Persisting inflation and AI hype shape investor sentiment

May focused on tech gains, commodities surge, inflation worries and central banks moves

May 2024 has been another robust month for markets, with the narrative largely unchanged, save for a recalibration of interest rate expectations and a notable rally in commodities and precious metals. In US, the S&P 500 has delivered +4.80%, the Nasdaq 100 a solid +6.28% and the Euro Stoxx 50 was up a more modest +1.27%.

Unsurprisingly, investors have been navigating through a mix of signals, buoyed by optimism around corporate performances, especially within the tech sector, as Nvidia’s impressive results have demonstrated. Nonetheless, the perennial concerns over inflation and interest rates have persisted. The Federal Reserve’s minutes revealed an inclination to intensify policy tightening should inflation risks continue, tempering expectations for imminent rate reductions. This prudent stance led to a downturn in the stock market, culminating in the Dow Jones Industrial Average’s most significant single-day decline since March 2023, with a drop exceeding 600 points.

Globally, economic indicators from key regions, including the U.S., China, the eurozone, and the U.K., have depicted a varied economic landscape. The U.K. experienced a marked reduction in its annual inflation rate, potentially aligning it more closely with the Bank of England’s target. Concurrently, the Reserve Bank of New Zealand opted to maintain steady rates in the face of enduring inflation and a decelerating economy. In the eurozone, the ECB has signalled a probable decrease in interest rates at its upcoming June meeting, with certain members already calling for immediate cuts. However, the ECB has also voiced concerns regarding the possibility of financial conditions remaining excessively lax, which could stoke inflationary pressures.

Key insights into policy outlook: a more hawkish Fed with less conviction

Investors have been closely monitoring the Federal Reserve’s policy direction, particularly following the release of the minutes from its May meeting on May 22. Despite April’s consumer price increases falling short of expectations, the Fed, led by Chair Jerome Powell, has adopted a cautious stance on potential rate cuts. Officials are awaiting more favourable inflation data before considering any reduction in rates, signalling a “higher-for-longer” policy approach. This sentiment is resonating with other central banks, adding to market uncertainty and influencing investor sentiment.

The market’s reaction to this policy stance was evident in the yield on 2-yr Treasury notes, which are indicative of market expectations for Federal Reserve policy. The yield experienced an uptick, climbing from 4.84% at the beginning of the week to 4.95% by week’s end.

Inflation has proven to be more persistent than anticipated, prompting the Fed to maintain its current rate levels. Recent remarks from Fed members have not hinted at any immediate plans to increase rates. However, concerns have been heightened by comments from Atlanta Fed President Raphael Bostic, who anticipates a gradual decline in inflation, and Boston Fed President Susan Collins, who suggests that more stringent measures may be necessary. The public expression of these divergent views by Fed officials has led to confusion and increased market volatility, reflecting ongoing disagreements over the interpretation of recent inflation data.

The economy’s robust growth, coupled with inflation rates surpassing the Federal Reserve’s 2% goal, is likely to exert upward pressure on bond yields and create headwinds for the economy. This comes at a time when other financial indicators suggest a strong economic performance.

Lack of sufficient progress in inflation and a resilient economy will not allow for a fast rate cut cycle, unless something within the system “breaks” – in the banking sector or in Commercial Real Estate, for example. The nuances of Chair Powell’s commentary during press conferences further complicated the monetary policy outlook.

