Uncertainty and politic risks, but market still resilient

Biden vs Trump heats up, France fighting for a change but markets are holding

As June 2024 has passed, the global economic landscape exhibits a complex blend of resilience and ongoing challenges. The U.S. economy, in particular, has demonstrated remarkable strength, defying earlier predictions of a recession.

In June rates were more or less flat, credit spread widened a bit, while US equities delivered another impressive upward move: the S&P 500 is up 3.80% and the Nasdaq up another notable +6%. The laggard is Europe with the Euro Stoxx 50 down 1.80%, due to the French elections. In the first half of 2024 the S&P 500 logged an impressive 15% gain, while the tech-heavy Nasdaq Composite surged even higher, driven by the continued AI boom. This performance is especially noteworthy given the backdrop of persistently high inflation and elevated interest rates.

However, cracks are beginning to show in this bullish narrative. JPMorgan maintains a price target of 4,200 for the S&P 500, signalling a 23% downside risk from current levels. The bank anticipates downward revisions in consensus earnings estimates after Q2 2024, citing the cumulative effects of higher interest expenses and a stronger U.S. dollar. Piper Sandler's chief market technician, Craig Johnson, warns of a potential 10% S&P 500 correction this summer, citing poor market breadth and waning momentum as key concerns.

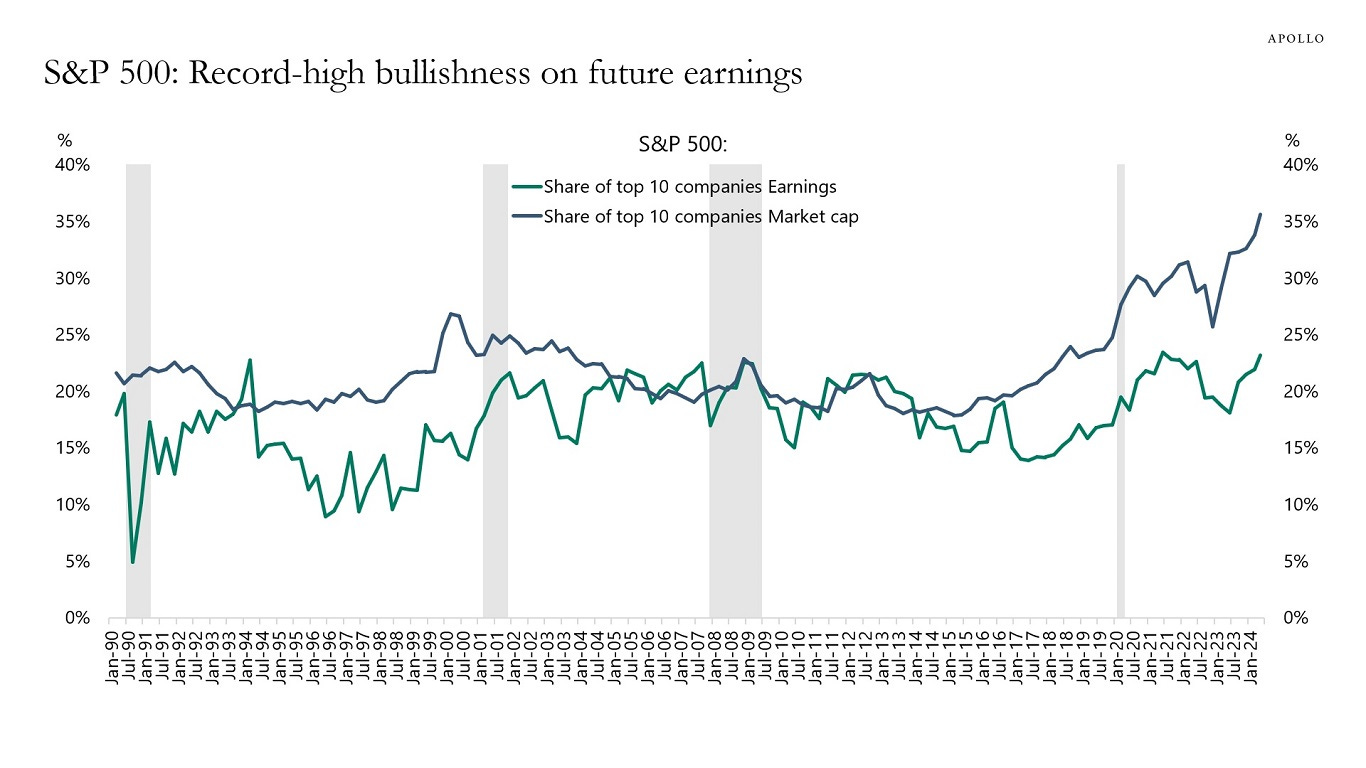

S&P 500 Looking More Vulnerable for Apollo’s Torsten Slok. The top 10 companies in the S&P 500 make up 35% of the market cap but only 23% of earnings, see chart below. This divergence has never been bigger, suggesting that the market is record bullish on future earnings for the top 10 companies in the index. In other words, the problem for the S&P 500 today is not only the high concentration but also the record- high bullishness on future earnings from a small group of companies.

