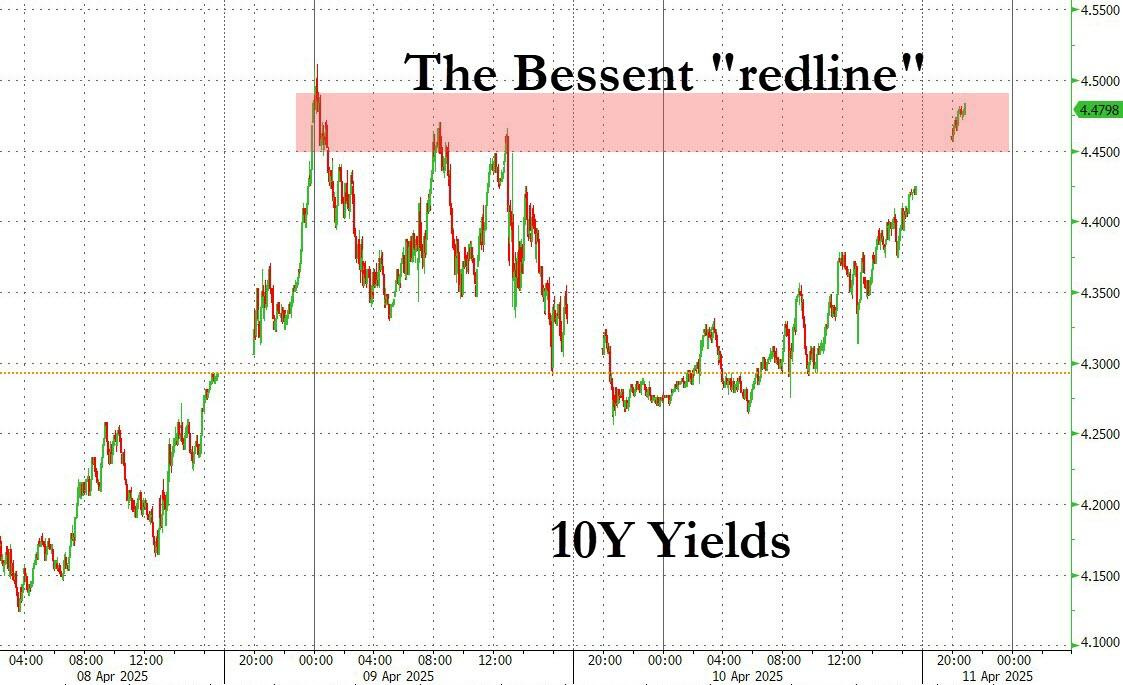

U.S. 10-Year Treasury yield jumped above 4.5%, triggering policy alarms and breaching what Treasury officials call Bessent’s “red line” (around 4.45). This level (unofficially targeted by policymakers) was exceeded when hedge funds were forced to liquidate Treasury positions. The 30-year yield likewise hit its highest levels in years. Rising long-term yields reflect forced selling of Treasuries by funds facing margin calls, rather than improving growth fundamentals. In the short term (next 3-6 months), such yield spikes tighten financial conditions dramatically, lifting borrowing costs for businesses and consumers.

Swap Spreads Turn Negative: A hallmark of the basis trade collapse is the plunge in swap spreads. Normally, interest rate swap rates sit slightly above Treasury yields, but now swap rates have fallen below equivalent Treasury yields, creating record negative swap spreads. This means investors are demanding far higher yields on Treasuries than on swaps, a highly unusual dislocation. It reflects hedge funds scrambling to unwind trades: dumping Treasuries for cash while receiving fixed in swaps to maintain rate exposure. Essentially, Treasury prices are collapsing relative to swaps, pointing to a breakdown in arbitrage. For example, the 3-year SOFR swap spread (swap rate minus 3-year yield) has swung deeply negative in an “unprecedented freefall”. This is illustrated by the widening gap between Treasury yields and swap rates; Treasuries now yield more than swaps of the same maturity, as funds panic-sell Treasuries to raise liquidity. Such extreme negative swap spreads signal severe funding stress and dysfunction in the normally liquid Treasury market. In the next few months, if unaddressed, this could impair the ability of investors and banks to use Treasuries as collateral, tightening credit further. It also indicates big losses at hedge funds that were long Treasuries vs. swaps, their highly leveraged “basis” positions are now deeply under water.

