US rates expectations & China shock

US Treasury Yields pull back and the Chinese stimulus

Interest rates direction

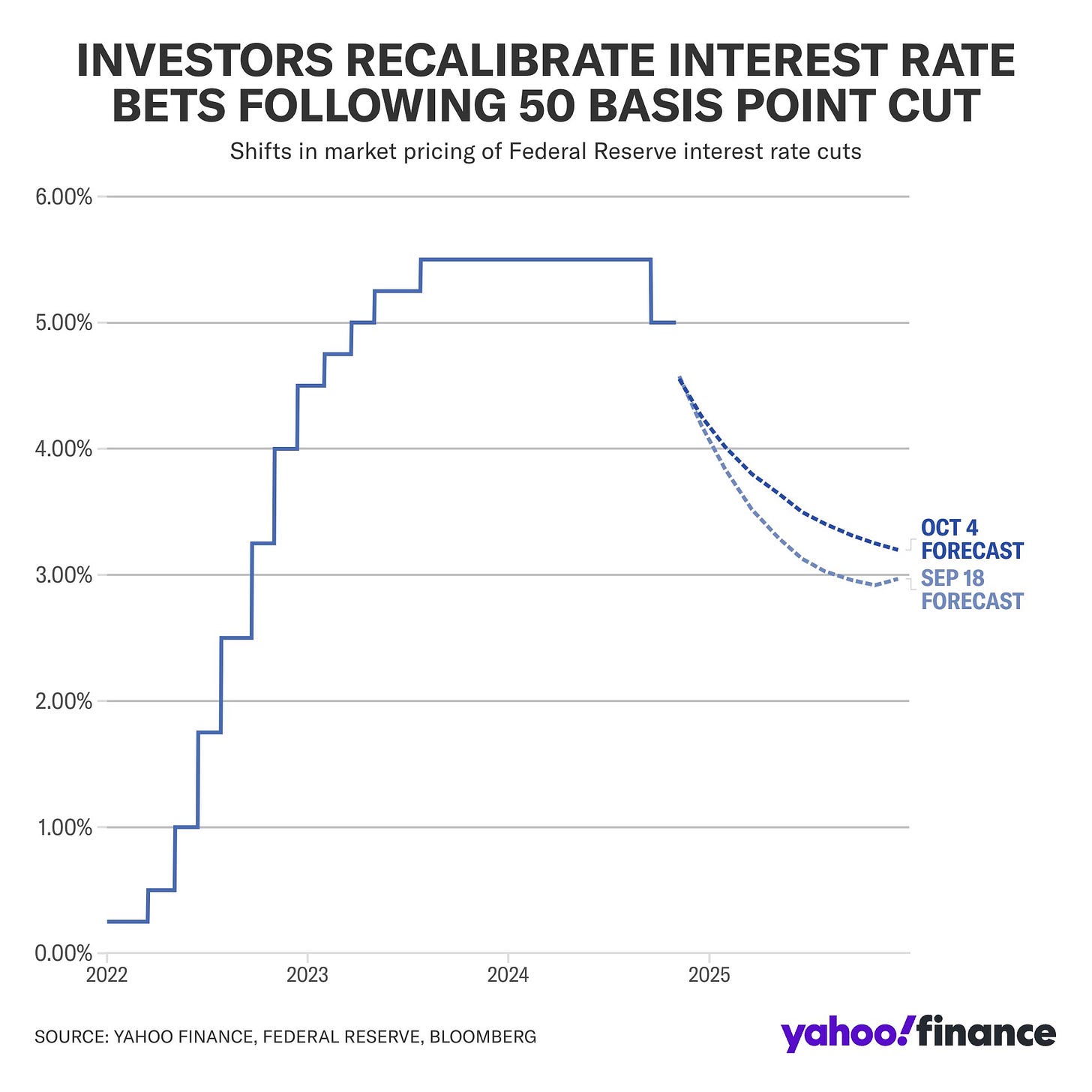

Fed cuts expectations revised down after the last Fridays’ Jobs Report. A stronger-than-expected September jobs report has pushed Wall Street's debate over how deeply the Fed will cut interest rates at its November meeting in favour of a more modest path. Some have even suggested the report could mean the Fed won't cut rates at all next month. Odds that the Fed will cut by a total of 50 basis point this year rise to 73% from 44% Thursday, while odds of 75-bps in cuts fall to 25% from 45%, CME data show. Bets on a 50-bps trim in November are down to 9%, from 32% Thursday. A few banks lowered their outlook on rates after the strong jobs report with Bank America changing their November Fed call to 25bps from 50bps cut.

Money markets imply fewer than 50bps of Fed rate reductions through the end of the year for the first time since Aug. 1. Citi now expects a quarter-point cut next month, abandoning its forecast for a bigger move.

