The soft landing narrative is fading, together with the market bullishness

The sentiment in the market has turned from greed to fear

US government could face a shutdown

US stand just days from a government shutdown. Over last weekend, lawmakers expressed few signs of movement on a budget resolution that would keep the US government funded for the remainder of the fiscal year, and the clock is ticking. Current spending laws are due to expire on Sept. 30: if Congress does not reach an agreement before 12:01 a.m. on Oct. 1, the government will shut down. House Republicans on Thursday sent the chamber into recess, delaying further developments in the negotiations. If Congress fails to act, there will be a lapse in funding, and all nonessential government functions must stop.

House Speaker Kevin McCarthy (R., Calif.) rebuffed a bipartisan short-term funding bill from the Senate in favour of a House Republican plan driven by conservatives, as dim prospects for a deal raised the likelihood of a partial government shutdown starting this weekend. Many lawmakers now anticipate that Congress will fail to fund the government past Sept. 30, a lapse that will partially close federal agencies and temporarily withhold pay for federal workers and active duty-military personnel. President Joe Biden said it was time for House Republicans to take action to prevent a shutdown, seeking to raise pressure on McCarthy before a midnight Saturday funding deadline. But McCarthy still lacks votes for GOP stopgap, increasing odds of a shutdown. (Politico)

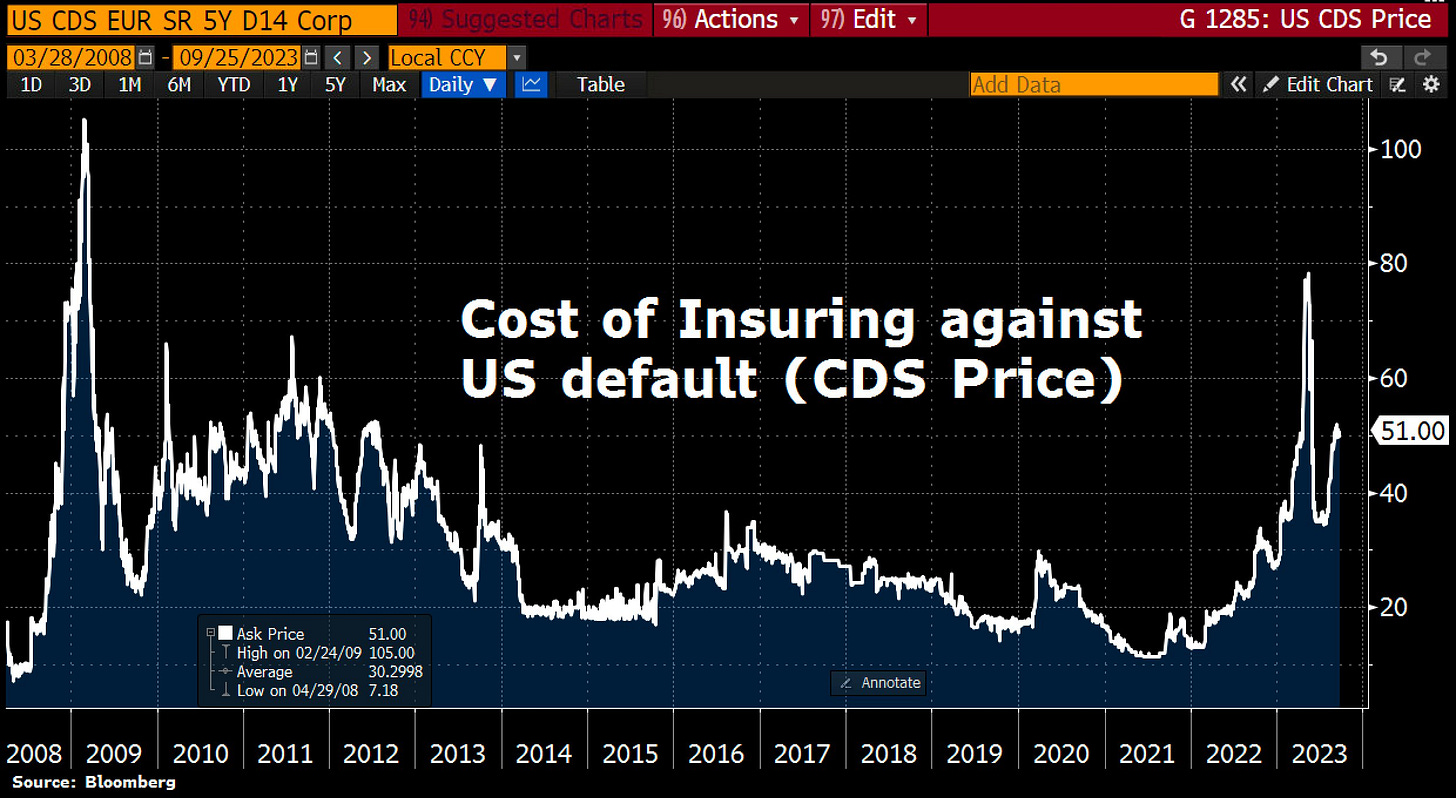

Moody’s, the only remaining major credit grader to assign the US a top AAA rating, says a government shutdown would reflect negatively on America’s credit rating. Analysts led by William Foster wrote in a report Monday:

“While government debt service payments would not be impacted & a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other AAA-rated sovereigns that we have highlighted in recent years”.

Pimco – Cantrill on the potential shutdown:

“Remember: If this comes to pass, it will be a full government shutdown (a la 2013), not a partial shutdown (a la 2018-2019) […] The longest full shutdown was in 2013 and lasted 16 days; the longest partial shutdown was in 2019-2019 and lasted 35 days.”

Goldman Sachs now thinks the odd of a US Govt shutdown have risen to 90% and it has looked likely for several months. “While there is still a chance that Congress can reach a last-minute deal to extend funding past Sep. 30, there has been little progress made and there is little time left.”

Credit Agricole is already looking at a potential trade: the yen, Swiss franc and gold may strengthen with a potential shutdown, they said.

Fed could hike once more, a monetary policy mistake

Fed officials are saying that at least one more rate hike is possible while emphasizing the higher-for-longer mantra. Boston's Susan Collins called further tightening "certainly not off the table" and Governor Michelle Bowman signalled that more than one increase will probably be required. Bowman also said higher rent burdens underscore the need to curb inflation.

Daly (non-voter) said on Friday that they stood pat on rates in recognition that they are closer to their destination and are holding rates steady to collect information to see if more is necessary, while she added that they need to go at a slower pace.

Kashkari (voter) said there is still more work to do on services inflation but added that they can definitely get back to 2% inflation, while he also stated that they may need higher rates for longer if the economy is too strong but added that they may need to cut rates if real rates are tightening. Furthermore, Kashkari said falling inflation next year could justify backing off the federal funds rate to stop it from getting tighter and noted he is one of the Fed policymakers who see one more rate hike this year. Kashkari also said he sees a 60% chance the US central bank can bring inflation down to its 2% target without causing severe damage to the economy, with a 40% chance the Fed will have to hike 'significantly higher'.

Goolsbee (voter) said the bigger risk is if inflation stays too high, but believes the Fed are getting inflation down to target but they cannot change the target until it is reached. Goolsbee added the current path is unusual for [inflation] to fall like it is without unemployment rising. On rates, the Chicago Fed President noted at some point the question shifts from how high rates need to be to how long they will stay there for. Moreover, the Fed will play it by ear whether rates need to move higher, and it feels like rates will have to stay higher for longer than markets had expected [referencing the 2024 Dot Plot]. Meanwhile, Goolsbee said concerns over yield curve inversion do not account for the possible differences in a post-pandemic economy.

But keeping central bank rates elevated for an extended period of years will likely increase the pressure on some institutions to become more reliant on costly brokered deposits known within the industry as "hot money." These brokered deposits come from outside firms that funnel large amounts of customers to higher-yielding certificates of deposit offered by banks. But because these deposits are typically more expensive for a bank, they cut into profits during a challenging time for many financial institutions.

Meanwhile, JPMorgan CEO Dimon warns that world is not ready for 7% Fed rate, a worst-case scenario with interest rates hitting 7% along with stagflation.

“If they are going to have lower volumes and higher rates, there will be stress in the system”. Warren Buffett says you find out who is swimming naked when the tide goes out. That will be the tide going out”.

Dimon, who has said rates may need to rise further to fight inflation, added that the difference between 5% and 7% would be more painful for the economy than going from 3% to 5% was.