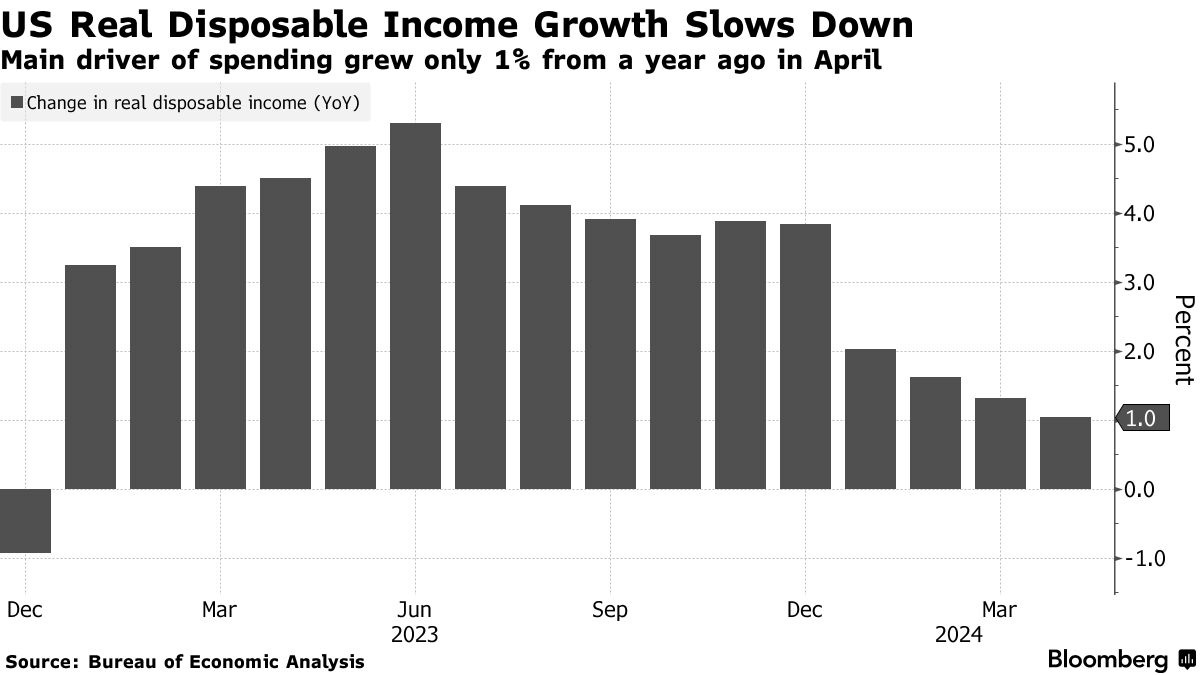

However, the main drivers behind the remarkably resilient American consumer are losing steam at the same time, suggesting a recent pullback in household demand may be more than just a one-off. Real disposable incomes have risen only modestly over the past year. The saving rate now stands at a 16-month low as households have mostly exhausted the extra pile of cash they squirreled away during the pandemic. In turn, many Americans are increasingly relying on credit cards and other sources of financing to support their spending.

In conclusion, the Federal Reserve faces the arduous task of achieving a soft economic landing amidst conflicting signals – an unexpected rise in inflation and a slower-than-anticipated economic growth rate. We anticipate that reaching the final stages of inflation control will be a protracted process, necessitating patience from all market participants.

