Inflation is back

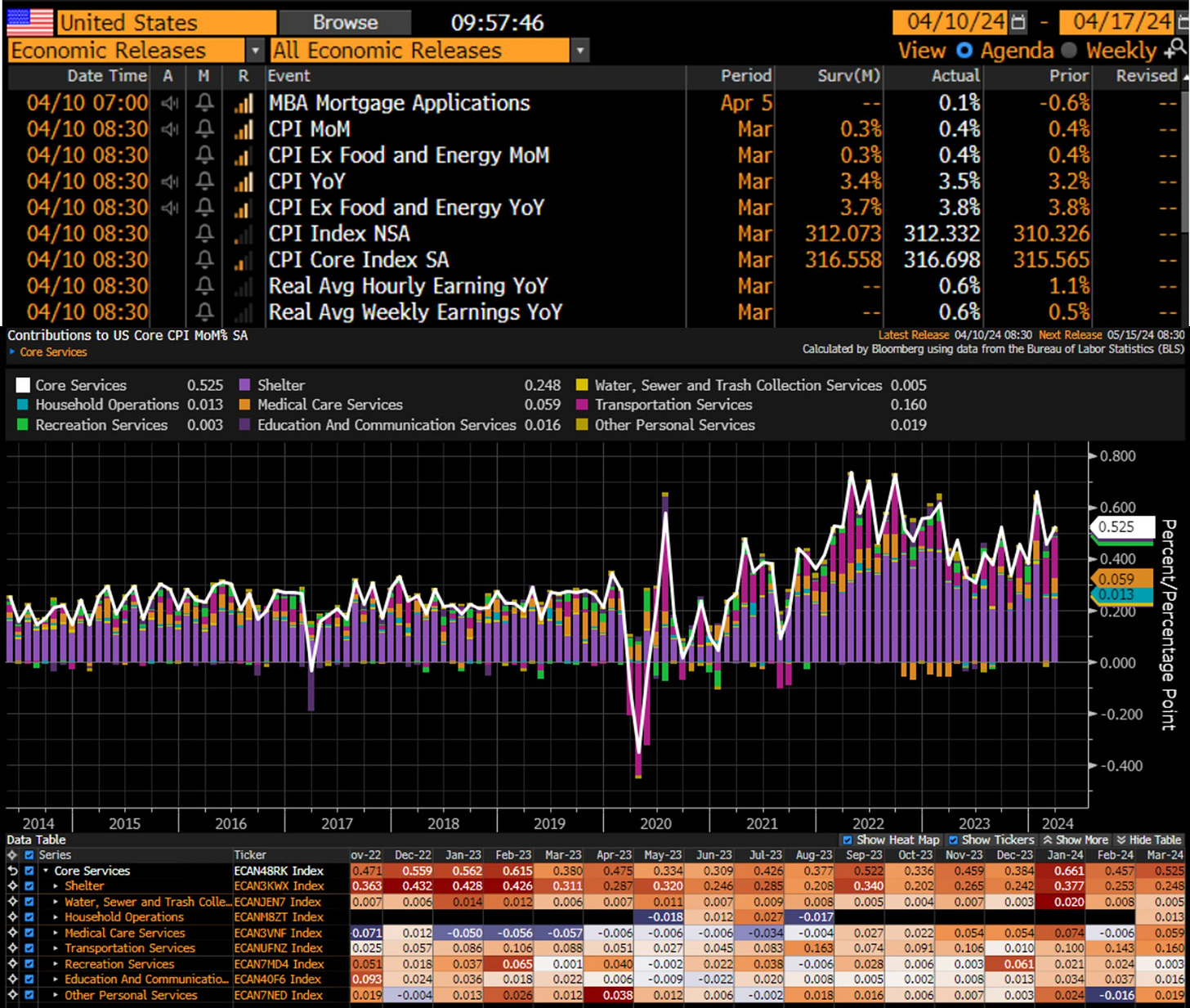

US headline and underlying inflation surprised on the upside for the third time this year, with the indices accelerating again in March to their highest level this year (+3.5% YoY for headline inflation, +3.8% YoY for underlying inflation, +4.8% YoY for the supercore index). With this inflation pressures persisting, the case for the Federal Reserve to begin reducing interest rates in June has derailed and it is not sure over whether it can deliver cuts this year without signs of an economic slowdown. Of the two necessary conditions for the Fed to cut, weaker jobs and slower CPI, we got none.

