Tariffs epicentre of market turbolence

How Trump’s policy pivot sparked chaos in trade flows, markets, and global diplomacy

A never-ending Liberation “day”

US tariffs – latest headlines – confusing messages and potential division inside the White House:

On Friday, US President Trump granted exemptions for key technology products like smartphones, computers, and semiconductors from newly imposed "reciprocal" tariffs. However, these exempted products still fall under the existing "20% Fentanyl Tariffs".

On Sunday, US Commerce Secretary Howard Lutnick indicated these goods might face separate new tariffs within the next two months. The exemptions are transitional while new tariff rates are still being discussed.

On Sunday, President Trump clarified that the temporary exemption for electronics (from steep tariffs like 125% on China, 10% globally) is a procedural step before applying a different, targeted levy. He stated the exempted products are moving to a different "Tariff 'bucket'" and that the electronics supply chain remains under review.

Trump insists this is only a temporary pause before implementing sector-specific tariffs.

China's Commerce Ministry described the exemptions as a "small step" and urged the U.S. to repeal all tariffs and return to dialogue.

In a retaliation response, China has halted the export of rare earth minerals and magnets which are used by industries around the globe that include automakers, aerospace manufacturers and semiconductor makers. China produces ~70% of global rare earths and over 90% of key refined materials which are crucial for EV motors, wind turbines, missile guidance systems, and advanced semiconductors.

It was a week for the history books: Largest 1-day gain since the GFC (before that, the last time it happened was in 1939!). It feels like more and more countries will bend the knee to Trump in terms of tariffs. And the collective bending of the knee of Big Tech at the inauguration now directly pays off as tech will be exempt from China tariffs. Looking at some extreme positioning data, one would conclude that bears also will have to bend the knee soon and that there won't be another low.

Bridgewater Associates founder Ray Dalio stated the ongoing trade war has brought the United States "very close to a recession." Referencing President Trump's recent tariffs, the 90-day pause (excluding China), and subsequent exemptions, Dalio highlighted the combination of tariffs, growing debt, and geopolitical tension as "very, very disruptive." He cautioned that things could become "worse than a recession" if not handled well, comparing the current profound global changes to the 1930s and noting that history repeats itself.

JPMorgan's Bruce Kasman says "There will still be blood" and maintains 60% recession odds as the "overall size of the Liberation Day tariffs that skewed risks to the downside remains in place. Moreover, the potential of sizeable disruptions [from China tariffs] raises a new risk," including risks around retaliation against China trading partners including the EU and Canada. "We have already begun marking forecasts down, as seen in the sharp drop in our global Forecast Revision Index (FRI). This has aligned with a large decline in our global GDP nowcaster revision index (NRI)".

BofA – Hartnett "On Profits: we think any US recession likely short/shallow and priced-in around S&P 500 4800 (US$ 250 EPS + policy response permits P/E 19-20x); but tremendous pushback on this…many believe full 10-15% EPS haircut to US$ 230 coming & US capital outflows mean 17-18x [which would] mean flush toward SPX 4k; labor market ok, claims not rising as US border shut, but negative wealth effect huge (using BofA private client equity holdings data we estimate US household equity wealth has fallen US$ 8tn thus far in 2025, follows US$ 9tn gain in 2024)".