Liquidity “Air-Pocket”: Market depth has evaporated amid these dislocations. Treasury market liquidity is deteriorating: bid/ask spreads are wider and market makers are pulling back. Notably, E-mini S&P 500 futures liquidity also hit record lows as the turmoil spread: the top-of-book depth fell to merely ~$1 million, meaning even small orders can move the market. This lack of liquidity is symptomatic of the basis trade sucking “every last bit of oxygen” from markets. In the short run, such thin liquidity conditions increase volatility and raise the risk that minor shocks could trigger outsized market moves. Financial conditions can tighten abruptly when key markets (Treasuries and equity index futures) malfunction, raising the probability of flash crashes or erratic price swings in the coming weeks.

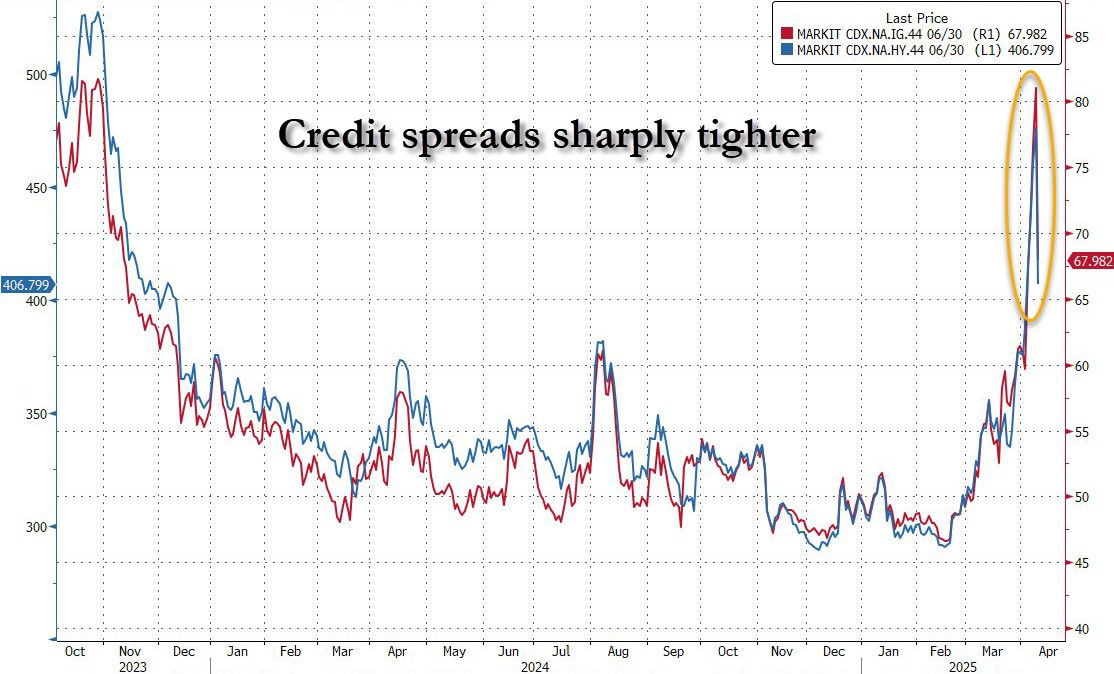

Volatility Surges and Flight to Safety Accelerates

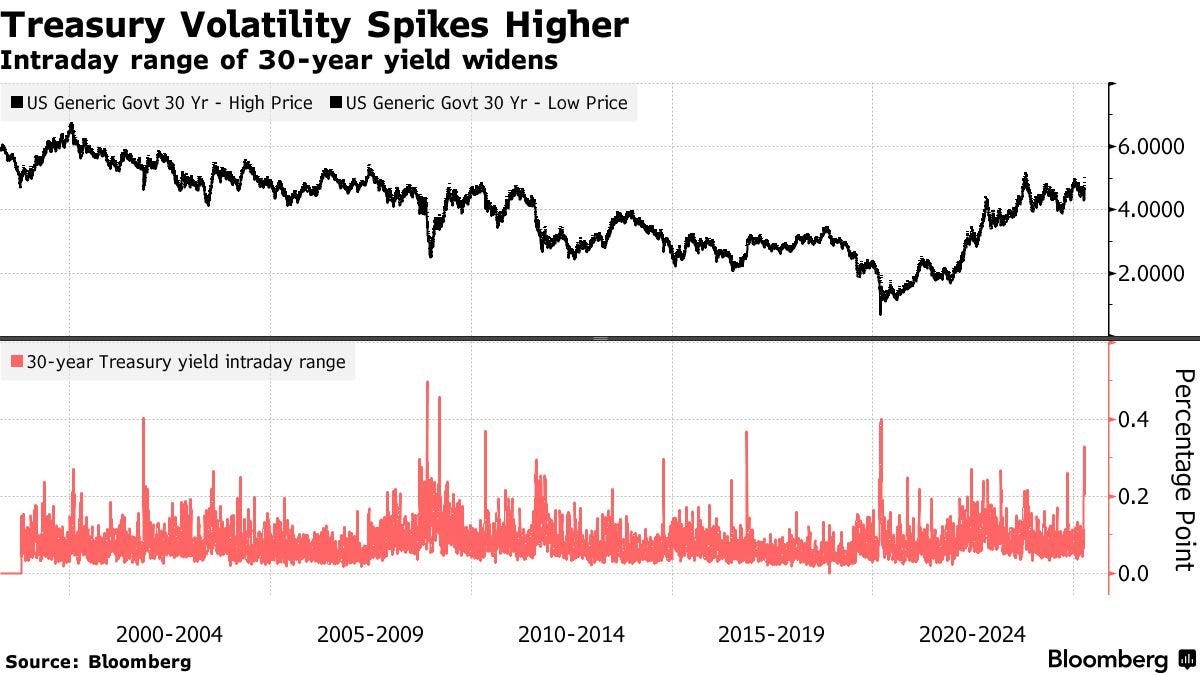

Treasuries suddenly trade like risky assets in warning to Trump. We are witnessing the largest drawdown in long-duration Treasuries during a risk-off episode in post-Volcker history. The 30Y SOFR swap spread is collapsing, the 30Y real yield (TIPS) is spiking to 2008 levels, and SOFR-IORB dislocations are edging toward funding dysfunction territory. This is not a classic “deflationary crisis,” it’s a liquidity evaporation plus collateral rejection episode a convexity spiral seeded in structurally unstable funding markets. The VIX is flashing alarm, yes but the bigger tells are in credit and rate vol: CDX High Yield spreads are blowing out, MOVE Index is surging, and repo/hedge basis trades are unwinding in real time. This is not just a sentiment washout it’s the start of a structural transition where Treasury bonds themselves are being repriced as risk assets, not safe assets. That’s a paradigm shift. If this persists through the weekend without a coordinated Fed-Treasury-JPMorgan liquidity backstop, Monday could be less a “limit down” event and more a failed auction or systemic “basis trade” unwind. The real crash isn’t equities. It’s the re-rating of the Treasury complex itself.

The volatility on 20+ year Treasuries (CBOE’s “VXTLT” index) is “unstoppable”, a clear sign of market distress. Bond vol is now outpacing equity vol: VXTLT has jumped far more (in % terms) than the VIX. In fact, bond vol is “leaving the VIX behind”.