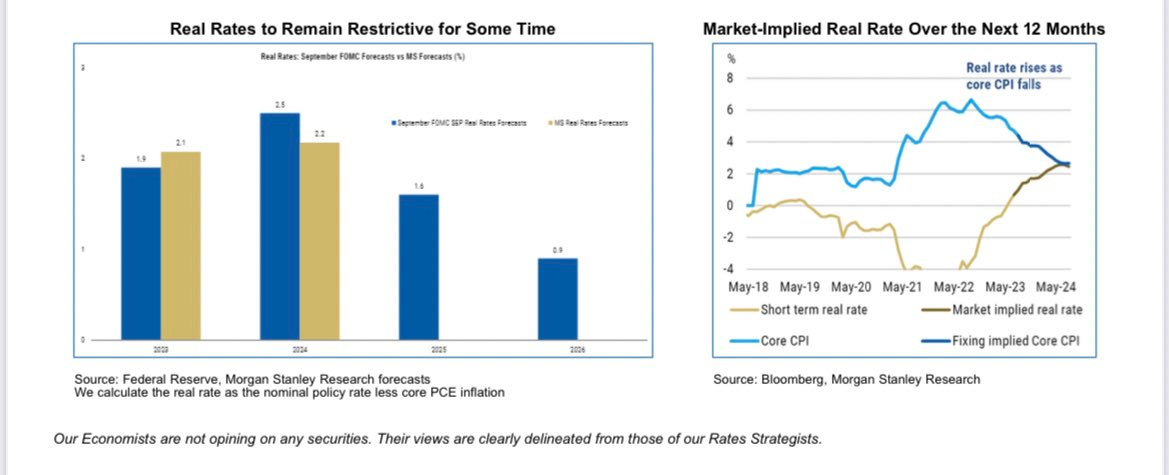

Morgan Stanley also commented US monetary policy:

“We remain more optimistic than the Fed on the deflationary process. […] our team sees real rates remaining relatively flat in 2024. As such, […] markets are ripe for a 50-75bp correction in the Fed path”.

Ellen Zentner predicts the FOMC will stay on hold until it's ready to cut next year.

Macro indicators starting to show high rates blows

Inflation going down. Policymakers on both sides of the Atlantic are expected to take comfort this week from a slowdown taking hold in key underlying inflation measures. In the US, the core metric may have fallen below 4% in August for the first time in almost two years. And the euro area's equivalent gauge probably slowed to 4.8% in September, a 12-month low, while the headline measure is seen decelerating to 4.5%.

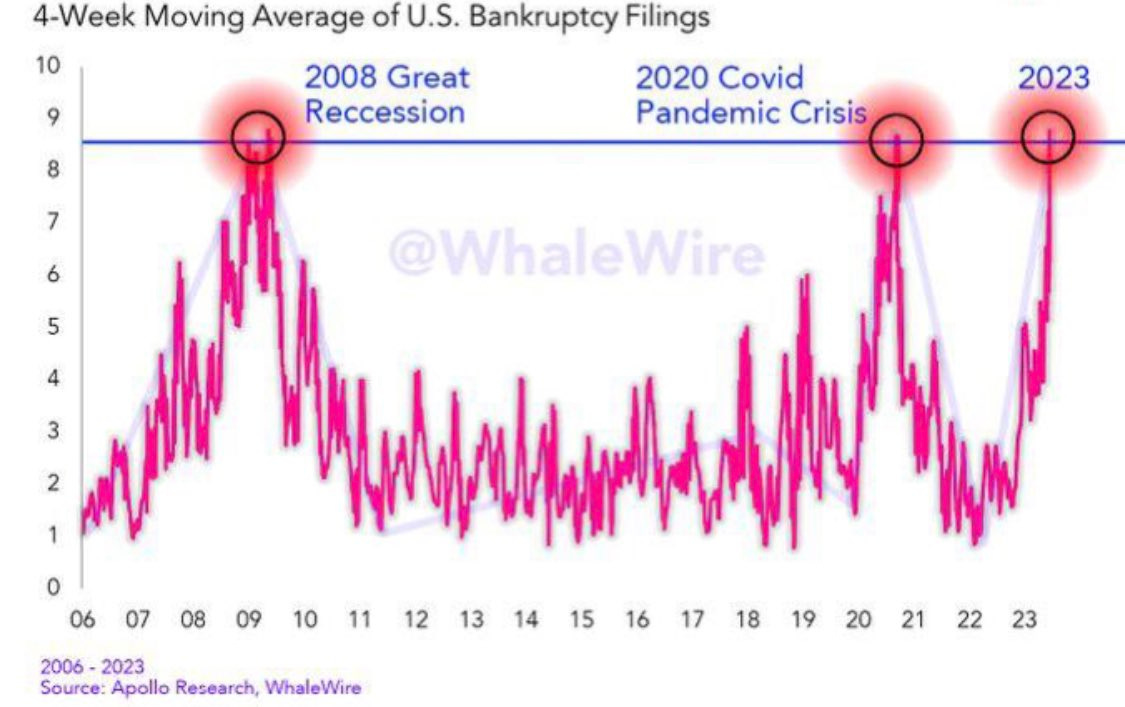

Bankruptcy filings surge to dangerous levels. Bankruptcy filings have recently reached levels on par with the Great Recession in 2008 and the 2020 COVID-19 pandemic. This indicator often suggests that the economy isn't performing well, and has historically always been followed by massive stock market crashes.

