Rates & Equity market tough relationship

Bond yields approaching 5% level are starting to bother Equity markets

Last week was a tough trading week, as it closed with a sharp selloff on Friday, after already choppy days. U.S. government yields spiked and equities fell after a good U.S. job report, with market entering a “good news is bad news regime”.

Fed’s challenge: strong economy combined with rising yields

The world’s biggest bond market and global bellwether is leading a reset higher in borrowing costs, with the prospect of a prolonged period of elevated rates carrying consequences for economies and assets everywhere. Just days into 2025, yields on US government debt are surging as the risks to supposedly super-safe assets mount. This is due to inflation dynamics, a strong economy (as confirmed by the last week employment report) and Trump’s economic expansionary economic policy, causing Federal Reserve rethinking the timing of further interest-rate cuts.

The rate on 10-year notes alone has soared more than a percentage point in four months and now is within sight of the 5% barrier last breached briefly in 2023 and otherwise not seen since before the global financial crisis nearly two decades ago.

Monetary policy is only part of the picture, though. As US debt and deficits pile up, investors are becoming increasingly fixated on fiscal and budgetary decisions and what they may mean for markets and the Fed, especially ahead of this month’s return of Trump and a Republican-run Congress. Bloomberg Economics projects the US debt-to-GDP ratio will reach 132% by 2034 — what many market watchers (e.g. “bond vigilantes”) see as an unsustainable level.

PGIM Fixed Income’s Peters said he “wouldn’t be completely shocked at all” if 10-year yields rose beyond 5% in this environment, part of a growing camp who see yields resetting to a higher range. BlackRock Inc. and T. Rowe Price recently argued that 5% is a reasonable target as they expected investors would demand juicier rates to keep buying longer-dated Treasuries.

Bianco Research: the rise in bond yields isn’t necessarily ominous. It’s how the world used to be before the financial crisis. Jim Bianco points out that 10-year yields averaged about 5% in the decade through 2007. The real outlier, he said, was the post-2008 period, when rates were pinned to zero, inflation was persistently running low and central banks were buying massive amounts of bonds in response to the crisis. That lulled the new generation of investors to accept that a 2% bond yield and zero inflation-adjusted – or real — interest rate were “normal.”

U.S. consumers’ long-term inflation expectations jumped to the highest since 2008 on concerns about potential tariffs from the incoming Trump administration. Americans expect prices will climb at an annual rate of 3.3% over the next five to 10 years, up from the 3% expected last month, according to the University of Michigan’s preliminary January survey released Friday. They also see costs rising 3.3% over the next year, up 0.5 percentage point from December.

But U.S. yields remain in soft-landing mode. U.S. 10-Year yield ascends beyond 5%, it signals markets are pricing in “no landing”. Conversely, a reading below 3.5% may point to a hard landing. According to this model, yields can descend modestly from current levels.

U.S. Treasuries are entering the 6th year of the 3rd Great Bond Bear Market of the last 240 years! The last two lasted 21 years and 35 years, respectively.

This is the biggest move higher in long-end yields after the first Fed cut ever, according to Goldman Sachs. The bond market is telling us that the Fed it made a policy mistake. Don't be too surprised if we see hikes later this year.

The continued pricing out of Fed rate cuts this year only compounds the poor performance of US government bonds compared to riskier assets such as stocks. The Bloomberg Treasury index has started the year in the red and is down 4.7% since just before the Fed’s first cut in September, compared with a 3.8% gain for the S&P 500 and a gain of 1.5% for an index of Treasury bills. Beyond the US, a global index of government bonds has lost 7% since shortly before the Fed cut in September, extending the decline since the end of 2020 to 24%.

Obviously, raising rates are bad news for Equities

If the 10-year Treasury hits 5%, expect a sharp selloff in equities. Historically, rapid yield spikes pressure valuations, and another drop in the S&P 500 would not be surprising.

S&P 500’s valuation edge evaporate as bond yields spike. The earnings yield for the S&P 500 is sitting 1% below what’s offered by 10-year Treasuries, a development last seen in 2002. In other words, the return on owning a significantly less risky asset than the US equities benchmark hasn’t been this good in a long time. Once yields get higher it becomes harder and harder to rationalize valuation levels,” said Mike Reynolds, vice president of investment strategy at Glenmede Trust. “And if earnings growth starts to falter, there can be issues.