The artificial intelligence boom has been a defining feature of the 2024 market landscape, propelling tech stocks to new heights and reshaping investor expectations across sectors. The "Magnificent 7" tech giants, led by standout performer Nvidia, have been at the forefront of this trend. Nvidia's stock price has skyrocketed by 150% this year, symbolizing the market's fervent belief in the transformative potential of AI technologies. This AI-driven rally has been a significant factor in the Nasdaq's outperformance, with the index rising almost 9% in the second quarter alone. However, the sustainability of these gains has come under scrutiny, with recent pullbacks in Nvidia and other chip stocks like Broadcom, Super Micro Computer, and Qualcomm highlighting investor concerns over stretched valuations. As we move forward, the AI revolution will likely continue to be a key driver of market dynamics.

On the macroeconomic front, the US labour market remains tight, with unemployment hovering near historic lows. However, there are emerging signs of softening, as evidenced by a slight uptick in unemployment benefits claims. The Federal Reserve's preferred inflation gauge, the Personal Consumption Expenditures price index, has shown signs of moderation, bolstering hopes for potential rate cuts later in the year. Despite this, the Fed has maintained a cautious stance, emphasizing the need for more conclusive evidence of cooling inflation before committing to monetary easing.

The International Monetary Fund (IMF) has issued a stark warning about the U.S. fiscal situation, criticizing the large deficits and growing debt burden. The IMF slightly downgraded its U.S. growth forecast for 2024 to 2.6%, emphasizing risks from expansionary trade policies and unaddressed vulnerabilities in the banking sector.

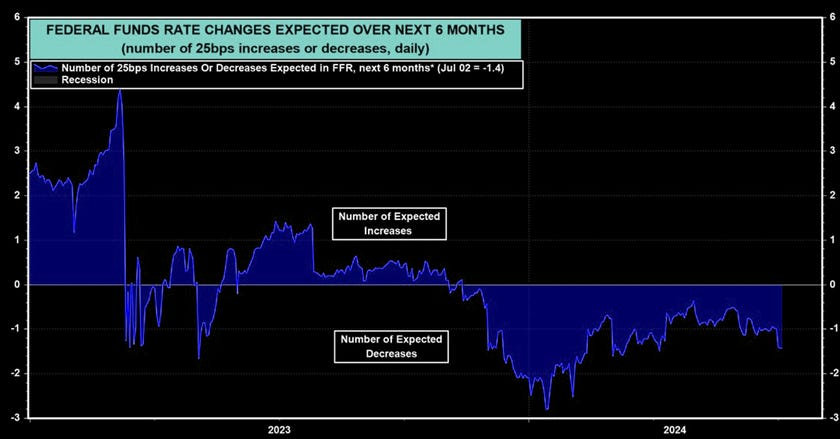

Recent comments of Fed officials suggest that the Fed Put is back. They expressed concern that the Fed might cause job losses if monetary policy stays too tight for too long. Their dovish comments reinforced investors’ expectations that the Fed will cut the federal funds rate by 25bps at least once and maybe twice over the remainder of this year.

In Europe, the economic picture is more mixed. The ECB cut rates by 25bps to 3.75% in June, marking a divergence from the Fed's policy path. This move reflects the different stages of the disinflation cycle between the two economic areas. However, the ECB remains vigilant, noting that domestic price pressures remain strong due to elevated wage growth. But as the Eurozone's PMI composite showed, growth remains lacklustre, especially in core countries like France and Germany, while the periphery shows more promising signs.

Globally, central banks are navigating a delicate balance between supporting growth and controlling inflation. The Bank of England, despite inflation reaching its target for the first time in nearly three years, has held rates steady. Meanwhile, the Swiss National Bank has cut rates for the second time this year, reflecting a broader trend towards more accommodative policies among global central banks.

In Asia, Japan faces similar challenges with wage pressures amid a tight labour market, although inflation has shown signs of easing; at the same time the country faces significant currency pressures, with the yen reaching its weakest level against the dollar since 1986. This has prompted warnings of potential intervention from Japanese authorities. China's economic recovery remains fragile, with mixed signals from recent data releases prompting expectations of further stimulus measures.