While, credit card companies are racking up losses at the fastest pace in almost 30 years, outside of the Great Financial Crisis, according to Goldman Sachs. Credit card losses bottomed in September 2021, and while initial increases were likely reversals from stimulus, they have been rapidly rising since the first quarter of 2022. Since that time, it’s an increasing rate of losses only seen in recent history during the recession of 2008. It is far from over, the firm predicts. Losses currently stand at 3.63%, up 1.5 percentage points from the bottom, and Goldman sees them rising another 1.3 percentage points to 4.93%.

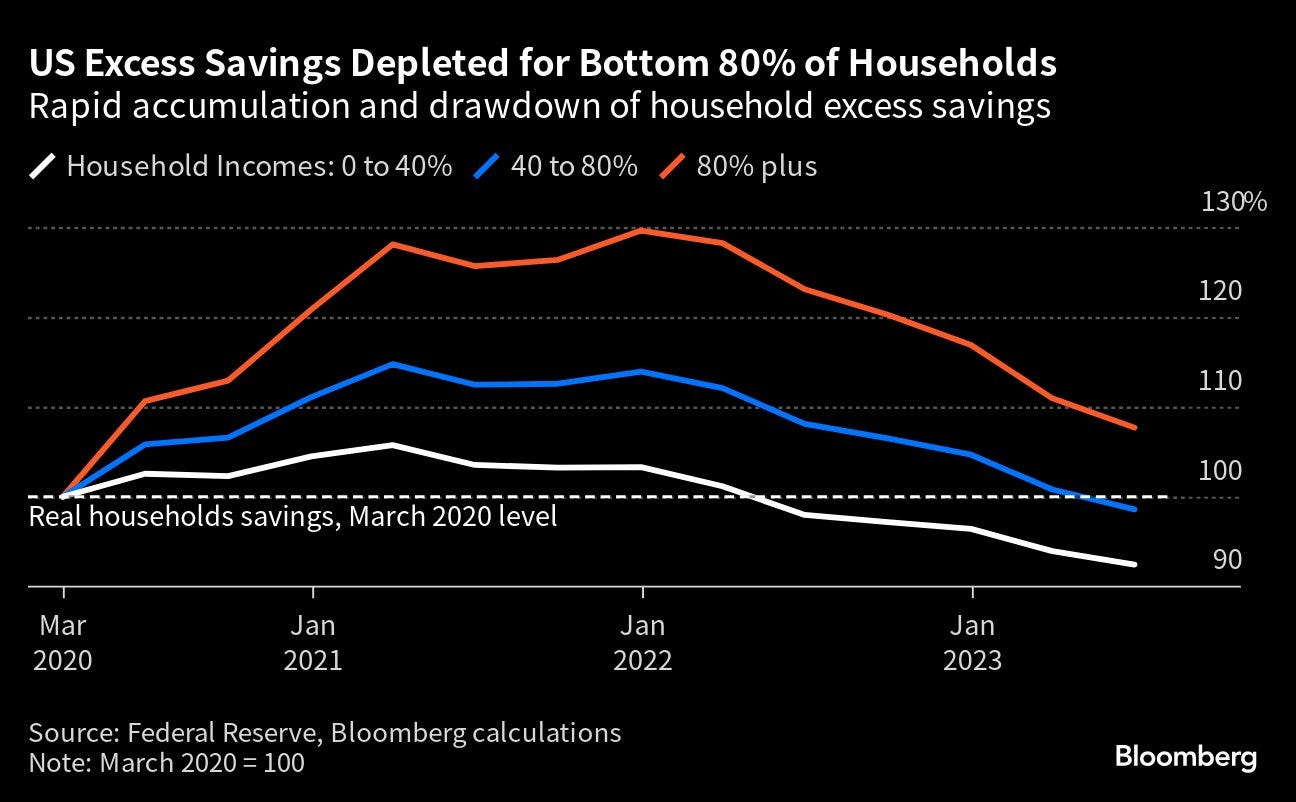

Americans outside the wealthiest 20% have run out of extra savings and now have less cash on hand than they did when the pandemic began. The figures point to dwindling firepower available for US consumers, whose resilience has kept the economy growing at a rapid clip this year and staved off the recession that many expected. Some analysts warn a downturn is still in the cards as households run low on spare cash.

