This cut was a "recalibration"

Fed cut rates by 50bps and sees a soft landing scenario

Fed decision

Fed voted to lower interest rates by a half-percentage point, opting for a bolder start in making its first reduction since 2020. The long-anticipated pivot followed an all-out fight against inflation that the central bank launched two years ago. Eleven of 12 Fed voters backed the cut, which brings the benchmark federal-funds rate to a range between 4.75% and 5%. Quarterly projections released Wednesday showed a narrow majority of officials pencilled in cuts that would lower rates by at least a quarter-point each at meetings in November and December. The long term neutral rate estimate moved from 2.8% to 2.9%.

With this policy, dual mandate risks are now balanced (vs. almost in balance last meeting) between inflation and employment. No longer skewed towards inflation. Fed also continues to reduce the size of balance sheet. This won't stop just because of cuts.

Regarding economy, Fed sees 2% GDP growth in the coming years, continued improvements in supply chain dynamics are supporting durable economic growth. Cuts allowed supply chain bottlenecks to ease as intended. Economic growth was called solid, with stable 2nd half growth for 2024 as roughly stable vs. the 1st half's 2.2% mark.

Consumer spending was called "resilient." Still close to "maximum employment." The labour market is "cooling but reasonably strong and "a little less tight" than pre-2019. Nominal wage growth is easing. However, the labour market is no longer a primary source of inflation. Fed sees the unemployment rate rising from 4.2% to 4.4% by end of year vs. 4.0% as of the June meeting. Watching for signs of sharp weakening. Not seeing them today. Immigration contributing to better labour supply & upward pressure on unemployment.

Moreover, Fed did not change its 2% inflation target. They have higher confidence in reaching this goal without sharp economic weakening. Market rents point to more housing disinflation. Slower than expected; direction is clear. Spoke on rate cuts potentially improving housing supply. Long term inflation expectations remain well-anchored. The Fed now sees a 2.3% PCE by end of 2024 and 2.1% by end of next year. Both lower than during the June meeting. Target is getting to 2% in 2026.

The Fed dots shifted lower, with median Funds Rate now forecast at 4.4% at end of this year (implying another 50bps worth of cuts), 3.4% at the end of 2025 (implying 100bps in cuts next year), and 2.9% in 2026 (implying 50bps of cuts in ’26). The terminal rate assumption ticked up 10bps, from 2.8% to 2.9%.

Powell comments summary:

Fed believes that the economy is "strong overall"

Fed has "growing confidence" that strength in labour market can be maintained

Consumer spending has "remained resilient"

Inflation has eased but "remains above 2% target"

Labour market is now less tight than before pandemic

Fed is moving to a "neutral stance" but "not on any pre-set course".

Powell commented that no one should think this is the new pace and he does not think the Fed is behind the curve with the rate move timely and a sign of the Fed's commitment to not get behind.

You can find a detailed recap by Nick Timiraos on WSJ.

Market reaction

Stocks rose immediately after the Fed announcement, but ended the day lower. The S&P 500 fell 0.3%. The Dow Jones Industrial Average dropped 0.25%. However, in after hours stocks rallied in view of a soft landing. The Nikkei 225 rose more than 2% as the yen slid. In the morning, US and European futures climbed, as did Bitcoin.

US yield curve steepens following jumbo Fed rate cut. 2s/10s yield spread now at +7.2bps.

S&P 500 was up 23.38% between the last Fed Rate hike and today's Fed Rate Cut. That is the largest pause rally in history!

Street comments

Bloomberg’s MLIV Pulse survey: US equities will climb through the rest of the year with the Fed’s jumbo move bolstering chances of a soft landing. The rally will likely be too modest to take the S&P 500 Index above 6,000 before next year, with 44% of the 173 respondents to the latest Markets Live Pulse forecasting the benchmark will rise less than 6% from its Wednesday close and 19% expecting it to decline. The remaining 37% of those who took the survey expect a climb steeper than 6%.

Citi: A subsequent 50bps cut is coming in November. A 50bps first rate cut completes the Fed’s hard pivot away from concerns over upside risk to inflation and toward downside risk to the labour market.

We have consistently held the view that a softening labour market would lead to more aggressive rate cuts than markets had expected. The unemployment rate is likely to move higher and we maintain our call for 125bps of rate cuts this year with a subsequent 50bps cut in November and 25bps cut in December. Risks remain balanced to an even faster pace of cuts.