The VIX itself climbed to around 40, a level rarely seen outside major crises (indicating equities are under severe stress). But VXTLT’s sharp rise reflects deep anxiety in rates markets, tied to forced unwinding of positions. Because Treasuries are critical to pricing all financial assets, such volatility is exacerbating instability across the board. Over the next 3-6 months, elevated volatility in bonds may persist until the basis unwinds complete and confidence is restored. Investors are likely to demand a higher risk premium, keeping volatility elevated. This is confirmed by Deutsche Bank that said yesterday: “If recent disruption in the US Treasury market continues we see no other option for the Fed but to step in with emergency purchases of US Treasuries to stabilize the bond market".

Another critical macro signals from the bond market that is flashing red. The current structure of the Treasury yield curve where the 2-Year sits at 3.86%, the 10-Year at 4.40%, and the 30-Year at 4.90% is flashing. The curve remains partially inverted (2s10s), suggesting ongoing recessionary fears, while the steepening between the 10s and 30s points to long-term inflation and fiscal concerns. Alone, each yield might seem like a typical market move, but together they reveal a stressed regime where short-term expectations are cooling while the long end reflects structural distrust in fiscal sustainability or inflation containment. The persistently elevated long bond yield, despite falling 2-Year yields, signals market skepticism that rate cuts or disinflation will fix the deeper structural imbalances.

Equities and Credit Under Pressure: This environment is classic “risk-off.” Stock indices have slumped amid the turmoil (S&P 500 futures fell) and corporate credit spreads are widening as investors flee to safety. Cross-referencing with credit markets adds another layer of complexity. The sharp +2.68% rebound in HYG (high-yield debt) could be mistaken for risk appetite returning. But when viewed alongside the -0.99% slide in the 3-7 Year Treasuries, it’s clear the market is not embracing risk, but rather shifting exposures selling duration while reaching for yield. This kind of divergence often precedes volatility, not relief. It implies forced reallocations rather than conviction. Without cross-correlating, one might assume risk-on sentiment is returning, when in fact it could be a mechanical bounce in an increasingly fragile credit environment.

In the near term, if bond liquidation continues, hedge funds may deleverage other assets (stocks, corporate bonds, etc.) to meet margin calls, which could spark a broader sell-off. The risk of contagion is real: what began in a “boring” rates trade is now roiling equities and threatening credit markets. Without intervention, this feedback loop (higher vol → less liquidity → more forced selling) could intensify over the next few months, potentially tipping markets into a deeper correction.

Flight to Quality - Gold Soars: Investors have flocked to safe-haven assets. Gold prices are surging, effectively acting as the “everything hedge”. After a technical bounce off its 50-day moving average, gold broke out to new highs. It reached a new all-time high close amid the recent panic.

In the short term, gold is benefitting from multiple tailwinds: safe-haven demand, lower real yields (as inflation expectations firm but nominal yields are constrained by intervention prospects), and a weaker dollar. Hedge funds that had trimmed gold positions are now being forced to chase the rally to hedge their other losses. This momentum could carry gold even higher in coming months, especially if monetary policy pivots dovish (which reduces the opportunity cost of holding gold). However, if volatility eventually subsides, gold’s ascent might pause but near-term, it remains a preferred hedge against systemic risk.

U.S. Dollar Plummets: In a startling reversal, the U.S. dollar index (DXY) has collapsed to its weakest level since mid-2023. The dollar broke below the key 100 level as sell-stop orders were triggered.

Meanwhile, other major currencies like the euro and yen are soaring (ironic, as their economies are not necessarily improving), but their exchange rates surge due to the dollar’s decline.

In the next few months, the dollar may remain under pressure if U.S. yields retreat (due to Fed easing) or if global risk appetite stays low (prompting diversification away from U.S. assets).