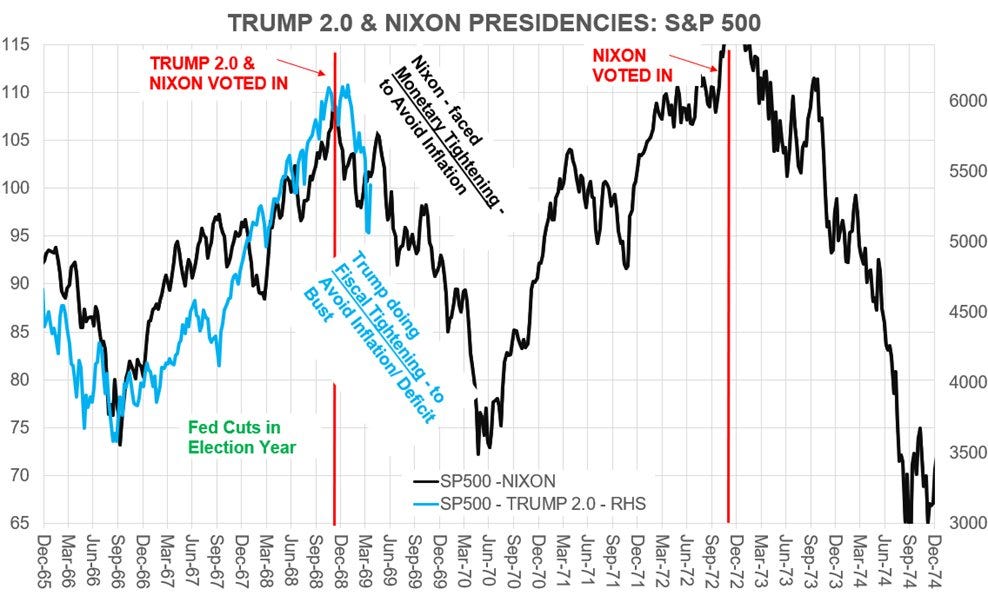

The parallels between Trump & Nixon are striking – Nixon introduced Tariffs at 10%. Both Presidents:

* Were Republican Presidents riding a populist “red-wave” with blue collar voter support

* Tariffs Introduced at 10% by Nixon and 10-110% by Trump

* Huge political comeback – suspicious of Washington, contemptuous of liberal elites & media they control

* Want to counter their competition for US manufacturing

* Want to drive a wedge between China & Russia

* Promising to end unpopular foreign war you didn’t start

The result? Chaos: stagflation, shortages & runaway inflation. History doesn’t repeat, but it sure rhymes.

The US tariffs announcement on April 4th, followed by China's retaliation, triggered a dramatic freeze in global shipping bookings. Comparing the week of April 1-8 to March 24-31, overall US import bookings crashed by 64% (with US imports from China also down 64%), while overall US exports fell 30%. Global TEUs booked dropped 49%. This indicates shippers paused activities mid-cycle to reassess costs and strategy amid the tariff blitz, significantly impacting global supply chains.

Implications for markets

Much different to last weekend, this weekend’s risk felt much more skewed to the upside, according to top Goldman Sachs FICC trader, Shawn Tuteja.

Friday’s rally felt like the trading community did not want to be offsides into potentially positive newsflow over the weekend (e.g. a positive US / China conversation or a deal with Japan that removes auto-tariffs). It feels that consensus is firmly shaping into the view that it’s necessary to separate a short-term view on markets from a medium-term one.

In the short-term, this past week removed the extreme left tail to the markets, as the government showed some sign of relent after SPX traded below 5000 and back-end bonds were bidless.

“As such, our framework is positive newsflow could take us back to 5650-5700, but from there, it’s difficult to imagine much upside.

The underlying economic data clearly shows that things are slowing – the trading community has revised down 2025 EPS to 250, and the optimistic 2026 EPS is in the mid 270s.

The Fed can only cut rates once the hard data allows them to, which makes it tough to believe that it will be before things are too late. This past week’s CPI composition looks eerily similar to the CPI from June 2024, and we all remember the growth scare that happened a month later after the Fed chose not to cut rates in July.

All of this leads me to believe we’re in a 5000-5650 range for the next few months. If I had to construct a scenario that causes a break below 5000 in the short-term, it would be a sudden, unexpected negative NFP print.”

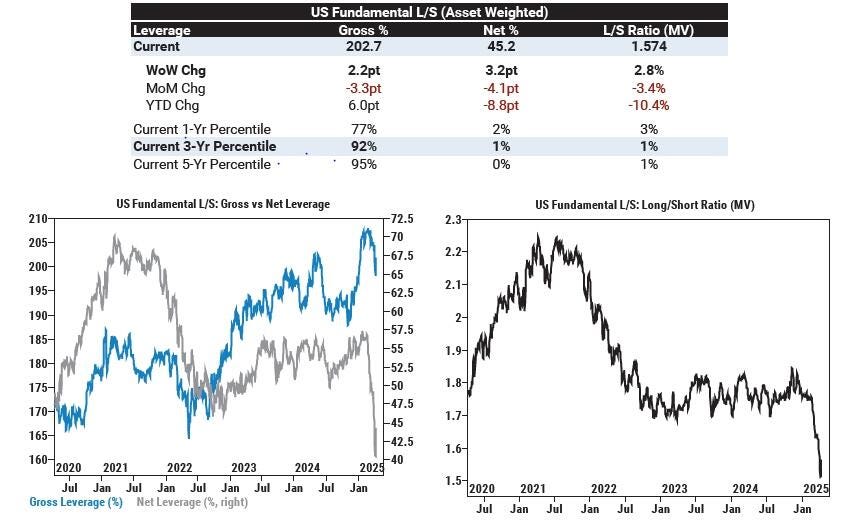

Positioning remains extremely light: Goldman’s Prime Book shows nets in the 0th percentile on a 5-year lookback, despite the largest week of net buying since November.