French Elections: a shock to the European Project

The recent snap parliamentary elections in France have sent shockwaves through the European political landscape. Marine Le Pen's far-right National Rally (RN) party secured a historic victory in the first round, winning 33.2% of the vote. This result has moved France closer to the possibility of a nationalist government, a development that could significantly impact the European project.

President Emmanuel Macron's centrist alliance, which came in third with 20.8% of the vote, now faces an uphill battle to prevent the far right from gaining an absolute majority in the July 7 runoff. Macron has called for a wide-ranging rally behind "clearly Republican and Democratic candidates," while Prime Minister Attal emphasized the need to prevent the National Rally from securing an absolute majority.

The election results initially sparked concerns in financial markets, given Le Pen's historically Eurosceptic stance and promises of expansionary fiscal policies. However, French markets showed resilience following the first round, with the CAC 40 stock index surging almost 3% on last Monday and government bonds opening higher. This rally was partly due to Le Pen's National Rally securing a smaller victory margin than polls had predicted.

Investors remain wary of the potential for expansive fiscal policies under Le Pen, especially given that France's budget deficit and debt levels already exceed EU limits. However, the prospect of a hung parliament is seen as potentially favourable for markets, as it could make it difficult to implement significant policy changes.

The political risks ahead should not be dismissed, but the base case scenario is likely manageable and tail risks may not be as extreme as the market believes. The base case is likely a hung parliament with a far-right Prime Minister cohabiting with President Macron, an outcome Europe has experience with. This scenario may not be ideal for governance but should limit the risks of immediate, extreme measures and reduce uncertainty.

Beyond politics, the risks that typically drive credit markets are low. Macro trends are moderate, cyclical conditions are benign, and we now have wider spreads, some de-risking, and a favourable seasonal outlook ahead. Unlike 2011-12, the eurozone's financial system is not fragile, its economy is not on the brink of recession, and its Central Bank is prepared to use its full toolkit.

Credit overview: balance between optimism and risk factors

In credit markets, June 2024 has been characterized by a delicate balance between optimism stemming from economic resilience and caution due to lingering inflationary pressures and potential monetary policy shifts. The US Treasury yield has shown promise, with potential for further rallies in the second half of the year as the economy and inflation moderate. The crowded trade suggest a possible move toward 4.0% vs the current 4.40%.

In the Treasury options market traders are placing aggressive bets on the Federal Reserve's interest rate path, wagering on up to 3 percentage points worth of cuts in the next nine months. While this scenario seems unlikely barring a sudden economic downturn, it underscores the market's growing anticipation of monetary easing.

The yield curve dynamics remain a focal point for investors. Despite earlier expectations of curve uninversion this year, significant bull steepening may not occur until the Federal Reserve begins its rate-cutting cycle, which could be delayed until after the November elections, assuming the economy maintains its current trajectory.

In the corporate bond market, credit spreads have remained relatively stable, supported by the overall economic resilience and strong corporate earnings. However, investors are keeping a close eye on potential signs of credit quality deterioration, particularly in sectors more sensitive to interest rate fluctuations and consumer spending patterns.

The High Yield bond market has shown resilience, benefiting from the risk-on sentiment driven by the tech and AI boom. However, as we move into the second half of the year, investors should remain vigilant. Any signs of economic slowdown or shifts in monetary policy could lead to a reassessment of risk premiums in this segment.