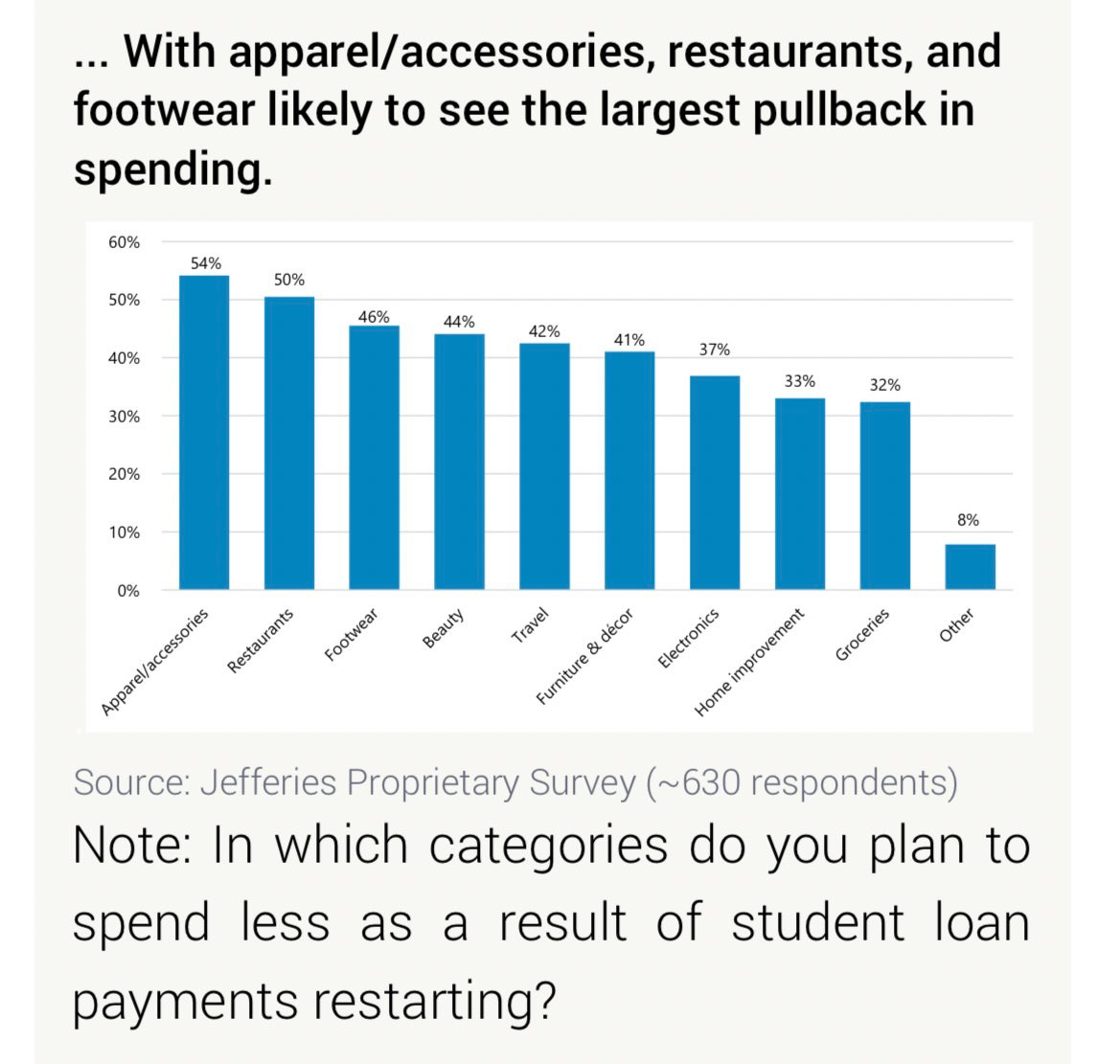

Jefferies on US consumers weakening:

“Our survey of 600+ US consumers with outstanding student loan debt indicates consumer spending is likely to be curtailed […] apparel, footwear, accessories, restaurants […] are likely to see the biggest pullbacks […] We flag LULU, FL, and URBN as most exposed”.

WSJ is showing that rising interest rates are hitting Americans’ finances. Those who need to borrow now are getting a lot less for their money.

And S&P said US bank deposits fell for the first time in data going back to 1994: total deposits slipped 4.8% in the year ended June 30 to about US$ 17.3tn as customers pulled out money to invest in higher-yielding alternatives. A series of bank failures also motivated withdrawals.

What is happening on Markets?

