Strong divergence between stock market and fundamentals

Technicals and Fundamentals are diametrically opposed

Ned Davis Research pointed out that Technicals and Fundamentals are diametrically opposed: macro and fundamental data are suggesting that conditions are going to worsen for the economy and corporate profits. Meanwhile, technical indicators are acting like the early stages of a cyclical bull market, while sentiment gauges are suggesting the extreme pessimism of late June has not been relieved.

Technicals are strong: more than 90% of S&P 500 components are above their 50-dma. Historically, it suggests that the bottom is likely in. However, by the time you get here, markets tend to be very overbought.

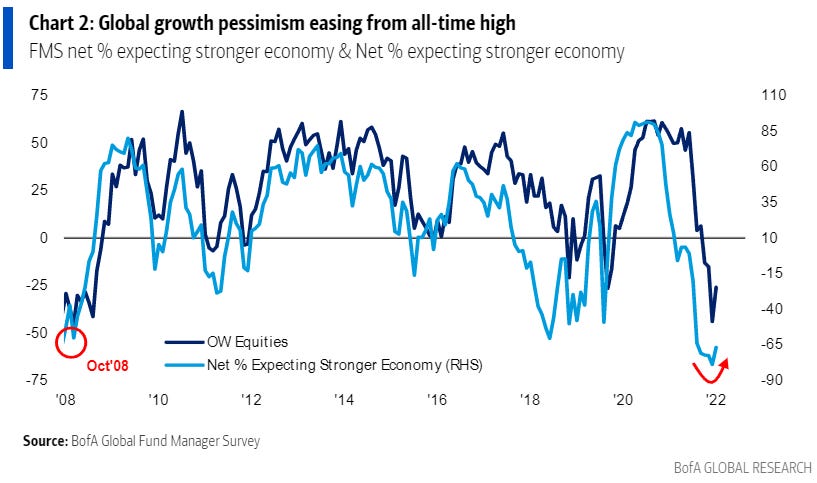

Global growth pessimism is easing: we are seeing bullishness on risk assets. BofA showed that investors are no longer "Apocalyptically" bearish as funds' cash holdings dip to 5.7% from 6.1%; August saw a rotation into US stocks, tech and consumer shares, reduction of defensive stocks.

Fund managers cash levels are at their highest since 2001: "plenty of cash on the sidelines."

Equity-rates divergence pointing to potential stock indexes pullback. The growth stock-driven rally is reliant on rates, and rates are beginning to move higher. Worth watching this closely as bullish animal spirits may have gotten ahead of themselves.

Stronger-than-expected corporate earnings have helped fuel the rebound for U.S. stocks but some investors are pointing to potential risks ahead for profits that could sap the market’s momentum.

Morgan Stanley strategist Mike Wilson thinks the catalyst for the next leg lower will be earnings disappointment as earnings revisions are deeply in negative territory. "What will be the driver of the next leg lower in earnings expectations? We think it's margins."

Seasonals for earnings revisions worsen materially over the next 8 weeks, and revisions have been following the seasonal pattern quite closely YTD. While many focused on the impact of the recent jobs and CPI prints from a Fed policy standpoint, the combination of sustained, higher wage costs and slowing end market/consumer pricing loudly signals margin pressure, which is at odds with optimistic consensus estimates.

Citi suggesting to tactically sell into strength: “The S&P 500 has rallied through our year-end 4200 target… higher index levels, combined with 2023 earnings risk, we think creates a valuation headwind. We would say that tactically selling into further strength is justified”.