The speech from Powell triggered a tech-led stock market rally on Wednesday

Chair Powell confirmed the Fed will be downshifting to smaller rate hikes at upcoming FOMC meetings

Beige Book commentary pointed to some progress on both labour demand and inflation, outlining a low-growth US economy

It seems market participants overreacted to the speech, as the narrative didn’t change much.

The Dow Jones Industrial Average popped 2.2%. The S&P 500 index leapt 3.1%. The Nasdaq composite jumped 4.4%. The small-cap Russell 2000 rose 2.7% and the S&P 500 was able to break above a key technical level, its 200-day moving average at 4,050. US Dollar Index fell, and buying picked up in the Treasury market. The U.S. Dollar Index was down 0.7% to 106.04. The 2-yr note yield fell nine basis points to 4.38% and the 10-yr note yield fell five basis points to 3.70%.

Optimism ahead

In front of Mr. Powell's remarks, the main indices were meandering around their flat lines until comments from Amazon.com CEO Andrew Jassy precipitated a modest decline. He said at the DealBook Summit that "people are very much hunting for bargains" and noting that the economy is "a lot more uncertain" than previously thought. This played into the market's concerns that the Fed is going to raise rates too much and create a hard landing for the economy.

The tone of the market changed completely, however, with the release of Mr. Powell's speech. The market predominately reacted to the following key excerpt:

"Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down. The time for moderating the pace of rate increases may come as soon as the December meeting."

The market rally that started mid-October was partially predicated on the notion that the Fed was apt to slow down the pace of rate hikes starting in December, which Mr. Powell's remarks corroborated. Fed Funds Futures odds for upcoming FOMC rate decisions shifted towards the dovish end of their recent spectrum of probabilities. The fed funds futures market now prices in a 81.8% probability of a 50-basis point increase at the December meeting versus a 66.3% probability before the speech, according to the CME FedWatchTool.

The focus was all on the dovish elements, but also on recession risk. The “very plausible” soft landing scenario is the key takeaway of the speech. Powell talked of a “balance of risk” to the economy from inflation and slower growth. Thus: not strong recession, but an economy slowdown. But the sectors that rallied the most are the growth stocks, exposed to the rate risk. And obviously investors are trying to exploit a rally to boost their performances, rather than building a long-term portfolio.

As much as Chair Powell is trying to contain investors’ animal spirits by talking about persistently high interest rates, markets are rejecting that message. But pay attention to the VIX. Instead, they are looking through his rhetoric and think they see the inflection point for monetary policy. That is a reasonably set up for a continued stock market rally, just as it was from June to August. Against that bullish assessment, however, let’s remember that the CBOE VIX Index is now trading below 20. Every time we have seen that level this year, rallies have fizzled and market was at his relative top.

Despite yesterday’s big rally, general growth concerns continue to fester. Market participants had a slate of economic data to digest, some of which piled onto the market's slowdown concerns.

The Chicago PMI reading for November (37.2) was particularly ugly looking, falling further into contractionary territory (i.e. sub-50 reading) than the market was expecting. China also reported weaker-than-expected Manufacturing PMI (48.0) and Non-Manufacturing PMI (46.7) readings that fell further into contraction territory.

Fed Powell favourite spread is the 3M/18M bills and it is showing a massive inversion, meaning recession (based on this spread) is close to certain. Yesterday’s rally mainly a technical move, that we have seen before. Not bullish signal.