A weaker dollar eases global financial conditions slightly, but it creates other problems: it tightens conditions for Europe and Japan (their stronger currencies hurt exporters) at a time when they face recession risks. This could prompt foreign central banks to respond (potentially cutting rates or intervening to stabilize their currencies). In sum, currency volatility is an added dimension of this turmoil, and abrupt dollar weakness can transmit stress internationally by squeezing exporter profits and reducing global dollar liquidity.

Short-Term Macroeconomic Implications (3–6 Months)

Financial Conditions & Credit: In the immediate term, these market moves amount to a rapid tightening of financial conditions. Higher Treasury yields and wider credit spreads mean more expensive financing for businesses and households. If sustained, this could cool investment and consumer spending. Banks may grow more cautious in lending as bond portfolio losses mount and liquidity strains emerge. There are also signs of incipient deflationary pressure in asset markets: what one analyst called a developing “deflationary maelstrom” visible to everyone except, so far, the Fed. Should the turmoil continue, the risk of a credit crunch rises: lenders pull back, and only the safest borrowers can access funds (at high rates). Over 3-6 months, this shock could slow U.S. GDP growth and potentially push the economy towards a mild recession if not buffered. Paradoxically, the very tariff-induced inflation fears that started this rout may be replaced by concerns of disinflation as demand weakens and commodity prices (aside from gold) fall amid a rush for liquidity.

Hedge Fund and Bank Stress: The failure of the basis trade is inflicting multi-billion-dollar losses on major hedge funds. Names like Millennium, Citadel, Point72, etc., were reportedly exposed. Their regulatory leverage was extremely high (20x to 50x, meaning even a 2%-3% adverse move could wipe out equity. Indeed, with swap spreads moving ~50+ basis points against them, some funds face existential threats. In the coming weeks, we may see fund liquidations or forced asset sales across markets as they raise cash. This delivering can amplify volatility and undermine unrelated asset classes (equities, emerging markets, etc.). Moreover, banks and dealers that financed these trades (through repo or prime brokerage) could be left with losses or hard-to-sell collateral. Signs of funding market strain are appearing; e.g. repo rates have been volatile, and dealer balance sheets are stretched, making it harder to arbitrage price dislocations. If a major hedge fund were to fail, there’s a contagion risk akin to LTCM 1998: counterparties and lenders could suffer, and fire-sales of assets would hit market prices broadly. Thus, a key short-term risk is a cascade of failures that freezes credit markets. This is why analysts are calling for a Fed/Treasury intervention to “short-circuit” the meltdown before it spirals.

Global Spillovers: The turmoil is not contained to the U.S. The dollar’s drop is tightening financial conditions in Europe and Japan, as noted. Their central banks may need to respond if their currencies overshoot, potentially through rate cuts or fresh liquidity injections. In fact, there were talks of the ECB and BOJ having an emergency call to coordinate policy as their exporters get squeezed. Additionally, U.S. Treasury market dysfunction can affect global markets since Treasuries are the world’s benchmark risk-free asset. If U.S. yields remain wildly volatile, global investors may retrench, causing higher volatility in emerging market bonds and currencies (many EM local yields have likely spiked in sympathy). Over 3-6 months, if the situation stabilizes, the dollar’s weakness could benefit some emerging markets (easier dollar liquidity), but if instead the crisis deepens, we might see a dash for cash globally, hitting EM assets hard. Furthermore, trade tensions (like U.S. tariffs on imports) remain a wild card, while the U.S. administration temporarily paused some tariffs to calm markets, any re-escalation would hurt business confidence. A Deutsche Bank analyst noted that even if tariffs are suspended, the recent episode has done lasting damage to confidence, underscoring the unpredictability of U.S. policy and spurring other nations to seek greater strategic independence from U.S. supply chains. This could modestly dampen global trade over the medium term.