DataTrek: After several weeks of seeing Wall Street analysts increase or at least maintain their 2023 and 2024 S&P 500 earnings estimates, the trend reversed to the downside last week. 1) The Street cut its aggregate Q3 2023 S&P estimate to US$ 55.74/share last week, down 0.6% from the prior week. Q3 numbers are now where they were at the start of August, erasing all the upside revisions we’ve seen over the last 7 weeks. 2) For Q4 2023, analysts cut their numbers by 0.4% last week, to US$ 57.85/share. That takes the Street’s Q4 estimate down to essentially where it was at the start of June. While small earnings estimate revisions don’t usually matter, trends in this data sometimes do.

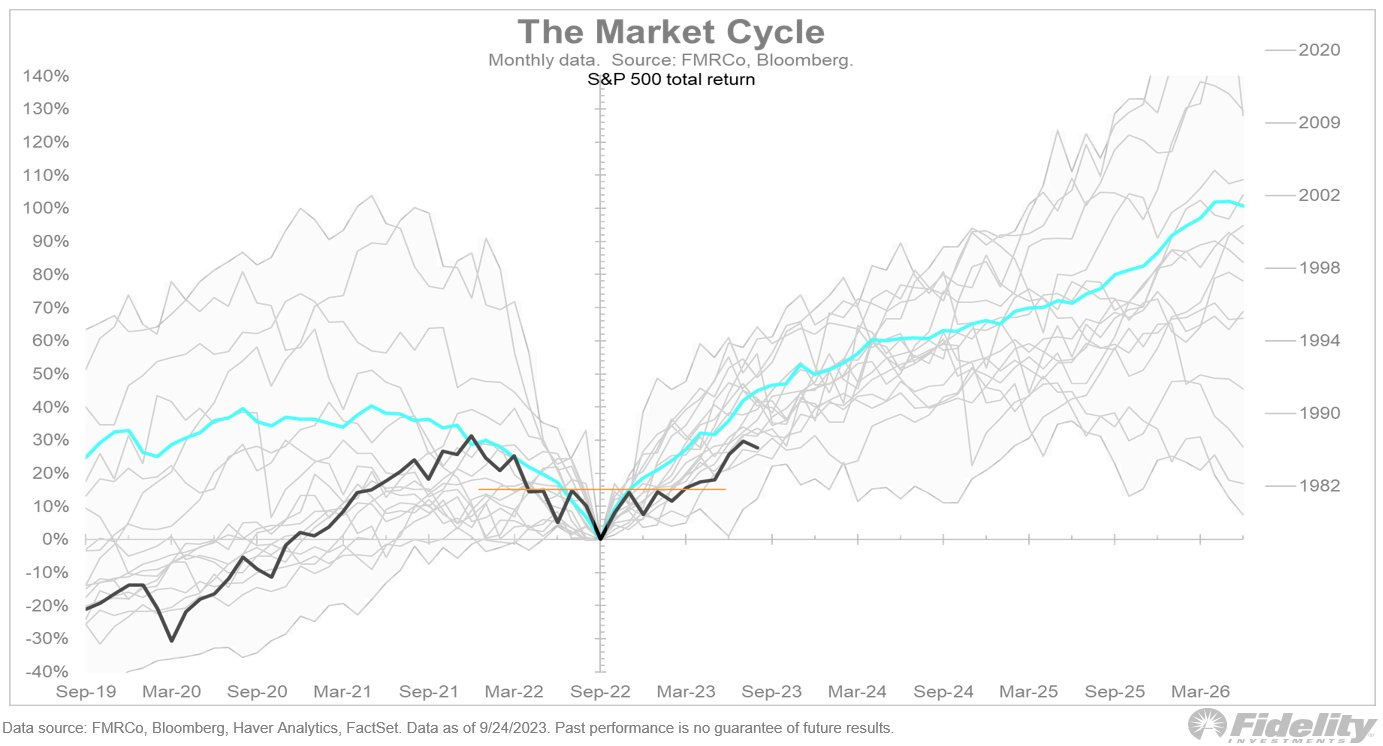

Is this really a bull market? If indeed a new bull market started on October 13, 2022, it is certainly testing our patience. The 23% rally remains well below average in terms of the typical recovery slope from a bear-market low.

Canaccord: There needs to be more than just oversold. The fact the market is oversold doesn’t mean the correction is over, it simply means the environment is ripe for a temporary bounce like mid-August, especially given the average NYSE stock is already down 30% from its 52-week high. Ultimately, there needs to be a significant and sustainable drop in U.S. Treasury, mortgage, and corporate bond yields for a more durable rally to take hold. In our view, such a dramatic change in the bond market tone is only likely to come from either a financial market event like the recent SVB failure or extreme weakness in the economic data, and more specifically the employment indicators. In the current instance it may prove to be a combination of the two.