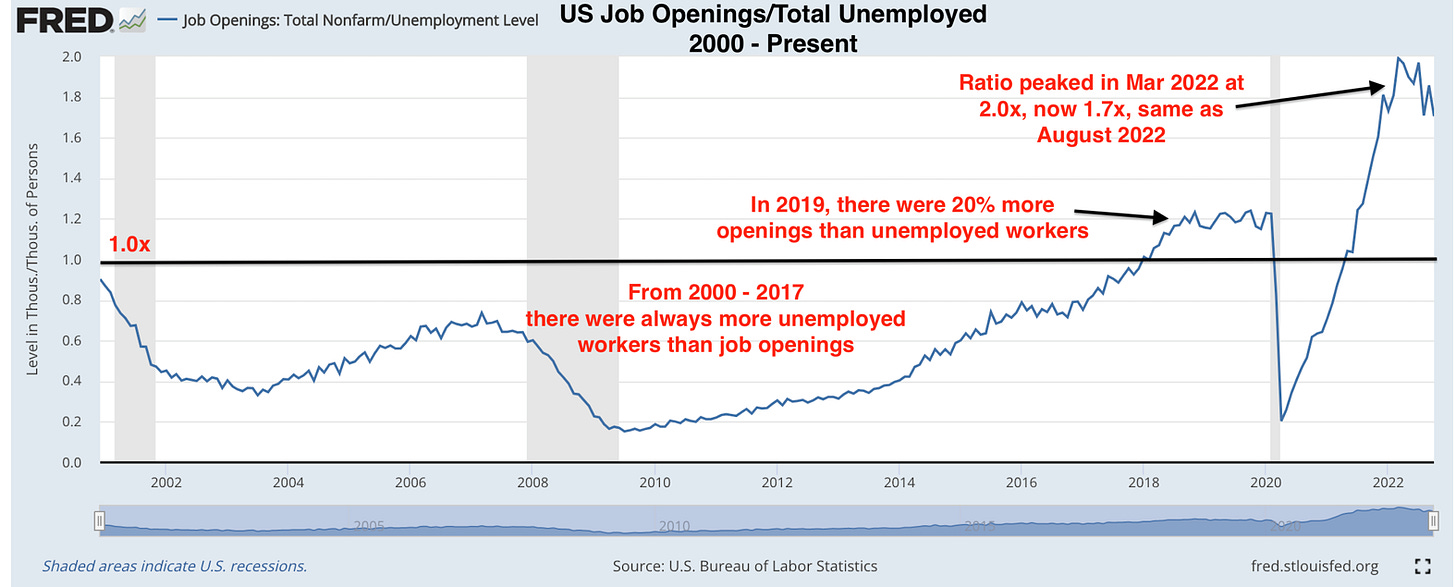

Another theme: Job openings

BLS Job Openings and Labour Turnover Survey (JOLTS) report showed only modest changes in still-hot US labour market conditions. Fed Chair Powell regularly cites this report, especially its data on job openings, as a sign there is still too much demand for labour, contributing to price inflation. NY Fed President Williams also cited excess demand for labour as contributing to service sector inflation in his speech on Monday.

JOLTS openings data is somewhat contentious; many people think it overstates actual labour market demand, but the measured imbalance it shows does triangulate with other economic indicators:

Initial Claims for Unemployment Insurance remain historically low, a sign that demand for labour is still high

Wage inflation, as measured the monthly first Friday Jobs report, is still running +4 percent, higher than March 2019’s peak of 3.5 pct (the zenith of the 2010 – 2019 economic expansion)

Street comments

JPM's Feroli on the Powell speech:

"Chair Powell effectively got the last word in before the December FOMC meeting... He used the opportunity to cement in place expectations for a downshift to a 50bp hike at the meeting, while also reiterating that ‘restoring price stability will require holding policy at a restrictive level for some time.’ The market took Powell’s remarks as dovish, or at least less hawkish than expected; we generally agree. Insofar as he repeated many of the themes from the November FOMC press conference and minutes, it doesn’t seem as though he were pushing back against the easing in financial conditions that has occurred since that meeting... in the bigger picture the Fed leadership is continuing to vow to ‘stay the course until the job is done.’ However, there is little sense that their level of alarm at the inflation situation is rising."

Saxo Bank: Jerome Powell sticks to the script.