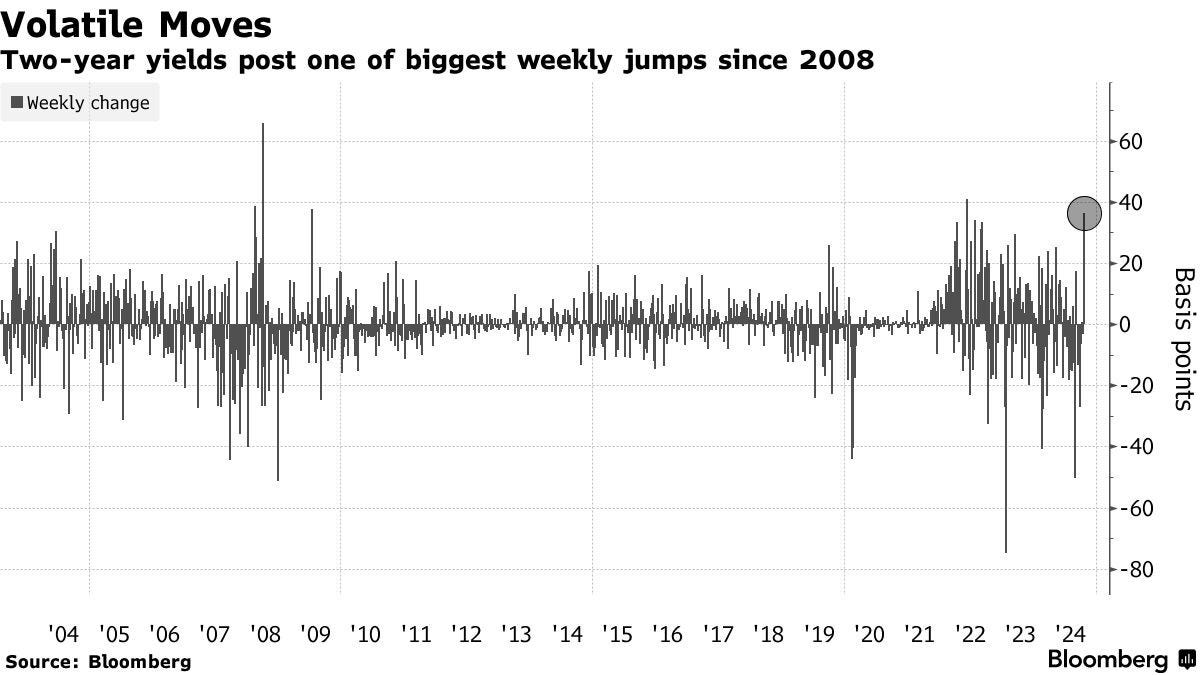

For traders, this is the latest painful adjustment, as they had been preparing for economic growth slowdown, moderate inflation, and significant rate cuts, buying a large amount of short-term US Treasuries sensitive to Fed rate policy. On the contrary, last Friday's report reignited concerns about overheating in the economy, disrupting the rise of US bonds; in contrast, the yield on 2-year US Treasuries had already fallen to multi-year lows.

Interest rate swap traders expect the Fed to cut rates by 24bps at the November meeting, meaning a 25bps cut is no longer seen as inevitable. The market expects the Fed to cut a total of 150 basis points by October 2025, lower than the expected cut of about 200 basis points at the end of September.

Apollo: No need for Fed cuts. The incoming data continues to remain robust, as showed by jobs report. Why is the economy still strong? Because of lower sensitivity to Fed hikes for consumers and firms with locked-in low interest rates. Because of strong AI spending. Because of strong fiscal and defence spending. These tailwinds are countering the long and variable lags of monetary policy. And now the Fed is cutting rates, which is boosting growth and inflation further. Combined with very easy financial conditions, the bottom line remains that rates will stay higher for longer.

US Financial Conditions are at its loosest point since Q1 2022. Financial conditions posted their largest year-over-year decline in 3 years and are back down to pre-interest rate hike levels. Since October 2023, the Financial Conditions Index has loosened at its fastest pace since March 2020, when the Fed cut rates to near zero.

US 2y yield's 36bp jump last week was one of the largest weekly moves since 2008. 2s10s UST curve less than 2bps away from re-inversion as Fed's path re-evaluated. Market erases pricing for another jumbo 50bp cut, grapples with the idea the Fed could pause their cutting cycle.

With yield above 4%, Joseph Kalish from Ned Davies Research suggests to buy the 2-year Treasury note.

“Our historical studies show following the first rate cut front-end yields falling in ten of the past dozen cases going back to 1970. Short-end yields only rose in two across four time horizons out to one year - 1980 and 1998. Over the course of the entire easing cycle, only 1998 shows short-end yields higher at the end of the cycle. At the conclusion of the Fed meeting last month, 2-year yields closed at 3.61%. A few days later, yields had fallen below 3.50%. So the market has clearly repriced.

Although Friday’s employment report was uniformly strong, other reports, such as JOLTS and ISM, showed a softer labour market. Once again, three non-interest rate-sensitive sectors (health care, leisure/ hospitality, and government) accounted for over 70% of the jobs created. Of those counted as employed in the household survey, the government sector added 785K. Another 79%, however, work in private industries. That group only saw an increase of 79K, not a great sign. Finally, there is a lot of political and geopolitical uncertainty in the coming weeks, which could push yields back down toward their lows.”