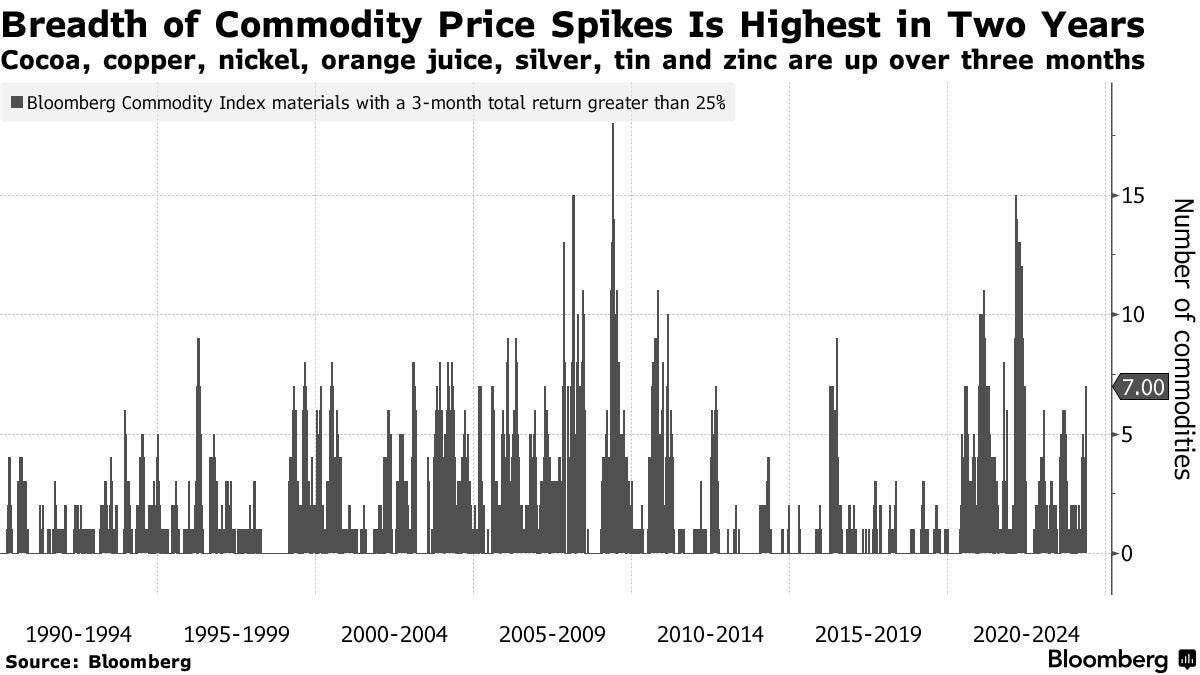

Commodities record surge in May: the new canary in the coal mine for inflation

The commodities market witnessed a remarkable surge in May, in particular precious metals, signalling potential inflationary pressures. This trend could mark the end of the global disinflationary period, as commodity prices are closely tied to inflation risks. According to Ned Davis Research, the impact of commodity price fluctuations varies significantly across economies, with the U.S. and Europe being most susceptible.

The Bloomberg Commodity Index is nearing a breakout from its 12-month range, having already increased by 13% year-to-date. Similarly, the CRB Industrials Index, which tracks non-exchange traded commodities, has begun to climb. Historically, the CRB Industrials Index has preceded the global median Consumer Price Index (CPI) – the median CPI of nearly 50 countries – by approximately six months.

In May, gold prices soared to an all-time high of $2,425 per troy ounce on May 20, representing a significant jump from earlier in the year. Silver also experienced a notable uptrend, closing at an historical record high at $32.51 per ounce on the same day, marking a 24% rise since the end of April. This increase was propelled by escalating geopolitical tensions and inflationary concerns, which boosted demand.