Shelter, medical care services, and motor vehicle insurance/maintenance & repairs continued to be the biggest drivers of inflation in March. Epic spikes in food, energy and core goods are over:

For the Fed what matters is services inflation. These are numbers that are easily influenced by rising wage costs, and they are still nowhere near their pre-pandemic norm. Shelter prices, much criticized for failing to keep up with the latest changes in rents, are part of this, so the Fed has given increasing attention to “super-core” inflation — services excluding shelter. This measure is now plainly moving back upward:

Also “sticky” prices, the ones that take a while to move and very rarely go down, are not coming down too. The index kept by the Atlanta Fed shows disinflation halting and beginning to reverse — at a level above 4% and far too high for the Fed’s comfort:

Higher rates are having a painful impact on real estate. In the US, the S&P 500’s real estate index dropped to an all-time low relative to the index as a whole. It has now underperformed the market by almost 70% since peaking in 2007, on the cusp of the financial crisis:

Falling real estate values need to be monitored very carefully; if there’s a possibility for higher rates to “break something,” as the slang usually has it, then Commercial Real Estate and those who lend to them appear to be most at risk.

Bond market reaction

Yesterday was an horrific day for US Treasuries. Hot CPI sent the Treasury 10-year higher, then the 10-year auction had a 24% dealer takedown and tailed 3.1 bps, the largest tail since Dec 2022 and 3rd largest on record. The biggest one-day spike in the 10-year yield since the COVID panic, up 19 bps and climbing.

The U.S. 10-year Treasury Rate rose to 4.51%, reaching a new high since November 2023. While the US 2-year yields jumped 16bps to 4.9%.

The policy-sensitive 2-year note up by nearly 23 basis points to 4.97% and yields on 5-year Treasuries briefly exceeded those on 30-year bonds for the first time since September.

While Goldman Sachs economists pushed back their forecast for a cut to July from June, their counterparts at Barclays said they now just expect one reduction this year. With a more extreme tone, former US Treasury Secretary Lawrence Summers, a Bloomberg Television contributor, said markets “have to take seriously” the chance the central bank’s next shift is a hike. Kathy Jones, Charles Schwab’s chief fixed-income strategist:

“Bottom line is that this data means for the Fed there will be one or two cuts at most this year, and right now they just have to be patient. Generally, the trend in yields is still higher, and we don’t want to fight the trend. But I’m not in the camp that we will make it to 5% in the 10-year”.

Zachary Griffiths, head of US Investment Grade and Macro Strategy at CreditSights:

“Seems like this will solidify the idea of high-for-longer and keep upward pressure on rates in the near term. From a longer-term perspective we think this back up in rates presents an opportunity to add duration at attractive levels”.

Torsten Slok of Apollo Global is sticking to his view of no cuts in 2024.

“Easy financial conditions continue to provide a significant tailwind to growth and inflation. As a result, the Fed is not done fighting inflation and rates will stay higher for longer”.

Equity got hit, but not that much

Equity market arrived at CPI day with a bullish momentum: 80% of S&P 500 stocks were trading above their 200D moving average, the 2nd highest level since August 2021.

Nomura's McElligott tried to explain the dynamics of the market: 1) US Economic strength. 2) driving a Fed path repricing. 3) creating an “impulse tightening” in US financial conditions (rates, oil, dollar up) 4) US Treasury is auctioning US$ 58bn in 3Y / US$ 39bn in 10Y / US$ 22bn in 30Y. 5) the Corporate “Buyback Blackout” looms. 6) broad liquidity drains with Cash being raised ahead of US Tax payments.