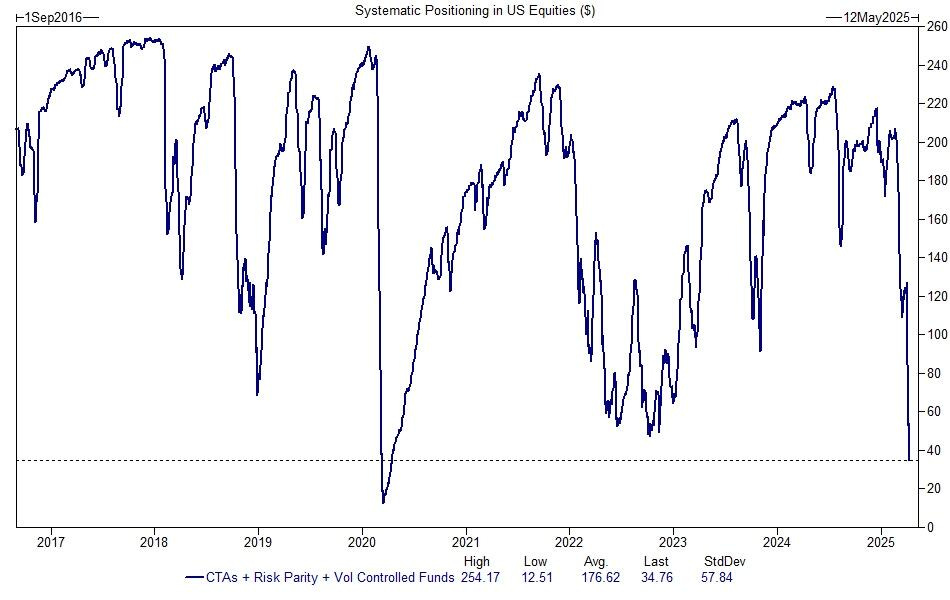

Systematic players (CTAs, risk-parity) are also at their lowest levels since COVID, suggesting dry powder exists, but it needs a vol collapse to re-engage.

If we do see further upside toward the top of the range, Tuteja suggests using it to scale into downside (via put spreads or call overwrites) especially in sectors exposed to growth slowdowns. Any break below SPX 5000 in the near-term would likely be triggered by a sudden negative NFP print.

Volatility remains elevated (VIX 37+), but historical VIX expirations rarely settle above 30. A vol crush could trigger systematic re-leveraging, especially in large-cap tech, which has started to see a bid as positioning cleans up and valuations improve.

Citi, on its end, has lowered its S&P 500 year-end target to 5,800, assuming that the index delivers US$ 255 in EPS. Tariff assumptions and recent signs of macroeconomic slowdown were reasons for Citi's reduction from the previous US$270 EPS forecast. Due to policy uncertainty, the broker considered some valuation compression reasonable.

Moreover, Bank of America said to short the S&P 500. This recommendation stems from the observation that global investors are shifting to safety, creating unfavorable conditions for equities. The bank anticipates these conditions will continue until two key shifts occur: a meaningful rate cut by the Federal Reserve and a pause in the ongoing U.S.-China trade conflict.

Goldman Sachs' Tony Pasquariello described recent market chaos, highlighting extreme S&P volatility (daily ranges of 3.1%-10.8%) and bond yield swings. He observed potential US asset outflows and the failure of bonds to diversify 60/40 portfolios. While suggesting peak implied volatility might be past, Pasquariello emphasized that with US recession probability effectively a "coin-flip" (Goldman's baseline is 45%), "preservation of capital is job #1." He advises against aggressive positioning, recommends watching jobless claims closely, noted a shift towards persistent US dollar weakness, and identified 4700 as key near-term S&P support.

Macro risk

Apollo’s Torsten Slok points out that consumer confidence is weaker than during the 2008 financial crisis, and the fear is that this will spill over to weaker actual spending. The April survey of consumer sentiment from the University of Michigan shows the following:

Consumer sentiment is declining rapidly both for households making more than US$ 100,000 and less than US$ 100,000.

Consumers’ worries about losing their jobs are at levels normally seen during recessions.