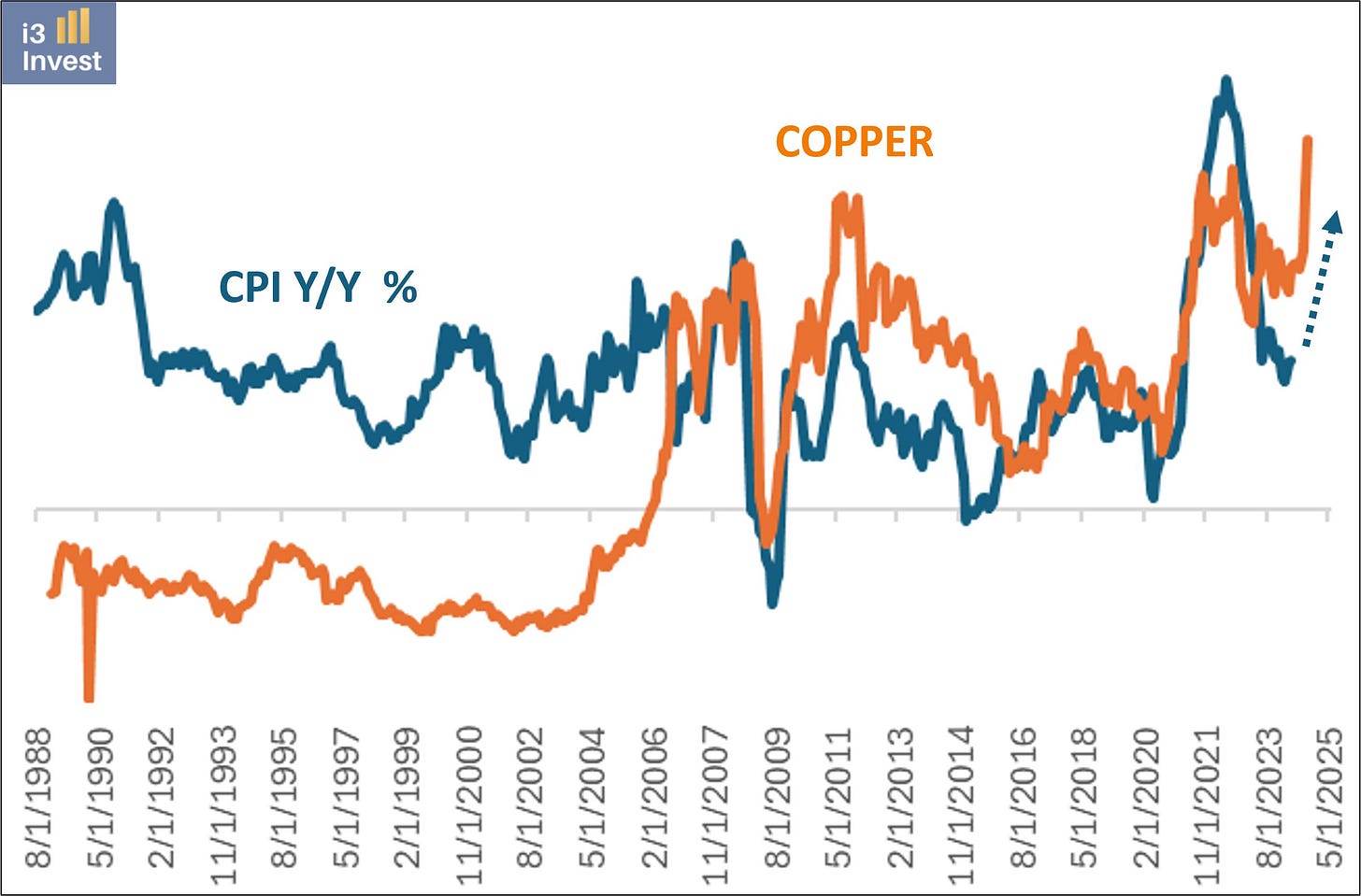

Copper, a critical element for the green transition and the electric vehicle (EV) market, has seen a spike in prices as well. This is noteworthy because copper prices have historically been a strong predictor of inflation, often leading it by 5-6 months.

The current surge in commodities, precious metals and copper prices serves as a warning – akin to the proverbial canary in the coal mine – of looming inflationary pressures. The question remains: will this instance prove to be an exception to the rule?

Credit overview: let’s continue to play momentum, till it lasts

Investors are treading carefully, weighing corporate growth prospects against the backdrop of economic challenges and central bank policies. Looking forward, the dynamics between corporate earnings, economic data, and central bank communications will be pivotal in shaping market dynamics and investor sentiment.

We are currently observing interest rate levels that compel us to contemplate a gradual increase in duration exposure. The recent uptick in rates suggests a shift towards a longer duration exposure, especially considering the moderating inflation trends and subdued consumption patterns. These indicators collectively hint at a potential economic slowdown in the near future.

While we remain concerned about the possibility of a reversal in the recent inflation downtrend due to rising commodity prices, this risk remains relatively contained for now. Our preferred duration sweet spot is gravitating toward the 5-year maturity range, where we recommend maintaining exposure. This zone offers the optimal balance for credit spreads and interest rates on both EUR and USD bonds.

Despite the persistently narrow credit spreads and robust investor appetite, market dynamics continue to be a driving force, resulting in a significant increase in supply. The European credit market, in particular, has seen heightened activity. A notable trend is the influx of U.S. firms capitalizing on the widening yield disparities. This comes as the ECB prepares for imminent monetary easing, possibly as early as next month, while the Fed is anticipated to maintain steady interest rates.