Other traders ramped up bets on further reductions, pricing in another 70 bps worth of cuts at this year’s two remaining meetings. But the Citi trader who boldly predicted yesterday’s rate call weeks ago isn’t sure big moves are ahead. Akshay Singal, Citigroup's global head of short-term interest rate trading, was disappointed by the Fed's cautious tone, leading him to reconsider his expectation of more large cuts. While the Fed's move was not overly aggressive, it left markets confused, causing reversals in Treasuries, the S&P 500, and a rise in the dollar. The Fed's "dot plot" suggests a slim majority favour further rate cuts, but Singal is uncertain now, especially given Chair Jerome Powell's more dovish stance compared to the rest of the board. Singal believes upcoming jobs reports will heavily influence future Fed decisions, with November’s rate cut now a "coin flip" between 25bps and 50bps.

Morgan Stanley:

The press conference solidified our views that a string of 25bp cuts from here is the best forecast. The Fed still sees the economy as healthy and the labour market as solid, but risks to inflation have come down while risks to the labour market have risen. To show their commitment to not falling behind the curve and confidence in inflation's progress, Powell asserted a large first move was warranted. Powell has stressed and proven with this rate cut that the FOMC is willing to move gradually or make bigger moves depending on the incoming data and evolution of risks.

We expect two more 25bp cuts this year (in line with the SEP) and four 25bp cuts in the first half of 2025. Chair Powell provided more clarity on the decision to cut 50bp at the September meeting. A strong start to the cutting cycle is not a signal that they think they are behind the curve, but a signal of their "commitment to not fall behind the curve" and their "confidence that inflation is coming down toward 2% on a sustainable basis."

On consensus for a 50bp cut, there was a wide range in the median number of cuts for this year, from two to five cuts. However, Powell stressed that there was still a broad-based shift downward in interest rate projections from the June FOMC Statement and "broad support for the decision that the Committee voted on."

As always, Chair Powell stressed the FOMC projections "are not a Committee plan or decision. As the economy evolves, monetary policy will adjust in order to best promote price stability goals." If the economy remains solid and inflation persists, we can dial back policy restraint more slowly. If the labour market were to weaken or inflation were to fall more quickly than expected, we are prepared to respond. Policy is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate.

The larger cut at this meeting shows their willingness to go big if needed. Chair Powell sees labour markets “in solid shape” with a “very healthy unemployment rate” and overall conditions that are close to what he would call maximum employment. However, he took signal from the recent slowdown in employment gains. Referring to the relationship between labour demand and unemployment, he stated that it appears that the economy is at a point in which “further declines in job openings will translate more directly into unemployment.” The future path of labour demand will be important in determining the pace of cuts ahead.

On inflation, Chair Powell stated that he still expects deceleration ahead in the shelter component, but perhaps more gradually than initially thought. Nevertheless, he mentioned that “the direction of travel is clear” as long as market rents inflation remains low. He also noted that the rest of the PCE components “have behaved pretty well,” and he remains confident that inflation will come down to 2%.

Goldman Sachs:

"We see the choice between a 25bp and 50bp cut in November as a close call. The deciding factor will likely be the next two employment reports, the second of which will come during the blackout period, and in particular the path of the unemployment rate, where twelve of nineteen participants said they see the risks to even their new higher forecasts as tilted to the upside."

Apollo’s Torsten Slok: Higher for longer, still for longer. Fed Chair Powell told the audience at Jackson Hole that “the time has come for policy to adjust,” acknowledging recent progress on inflation, and setting the scene for a rate cut today—the first reduction in more than four years. While the announcement provided investors with much-needed clarity about the timing of the first rate cut, there remains a large deal of disagreement around the magnitude of rate cuts throughout the rest of the year and into 2025. It seems as though overnight investors have replaced concerns about a stubbornly high inflation with a possible recession that will force the Fed to cut rates more aggressively.

In our view, recent economic data—including the July and August payrolls reports—point to an economy that is slowing down but not heading into a recession. This was very much the outcome that the Fed was working towards given the resilience and stamina of the US economy over the past three years. While employment gains have been more moderate over the last three months, average hourly earnings have increased, and the unemployment rate declined in August.

On top of that, recent economic indicators continue to point to a strong economy. Initial jobless claim applications fell to the lowest since July, US retail sales accelerated in July by the most since early 2023, and gross domestic product rose at a 3% annualized rate during the second quarter, up from the previous estimate of 2.8%. Other indicators continue to signal robust growth: restaurant bookings, TSA travel data, hotel bookings, and box office revenue remain strong.