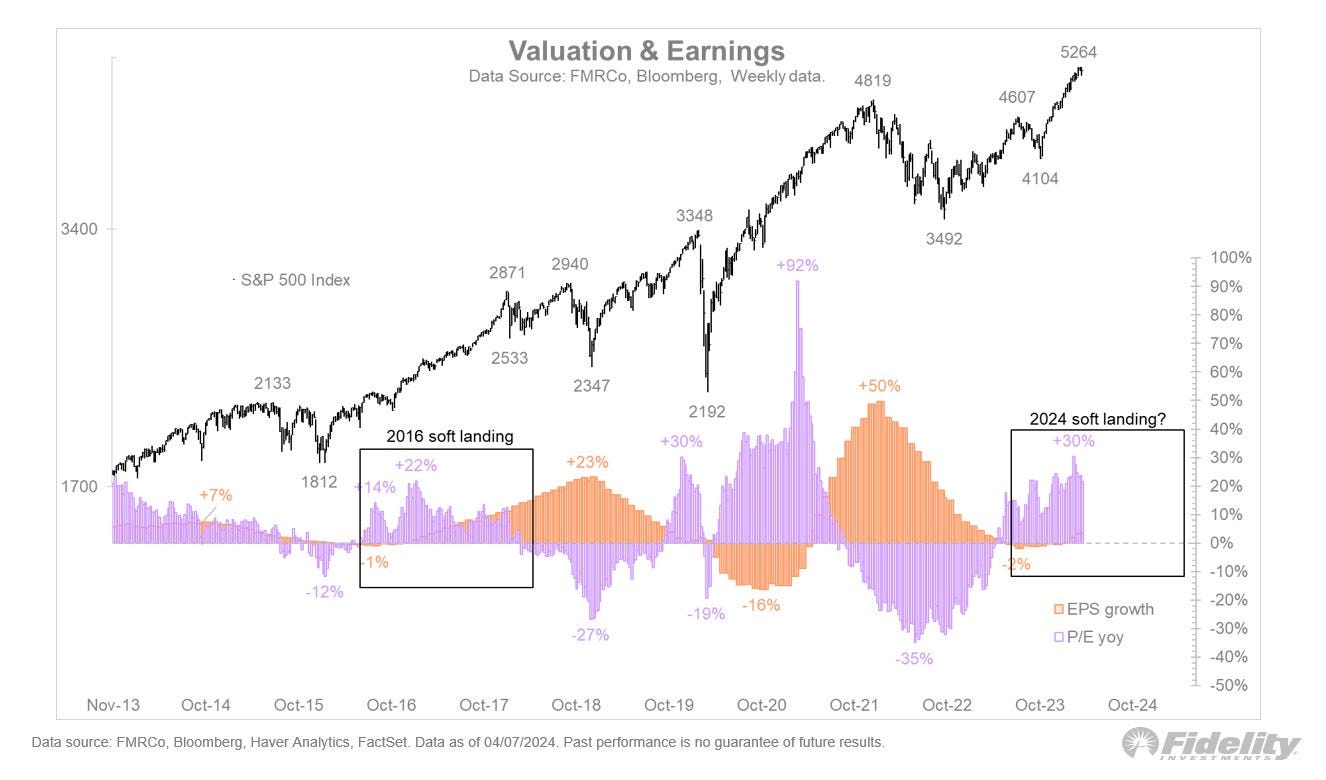

Fidelity Investments: We remain in that phase of the bull market in which P/E-multiple expansion should give way to earnings growth. Following a 40% P/E-expansion from 15x to 21x, we are overdue for a baton pass.

And what happened after CPI? S&P 500 futures lost nearly 100 points in less than 10 minutes.

The Nasdaq 100 fell less than a percentage point (0.9%), showing that some equity people are still too optimist. If we look at S&P 500 sectors, yesterday traders kept buying oil (due to middle-east conflict) while Tech and Communication Services registered relatively small losses. On the other hand and as expected, utilities and real estate were the worst performers.

Goldman Sachs says it’s time to take Tech profits and invest elsewhere. The firm believes tech shares will come under pressure and prefers areas like energy and Japanese shares, according to Alexandra Wilson-Elizondo, co-chief investment officer of multi-asset solutions. In her view, the US economy is on track for a soft landing, but there are plenty of risks that could change the trajectory. Goldman Sachs is holding an overweight position on energy shares as a hedge against inflation and geopolitical risks, said Wilson-Elizondo. Japan is another area that Goldman is overweight due to corporate reforms, improving business sentiment and relatively low valuations.

Street views on economic environment

Odds of a US recession are NOT zero! And US Small Business 'Optimism' is one of them. In March, US small businesses were the least upbeat since December 2012. That's right; small businesses are more depressed now than during the COVID crisis. That's remarkable, as small businesses suffered greatly from the lockdowns and other mobility restrictions. Inflation, directly linked to wage pressures, remains a severe issue for US small businesses.

Morgan Stanley's Michael Zezas on US fiscal deficit: US fiscal deficits will expand under either Democrat or Republican leadership later this year, with the deficit expanding about US$ 450bn under Democrats over 10 years and by an expected US$ 1tn under Republican leadership. Democrats would increase social spending and extend some tax breaks, while offsetting that with tax hikes elsewhere. Under Republicans, "we'd expect lower taxes without new revenue, and thus a bigger increase in the deficit."

Jamie Dimon warns interest rates could hit 8% or more and wars are creating outsize geopolitical risks. JPMorgan Chase chief executive warned that US inflation and interest rates could remain higher than markets expect because of high government spending. Dimon warned that recent geopolitical events “may very well be creating risks that could eclipse anything since world war two”, pointing to Russia’s full-scale invasion of Ukraine and the current violence in the Middle East.

Wells Fargo market forecasts: “We raised our year-end SPX target to a Street-high 5535 (20.5x 2025E's US$ 270) from 4625, implying 6.4% upside. […] systemic risk is on the rise as various incentives (e.g., monetary policy) spurs risk and leverage-seeking, but in our view systemic risk is not close to a top. […] We will maintain this stance until we see one of the following: (1) IG credit spreads widen to 115bps; (2) Inflation rises enough to erase Fed 2024/2025 easings; and/or (3) a 10yr UST yield of 5%+ for six month.”

Thanks for another brilliant write-up, team!

"Viewed in the abstract, the Federal Reserve System had the power to abort the inflation at its incipient stage fifteen years ago or at any later point, and it has the power to end it today. At any time within

that period, it could have restricted the money supply and created sufficient strains in financial and industrial markets to terminate inflation with little delay. It did not do so because the Federal Reserve was itself caught up in the philosophic and political currents that were transforming American life and culture." - Arthur Burns on the failure to control inflation in the 1970s