Bearish bets. Hedge funds ramped up wagers against stocks to drive down their net leverage — a gauge of risk appetite that measures long versus short positions — by 4.2 percentage points to 50.1%, according to Goldman's prime brokerage. That's the biggest week-on-week decline in portfolio leverage since 2020. And JPMorgan's Marko Kolanovic said retailers, automakers and airlines will take the biggest hit as their pricing power wanes on falling inflation.

Goldman Sachs, JPMorgan trading desks warn selling starting to turn disorderly. Goldman: "we are witnessing degross-flavored activity across our equities floor: HFs long selling what they own vs covering some of what they are short (yes, they are very short at the moment)." JPM: “The way I see it, you have to reach further […] into the future to identify potentially positive catalysts […] I don’t think another positive earnings cycle is enough at this point […] this feels more systematic […] not one client has asked me ‘what’s for sale?’.” ZeroHedge

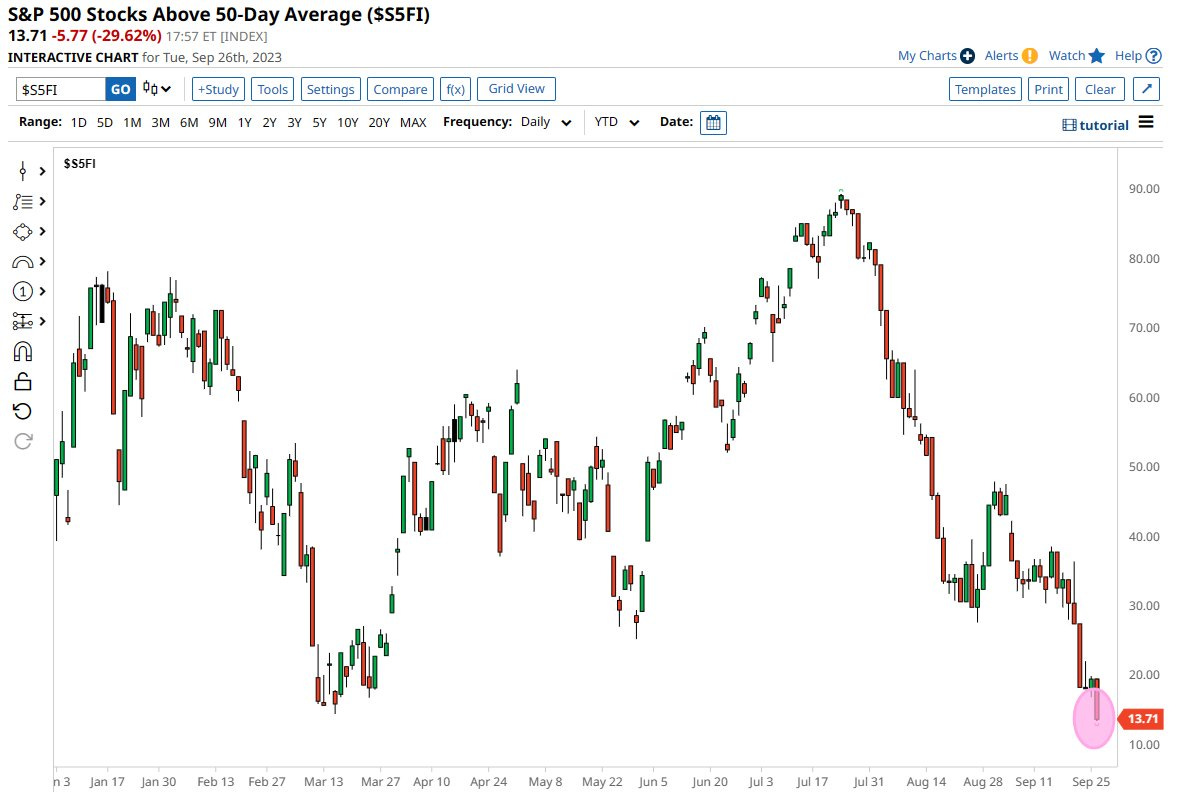

Less than 14% of S&P 500 companies are trading above their 50D moving average, the lowest level of the year.

Nasdaq 100 now trading below the trendline that had held from the beginning of the year. September has held to form as the QQQ has lost the 50D and 100D moving average.

Market Concentration Risk: S&P 500 market concentration is at its highest level in 50 years.

Nasdaq 100 Put vs Call Interest Just Hit Highest Level Since December 2021.