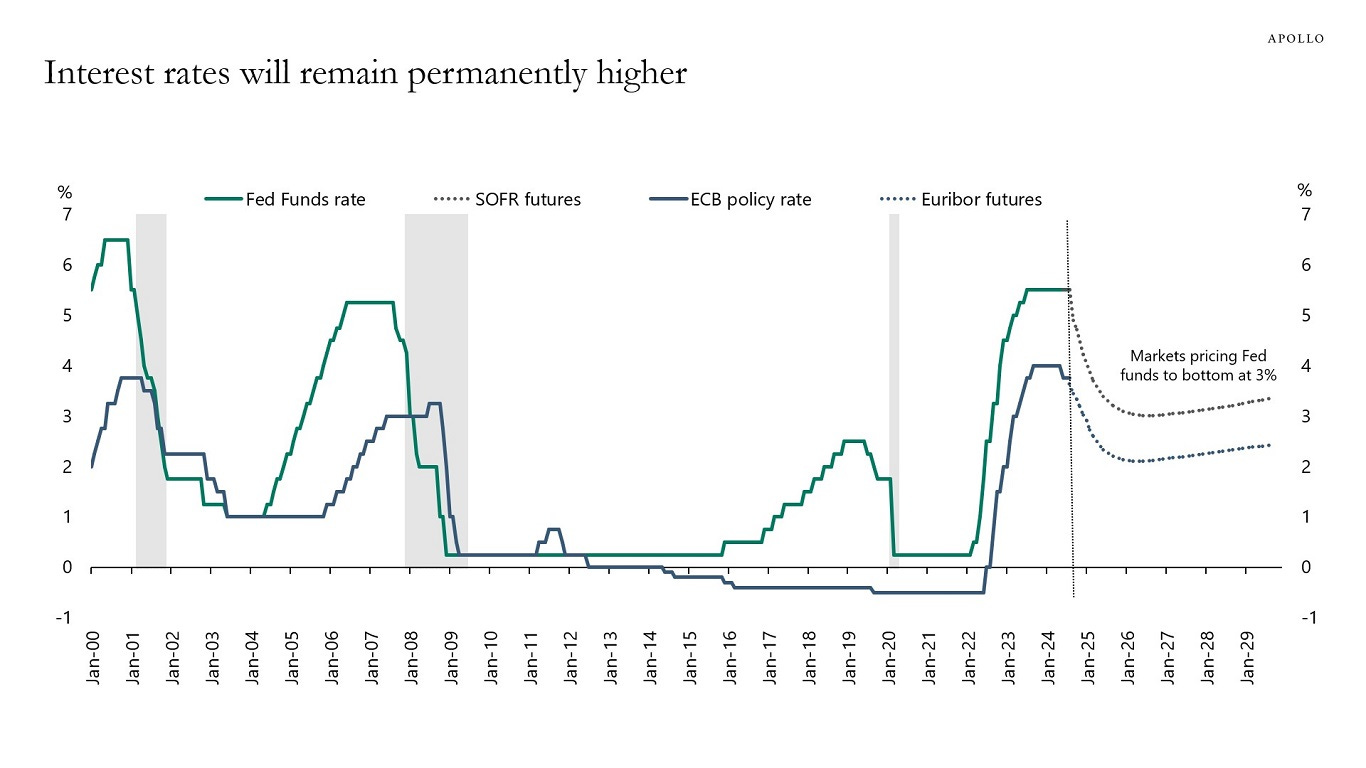

Even if the Fed embarks on an easing cycle, we believe that interest rates will remain relatively higher for longer. If we assume the interest rate futures market is correct in pricing in at least four rate cuts in 2024—which we believe is overblown—short-term interest rates would by the end of 2024 be around 4.5%, a level that would still be the highest for overnight rates since 2007 (excluding the Fed’s current hiking cycle). Furthermore, if we take in the expectations for additional ~five rate cuts in 2025, rates will reach 3% by the end of next year, which is nearly double the average 1.8% rate over the past decade.

A soft landing remains our base case, driving our broadly constructive view on direct lending. Our expectation remains that it will take longer for inflation to come down to the central bank’s 2% target range, and as a result, the curve will continue to steepen, meaning long rates are going to decline less than short rates.

The combination of a strong economic backdrop along with elevated yields further out the curve is favourable for high-quality private credit. With private credit spreads of 5%-6% and Original Issue Discounts of 2% factored in, investors should still be able to command solid returns over the coming years. We continue to believe that the opportunity set to lend to bigger businesses on a first lien, senior secured basis at elevated yields remains attractive.