Outlook - Cautious until Backstop Arrives: In summary, the short-term macro outlook is highly uncertain and skewed to the downside unless decisive policy action is taken. Markets are in a “spectacular meltdown” and effectively forcing the Fed’s hand. If authorities step in with a liquidity backstop, we could see yields pull back, the dollar stabilize, and volatility ease within a few weeks, setting the stage for a recovery in risk assets later in the 3-6 month horizon. However, absent intervention, the negative feedback loops (forced selling → illiquidity → more selling) could intensify, with rising odds of a financial accident. Each day that major markets remain dysfunctional raises the probability of market-wide dislocations, which would impair growth and possibly necessitate an even larger eventual rescue. Thus, all eyes are on policymakers’ next moves.

Policy Recommendations

Given the gravity of the situation, immediate policy responses are needed to restore market functioning and confidence:

Federal Reserve - Monetary Tools: The Fed should act without waiting for the next scheduled meeting. Key options:

Emergency Rate Cuts: A prompt cut in the Fed Funds rate (50-100 bps) would signal recognition of deflationary risks and help ease pressure on the yield curve. The Fed had been stubbornly waiting until June despite clear signs of stress, but conditions warrant an earlier move. Cutting rates would lower short-term borrowing costs and could weaken the dollar further (which the administration actually desires to boost exports). However, rate cuts alone may not fix liquidity problems in the Treasury market.

Targeted QE “Hedge Fund Bailout” Facility: To directly address the basis trade unwind, the Fed may need to buy Treasuries and simultaneously short Treasury futures or enter pay-fixed swaps, essentially taking the other side of the basis trade. This was hinted at by former Fed officials (e.g. Jeremy Stein’s suggestion of a facility to relieve dealer balance sheets by absorbing unwinding trades). In practice, the Fed could announce a special QE program focused on off-the-run Treasuries (which are being dumped) to stabilize their prices. By hedging those purchases with futures or swaps, the Fed would essentially warehouse the basis trade until normalcy returns. This kind of facility, while extraordinary, might be the only way to prevent “the biggest hedge fund conflagration in history”. Indeed, strategists like Deutsche Bank’s George Saravelos argue that only launching QE can short-circuit the crisis. The Fed should prepare a sizable backstop (analysts estimate on the order of $1.5-2 trillion may be needed to cover the market’s DV01 exposure). An announcement of such a facility would immediately calm markets and reverse the upward yield spiral.

Standing Repo Facility (SRF) Enhancements: The Fed already has an SRF to provide overnight cash against Treasuries, but usage has been minimal. They should consider lowering the SRF rate and extending its term (e.g. offering 1-week or 1-month repos in large size). Making the SRF more attractive would encourage dealers to take Treasuries onto their balance sheets (funding them via Fed repo) rather than let prices free-fall. Essentially, the Fed would act as “buyer of last resort” via repos. Additionally, the Fed could widen collateral eligibility if needed to include agency MBS or other high-quality bonds, to free up dealer capacity to absorb Treasuries. These actions would improve funding liquidity and help cap Treasury yields in the short run.

Swap Lines and Global Coordination: The Fed should also stand ready to activate international USD swap lines to assist foreign central banks. As the dollar drops, paradoxically overseas funding stress can rise (if foreign banks can’t get dollars to meet obligations). Ensuring ample dollar liquidity globally (via swap lines with ECB, BOJ, etc.) would preempt a global dollar crunch. A coordinated statement by major central banks that they are monitoring markets and ready to provide liquidity would boost confidence.

In deploying these tools, the Fed must balance moral hazard concerns, bailing out hedge funds is politically fraught. However, allowing an uncontrolled collapse would likely be far worse for the economy. The Fed can justify action by framing it as protecting the Treasury market rather than rescuing speculators. Indeed, the chain reaction from hedge funds to broader markets means Main Street’s interests (stable markets, lower borrowing costs) are also at stake.