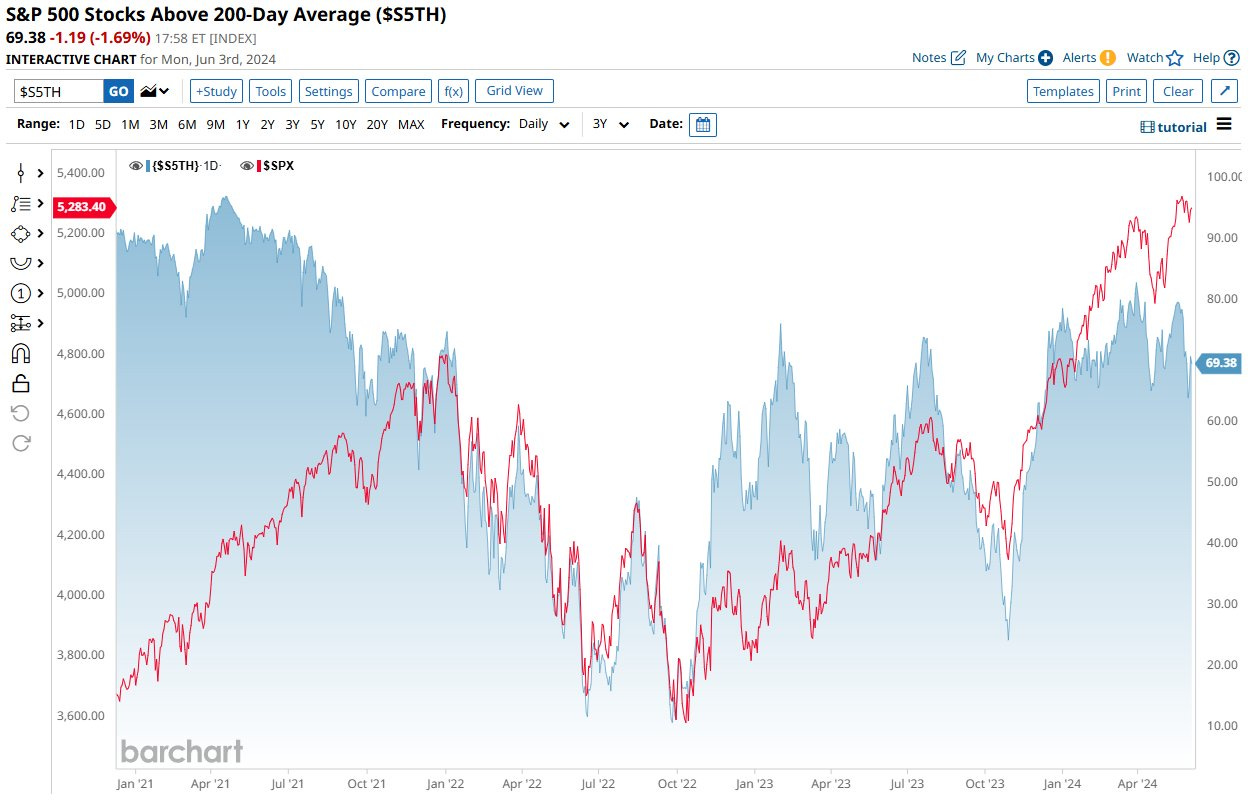

In the equity domain, we are observing signs of momentum deceleration. Valuations, especially within the Technology sector, appear overstretched. The Artificial Intelligence (AI) theme remains a solitary robust performer. While it may be premature to divest, awareness of this evolving market landscape is essential.

Additionally, there is increasing concern around complacency and diminished trading volumes in the equity market. For instance, in May, the SPDR S&P 500 ETF Trust (SPY), the largest ETF tracking the S&P 500, experienced its second-lowest trading volume day within a year – surpassed only by the shortened trading session during Thanksgiving. This was also one of the lowest full-day volumes in recent years. This trend coincides with a decline in the Volatility Index (VIX) to 12.

While these tepid volumes may currently support market advances, they instil limited confidence, raising questions about the rally's sustainability. However, US equities will likely benefit from continued buyback activity.

At present, playing against the trend is unproductive. We await further evidence to ascertain whether the bull market has exhausted its strength. Consequently, credit spreads are likely to remain tight, compelling investors to continue chasing this market.

Geopolitical risks continue to be a focal point, with trade tensions, commodity market fluctuations, and uncertainties in the Middle East and Russia dominating investor concerns. The market appears to underestimate the implications of the ongoing trade disputes and volatility in commodity prices.

In conclusion, given the factors above, we would warn to exercise restraint and avoid succumbing to overenthusiasm. Inflation remains an unpredictable element that could disrupt monetary policy trajectories. Our preference still leans towards Investment Grade bonds, where the fundamentals are robust, and default risks are considerably lower, offering attractive yield (and carry) prospects in the current market environment. At the same time, LatAm and High Yield continue to offer specific opportunities where we see value.

Source: Ashenden Fixed Income Monthly Report

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Feel free to ask us more information: write to us at research@ashendenfinance.ch