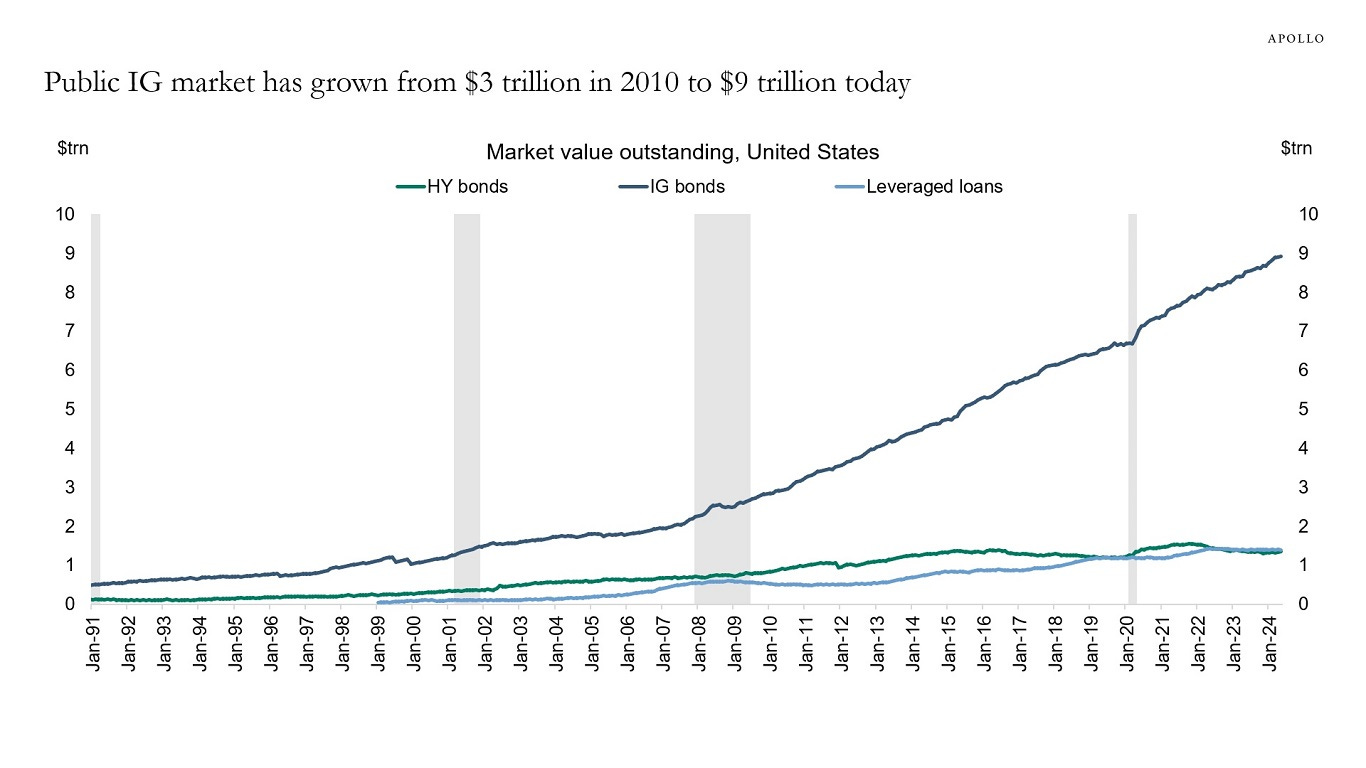

Apollo's analysis suggests a divergence in the credit market that is expected to persist through 2024. They anticipate that demand for high-quality credit will keep index spreads near record tights, while a subset of lower-quality corporates may struggle with generationally high interest rates. Investment grade bonds and BB spreads are expected to remain stable despite historically tight valuations, given supportive technicals and strong credit metrics. However, the outlook for lower-quality credit is more uncertain, with potential pressure on credit spreads across the B/CCC universe if the economic backdrop deteriorates.

In Europe, the ECB's rate cut has introduced a new dynamic in the credit markets. While this move has generally been supportive of bond prices, it has also raised questions about the long-term implications for credit quality, particularly if inflation proves more persistent than anticipated.

Looking ahead, several factors will be crucial in shaping the credit market landscape. The pace of disinflation, the Federal Reserve's policy decisions, and the outcome of the November U.S. elections will all play significant roles. The election, in particular, could have longer-term effects on fiscal policy and debt issuance, regardless of the outcome, as both leading candidates have shown a tendency towards fiscal expansion.

In terms of investment themes, it's advisable to add beta, not just carry. US credit remains resilient, with tightening potential in IG long duration and BBB. European credit, while exposed to near-term political risk, justifies adding beta in corporates more than banks. While Emerging Markets offer opportunities. An interesting development in the credit market is the compression of the BB-BBB ratio, which has reached its tightest level since January 2020. The intermediate BB-BBB basis has compressed to year-to-date tights, with BBs tightening by 11bp and shorter-duration (<10y) BBBs widening by 2bp since mid-June. This presents potential opportunities for decompression strategies.

Source: Ashenden Fixed Income Monthly Report

Every month, we publish the Fixed Income Monthly report. The report is a synthesis of the Ashenden’s team view on Fixed Income, pursuing a global approach through the full spectrum of the asset class and providing bond picks. We range from Investment Grade bonds to High Yields & Emerging Markets.

In the report we disclose our bond model portfolio (6 years track record) with more than 60 individual names. We include new single bond ideas, switches, new entries and exits.

All this is corroborated by a bottom-up analysis for each single position (new and old) and merged with a top-down consideration so to include the key market drivers.

This is one of the research piece our team produces internally. The intent of the report is to support wealth managers/asset managers in their decision and allocation process.

Feel free to ask us more information: write to us at research@ashendenfinance.ch