U.S. Government - Fiscal & Regulatory Measures: The Treasury Department and other regulators should complement Fed actions with steps to shore up market confidence and liquidity:

Temporary SLR Relief for Banks: Regulators could temporarily relax the Supplementary Leverage Ratio (SLR) for commercial banks, excluding Treasuries and reserves from the leverage calculation (as done in 2020). This would encourage banks to step in and buy Treasuries (and fund them with Fed loans or deposits) without penalty. By freeing up bank balance sheets, more private demand can absorb the selling. This measure directly adds balance sheet capacity where it’s needed and could help narrow swap spreads by bringing in bank arbitrageurs. It’s a regulatory tweak that can be implemented quickly and later reversed.

Debt Management Adjustments: The U.S. Treasury could adjust its debt issuance strategy to support market function. For instance, Treasury buybacks of older illiquid issues (funded by issuing more bills or a financing schedule tweak) would provide support to off-the-run bonds that are under stress. Treasury officials had already been considering buybacks for liquidity reasons; accelerating this plan could retire some securities that are being dumped and improve overall market liquidity. Additionally, Treasury can temporarily tilt issuance to shorter maturities (bills and 2yr notes) to reduce duration flooding the market: this takes pressure off the long end yields temporarily.

Pause/Reduce Tariffs and Uncertainty: From the fiscal policy side, the administration should definitively pause the proposed tariff increases that helped spark the stagflation fears. In fact, a 90-day suspension of new tariffs was already hinted; making that official (or extending it) would remove one catalyst of the bond selloff. Clear communication that trade tensions will not be escalated further in the near term can alleviate some inflation fear in the bond market. In short, remove the stagflation genie that was “unleashed so that inflation expectations can stabilize. This policy move costs nothing fiscally but can help anchor the long-end yields.

Support Money Market and Credit Channels: The government could coordinate with the Fed to ensure money market funds and other short-term funding markets remain stable. For example, if pressure emerges in commercial paper or municipal markets, the Treasury’s Exchange Stabilization Fund (ESF) could be used in tandem with a Fed facility to guarantee money market mutual funds (as was done in 2008). While we haven’t seen stress there yet, being proactive enhances confidence that no part of the financial system will be left unsupported.

Public Communication and Confidence Measures: High-level officials (Treasury Secretary, President’s economic team) should make public statements to reassure markets. For instance, indicating that they are watching the situation closely and are prepared to use “all available tools” to maintain orderly markets can bolster sentiment. Even if the Fed leads the technical response, political support for the Fed’s actions is crucial. The government might also convene a President’s Working Group on Financial Markets (Plunge Protection Team) meeting to signal seriousness. Such symbolic actions, alongside concrete steps, can help break the psychology of panic.

Contingency Plans for Extreme Scenarios: As a backstop-of-last-resort, authorities should dust off plans for more aggressive intervention if needed; for example, a temporary halt to Treasury futures trading in a meltdown scenario, or use of Treasury’s powers to guarantee certain obligations. While likely not needed, knowing these options exist can by itself calm markets (the way FDIC’s readiness to guarantee bank deposits beyond $250k reassured depositors recently).

In conclusion, swift and decisive policy action is required to contain the basis trade crisis and its macroeconomic fallout. The Federal Reserve’s liquidity backstop (via rate cuts and targeted QE) is the centerpiece of the response, while the Treasury and regulators can reinforce it through regulatory relief and clear communication. The next 3-6 months will remain volatile, but with the recommended policies in place, the worst-case outcomes (cascade of fund failures, credit freeze, deep recession) can be averted. Instead, markets can gradually normalize, allowing the economy to navigate this episode with only a minor growth hit. Policymakers appear to recognize that failing to act would mean risking a “multi-trillion liquidation panic”; a risk that, in current circumstances, far outweighs moral hazard concerns. By acting now, the Fed and government can stabilize the system and restore the “safe” in safe-haven assets, putting the economy back on a steadier footing.

Source: Ashenden Finance & various external sources

This is a really good overview of what's going on in the U.S. bond market, including other fiscal influences! Thanks!