“Fed Chair Powell repeated his comments from the November FOMC and what we have heard more generally from the Fed speakers over the course of the month. He said it makes sense to moderate the pace of interest rate hikes and the time to moderate the pace of hikes may come as soon as December, while he added it seems likely that rates must ultimately go somewhat higher than what was thought in the September SEPs. Powell also said they have made substantial progress towards sufficiently restrictive policy but have more ground to cover and they will likely need to hold policy at a restrictive level for some time. While his comments still tilted towards the hawkish side but there was no escalation that the markets had hoped for. His comment that he does not want to over-tighten but cutting rates is not something to do soon was a slight contrast to his earlier acceptance that risk of tightening less is greater that the risk over-tightening. Fed's Cook (voter) also said it is prudent for the Fed to hike in smaller steps as it moves forward and how far the Fed goes with hikes depends on how the economy responds, overall sticking to the consensus”.

JPMorgan’s Marko Kolanovic:

“Previous lows in equity markets are likely to be re-tested as there may be a significant decline in corporate earnings… we are inclined to think that this market decline could happen between now and the end of the first quarter of 2023”.

"We believe that previous lows in equity markets are likely to be re-tested as there may be a significant decline in corporate earnings, at a time of higher interest rates (implying lower P/Es and lower prices relative to the 2022 lows)"

Goldman Sachs’ Kostin:

"Despite the recent, albeit uneven, rebound in equities, we don’t think the bear market is over, as the conditions typically consistent with an equity trough have not been met. Indeed, we would expect lower valuations, a slowdown in the momentum of growth deceleration, and a peak in interest rates before a sustained recovery begins".

BofA’s Hartnett:

“2023: long Bonds H1, long Stocks H2… we stay bearish risk assets in H1, set to turn bullish H2 as narrative shifts from the inflation and rates "shocks" of '22 to recession and credit "shocks" in H1'23, then bullish "peak" inflation, Fed, US$ in H2'23”.

Ed Yardeni says bond yields are pointing to a bottom for stocks and no ‘hard landing’. With the Fed aggressively boosting rates to tame inflation, short-dated yields have eclipsed those on longer maturities since around mid-year, a phenomenon with a long history of flagging a looming recession. The gap is now as extreme. Bloomberg

November is shaping up to be another month of net redemptions out of US mutual funds and ETFs.

Investment Company Institute data:

Through the week ending November 22nd (latest data available, out 30.11.22), fund investors have sold a net US$ 9.6bn of their mutual fund/ETF holdings this month. Money flows have been negative on a monthly basis since April, and the YTD monthly outflow average is US$ 34.0bn.

Last week saw equity fund redemptions of US$ 11.3bn, with US$ 8.5bn out of US equity products and US$ 2.8bn out of international stock funds. Flows have seesawed this month on a weekly basis, with MTD redemptions from US/international funds totalling US$ 1.0bn / US$ 4.6bn.

Bond funds, however, are starting to see some buying interest after a long drought this year we have dubbed the “fixed income buyers strike”. Money flows into these products totalled US$ 1.8bn last week, pushing the MTD total to + US$ 2.4bn. Money flows out of fixed income funds have averaged US$ 29.7bn/month YTD, so November’s inflows may reflect some renewed buying interest in this asset class.

Commodity funds saw small inflows last week, totalling US$ 0.3bn, but MTD these products are still seeing outflows of US$ 0.6bn. Heavily favoured by fund investors earlier this year, commodity-based investment funds have had outflows every month since April.

This year has seen fund investors only add to their equity positions when the VIX is over 28, essentially buying outsized dips. When the VIX is low (20-24), they have been sellers. That trend has continued this month. This month’s bond fund inflows do, however, mark a change from recent fund investor behaviour. It is too early to call a bullish turn in bond prices in the hopes this cohort will start buying again, but November’s data means we may be nearing an inflection point.

Important also to highlight that on Monday more than US$ 3bn exited the US$ 36bn iShares iBoxx $ Investment Grade Corporate Bond ETF (ticker LQD). That’s the biggest one-day outflow since the fund’s inception in 2002. ~10% of the fund left! Bloomberg

Great article, thank you!