A record-high share of consumers think business conditions are worsening.

Households’ income expectations are declining.

Inflation expectations are rising at an unprecedented speed.

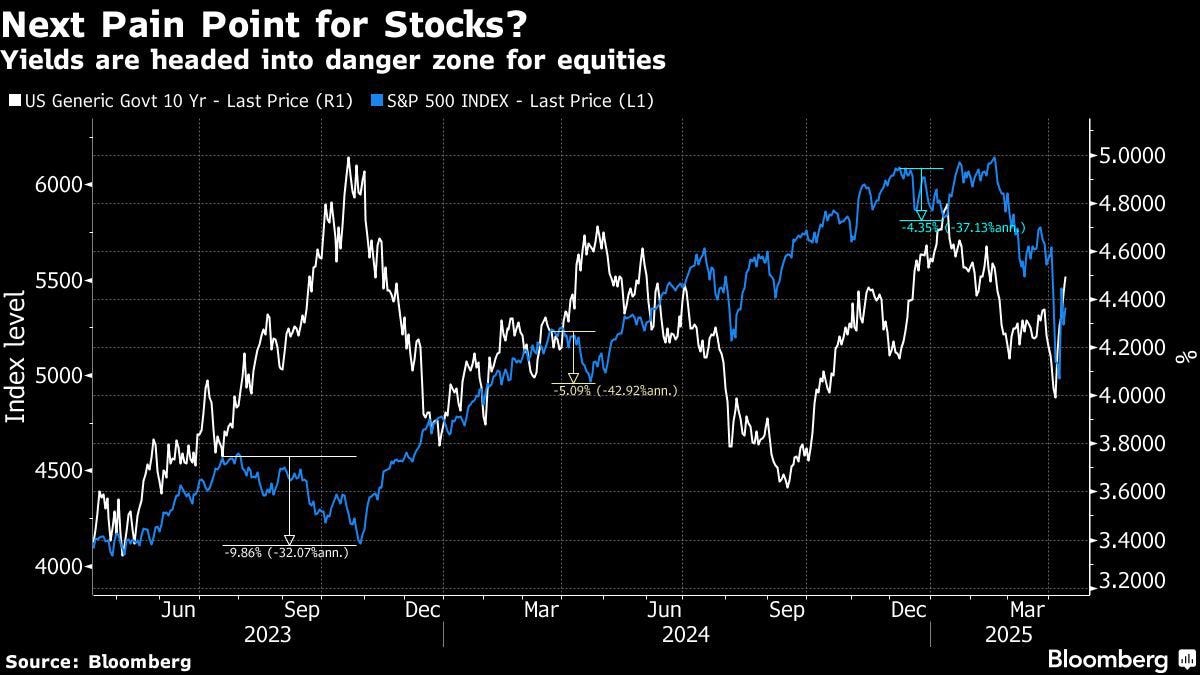

US Yields headed in danger zone for equities. When yields rise (white line) while the dollar falls (blue line), it typically signals one of two things: 1. Foreign selling of Treasuries: countries under stress (e.g. China, Japan) could be liquidating USTs for FX defense or capital repatriation, which pushes yields up while pressuring the dollar down. 2. Loss of confidence in U.S. fiscal or policy credibility: If markets believe the Fed will be forced to monetize deficits (i.e. stealth QE or yield curve control), investors demand higher yield for holding Treasuries while the dollar weakens due to expected dilution. This exact setup preceded the COVID panic in March 2020, Eurozone stress in 2011, and the post-GFC dollar unwind in 2009. n 2025, with: the UST rollover wall looming, tariff-driven inflationary pressure, and global FX tension (CHF, CNH, JPY) already breaking trend, this move could be the market pre-pricing a policy break or credit event.

JPMorgan Asset Management's Bob Michele believes Treasuries may have hit their price low and yield high due to robust foreign demand and expected Federal Reserve support. Michele cites conversations with overseas investors who remain committed to Treasuries, and Fed data showing foreign central banks and reserve managers recently increased their Treasury holdings. The comments come after Treasuries suffered their biggest slump since 2001 last week, prompted by trade tensions and concerns about US deficits, with speculation about China selling Treasuries in retaliation to US tariffs.

The Treasury market’s steepener bet is on a historic run as investors flee long-term US bonds. DoubleLine and other money managers are positioning for a steeper yield curve.

US High yield spreads edged off a touch but remain near the highest since Oct 2023.

Source: Ashenden Finance & various external sources