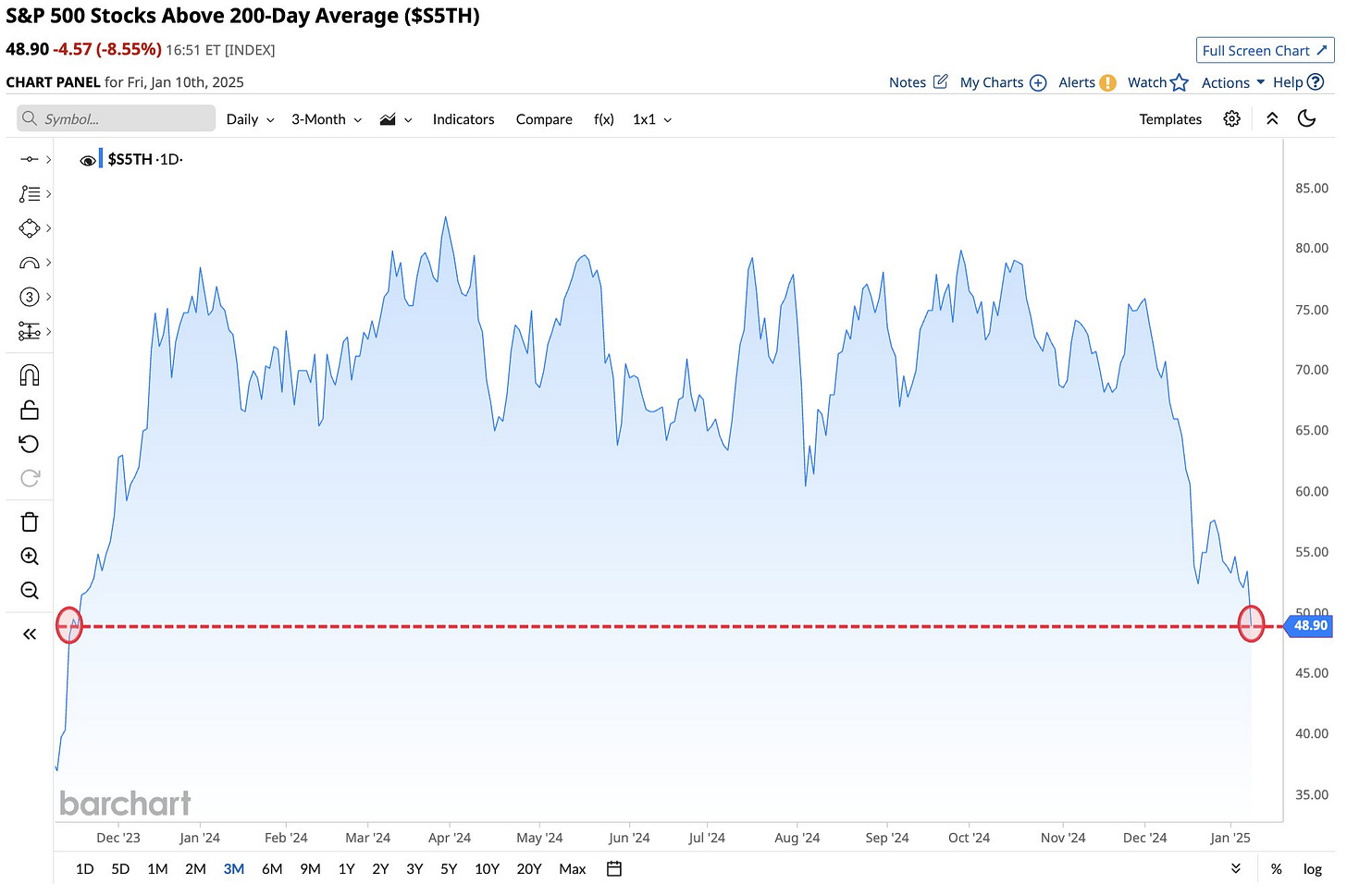

The S&P 500 fell -1.9% last week, closing at its lowest since the election. It's fallen in four of the past five weeks, pulling back a total of -4.3% on a closing basis. While the index remains comfortably above its 200-day moving average, more than half of its components are below their 200-DMAs for the first time since November 2023.

Taking a more detailed look at the damage beneath the surface of the index. Breadth continues to deteriorate beneath the surface of the S&P 500. Only 11% of S&P 500 stocks are in an uptrend, while 46% are in downtrends.

Yardeni Research said

“On balance, we expect that the next few weeks could be choppy for the stock market before the S&P 500 and Nasdaq resume climbing to new record highs during the spring.”