Moreover, the U.S. 10yr Treasury is back over 4.00%.

China disappoints

The recent surge in Chinese equities, triggered by promises of substantial economic stimulus: September saw a sharp rally in Chinese indexes as investors rushed to position themselves ahead of anticipated actions from the People's Bank of China and the government. This spike was further amplified by hedge funds and institutional investors scrambling to cover their short positions.

However, the enthusiasm was tempered by an undercurrent of caution. As the Chinese holiday period came to a close, we were expecting a pullback: without concrete follow-through on the promised stimulus measures, the market was ripe for a reality check.

China said on Tuesday it’s confident in reaching its economic targets this year and promised to further support growth, although it held back in unleashing more major measures. A rally in onshore Chinese stocks after a week-long holiday fizzled as their world-beating gains lost momentum. That comes as a government briefing expected to unveil more economic stimulus measures underwhelmed investors.

Hong Kong's benchmark Hang Seng Index fell 9.4%, in its worst one-day decline since 2008 and on course to erase almost all of the gains made while onshore markets were shut for the Golden Week. In the end, the CSI 300 Index finished just 5.9% higher.

Chinese A-shares' trading turnover so far today has topped 3tn yuan for first time in history. That's compared to 801.1bn yuan turnover at same time in previous trading day.

Goldman Sachs upgraded its call on Chinese stocks to overweight, as it joined a growing camp of optimists that are touting the positive impact of Beijing’s stimulus. Gauges tracking the nation’s equities may rise another 15%-20% if authorities deliver on policy measures, strategists including Tim Moe wrote in a note dated Oct. 5. Valuations are still below the historical average, earnings may improve and global investors’ positioning remains light, they added. The recent stimulus announcements “have led the market to believe that policy makers have become more concerned about taking sufficient action to curtail left-tail growth risk,” the strategists wrote.

Goldman Sachs:

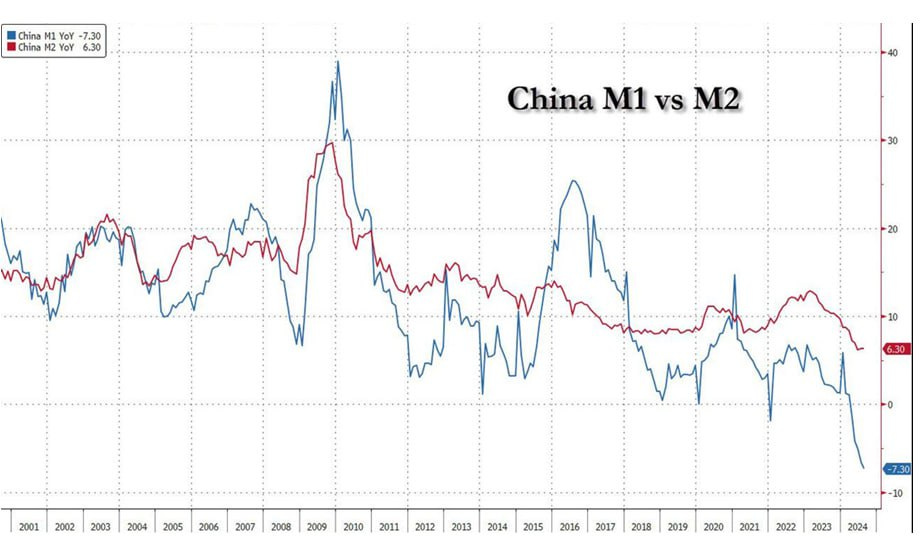

“To escape deflation and for rally to be sustained, China M1 has to overtake M2. For that to happen, China will need to unleash a historic credit impulse (record new debt creation, launch QE) and global inflationary shockwave.”

Translation: Unless China does QE now, the current market rally will crash and burn and the economy will be a crater. If China does do QE, oil will soar, and gold and bitcoin will be orders of magnitude higher.

A look at S&P 500

S&P 500’s US$ 8tn rally will be tested by tricky Earnings Season. Companies in the S&P 500 are expected to report a 4.7% increase in quarterly earnings from a year ago, according to data compiled by Bloomberg Intelligence. That’s down from projections of 7.9% on July 12, and it would represent the weakest increase in four quarters, BI data show. The earnings season will be more important than normal this time.

Goldman Sachs updated its forecasts for the S&P 500, painting a bullish picture for the coming years. The bank raised its 2025 EPS growth forecast to 11% and increased its 12-month index target to 6300, above the consensus among strategists for both 2025 and 2026. Goldman projects earnings of US$ 274 for 2025 and US$ 300 for 2026, which, while lower than current bottom-up analyst consensus, still represent significant growth. The bank notes that the current P/E ratio of 22x aligns with their fair value model and is expected to remain stable through 2024. With these projections, Goldman has lifted its year-end 2024 target to 6000 and its 12-month target to 6300, suggesting potential upsides of 4% and 10% respectively. This outlook reflects Goldman's confidence in continued market strength and earnings growth over the next few years.