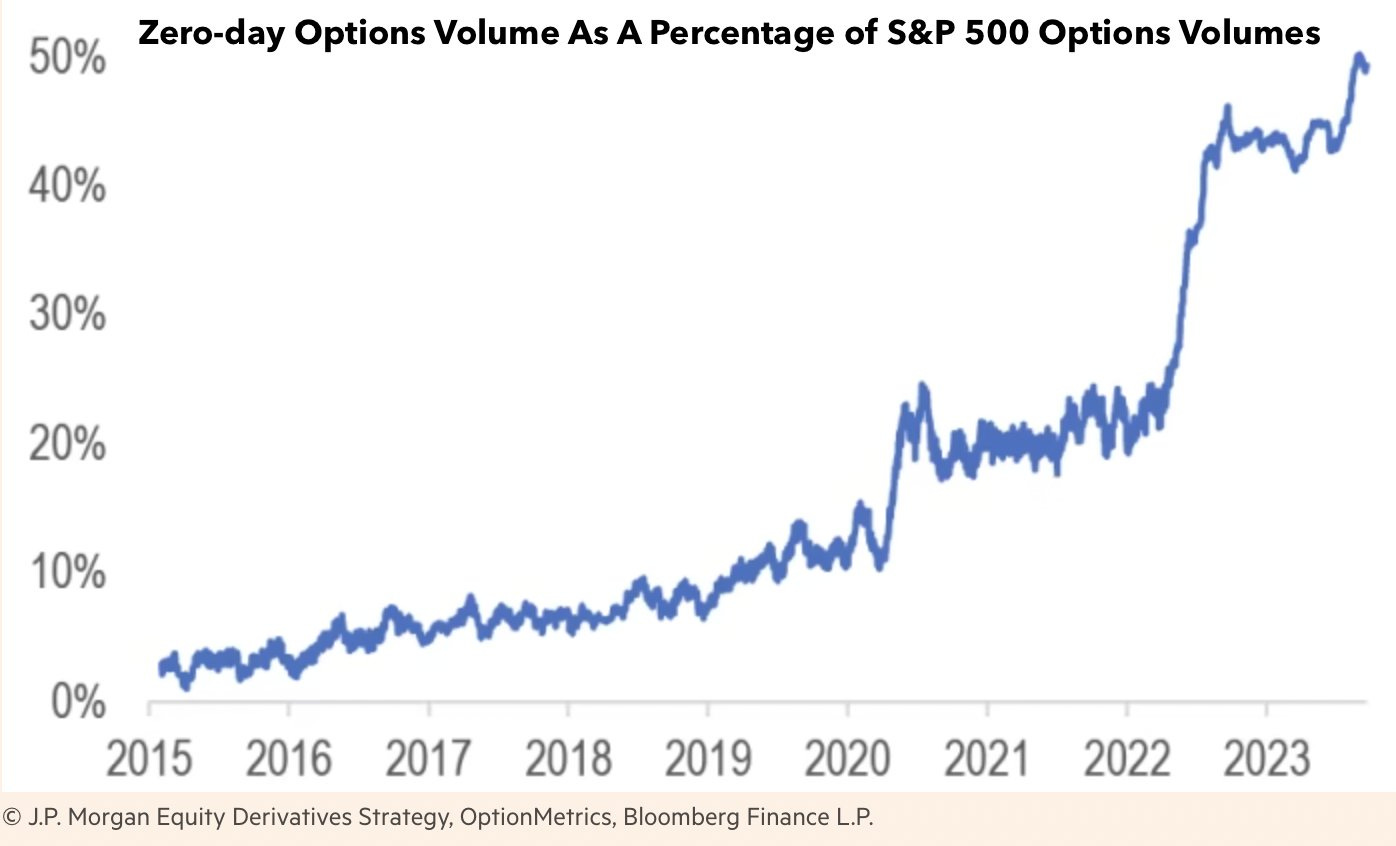

And Zero-day options are now HALF of the S&P 500 options market!

And the winner is… Cash had by far the biggest inflow of all asset classes this month. Equities a surprising (distant) second. Cash is king!

In conclusion, we keep a negative stance over the medium term for both the equity and the credit market; on the latter we expect a spread widening in 2024 with an increasingly heavy maturity wall. While in the short term, the equity market seems more prone for a rebound that could bring us close to the end of the year.

The move we are seeing in rates both in US and Europe is keeping markets nervous and we see over the next few months the potential for a more disorderly price action that could culminate in a capitulation. Therefore we recommend to keep a higher portion of cash, overweight short term investment grade bonds and value stocks in the portfolios. More opportunities will be available soon.

Thanks for an amazing read !