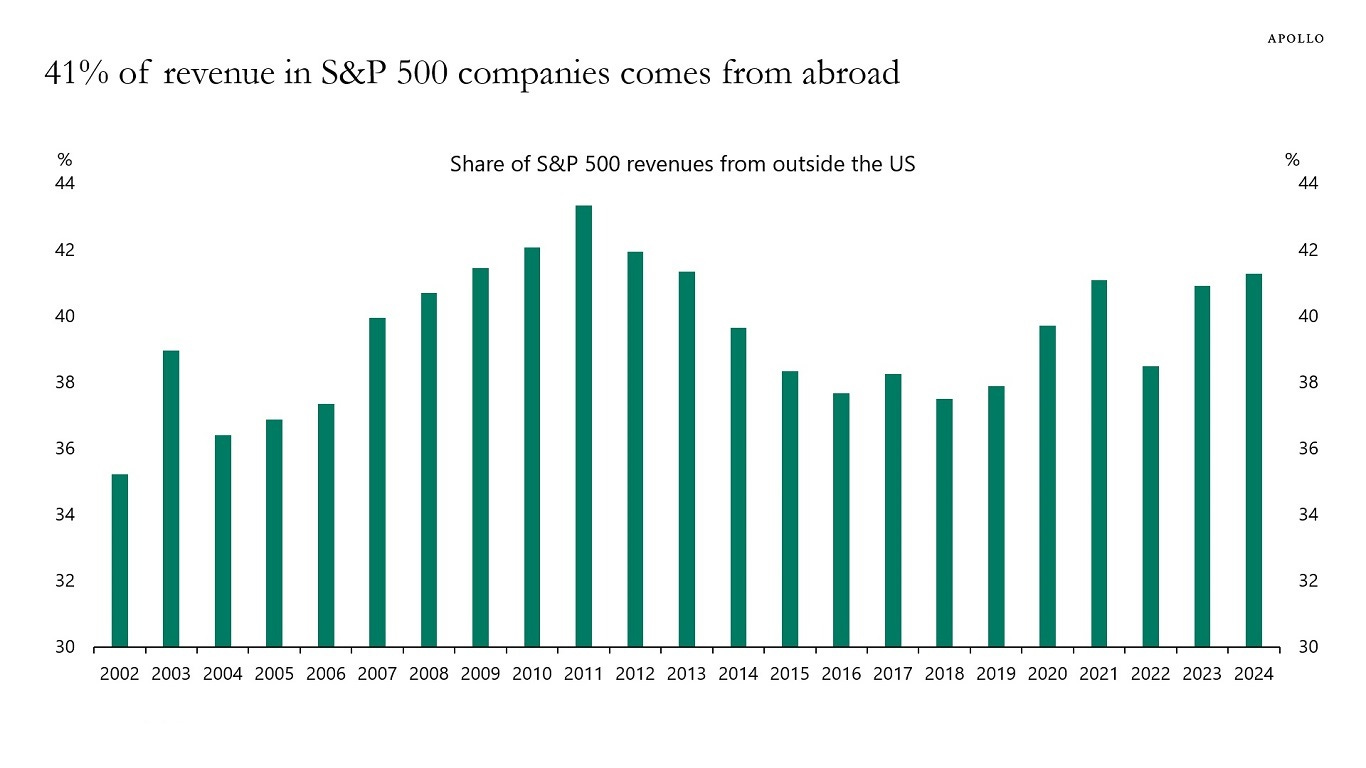

Apollo: The problem with the current S&P 500 narrative. The narrative in markets is that the outlook for the US is great, and the outlook for Europe, UK, and China is not good. For markets, the problem with this narrative is that 41% of revenues in the S&P 500 come from abroad. If we have a recession in Europe and a continued slowdown in China, it will have a significant negative impact on earnings for S&P 500 companies.

Goldman Sachs: "a more complicated equity backdrop in the near-term"

Our baseline US forecast remains supportive for US equities and credit. But the mix of high growth expectations and a more hawkish Fed that the market has priced complicates the risk backdrop locally.

As the pendulum has swung back from growth worry to inflation/rate worry, US equities may now need clear relief from hawkish policy to make a sustained move higher.

While we expect the mix of growth and inflation to ultimately support fresh equity highs, stocks may be more fragile until we reverse the perception that the Fed put is now “struck lower”.

But do not lose all the hopes! JPMorgan said:

"...we could be approaching a more interesting level, given the TPM’s 4wk change is -1.0z, due to the continued pullback from mid-Dec highs. If we get a bit more selling, we could see an attractive set-up take shape (i.e., -1.5z), which could indicate a BTD opportunity."

And also Bloomberg said that, systemic buying may resume ahead of Wednesday’s CPI report -- which for now is expected to show rather benign inflation. With 5,800 proving support and VIX failing at 20+, it is likely the algos flash a short on VOL into this week's CPI. This would in turn force the dealer community to BUY equities, creating a vanna driven recovery from current sell-off.

Source: Ashenden, external various